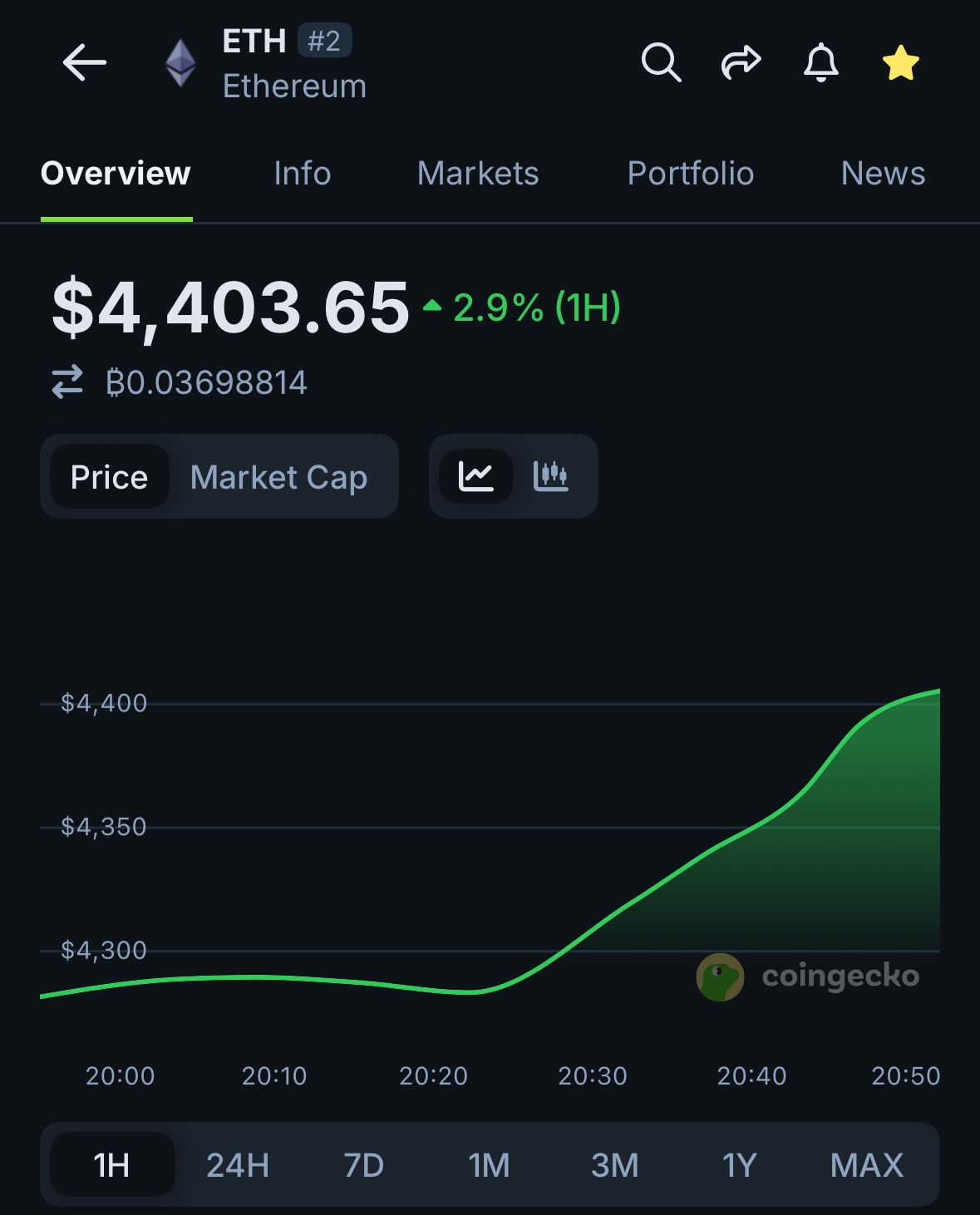

🚀 Ethereum Soars Past $4,400 as BitMine Deploys $20B War Chest to Gobble Up ETH

Ethereum just punched through $4,400—another milestone in its relentless bull run. Meanwhile, BitMine’s throwing $20 billion at the market like a hedge fund at an open bar.

The ETH feeding frenzy

Institutional players are piling into ETH like it’s the last lifeboat off a sinking fiat ship. BitMine’s aggressive accumulation strategy suggests they’re betting big on Ethereum’s post-merge dominance.

Liquidity tsunami incoming

That $20B buy-in could send shockwaves through DeFi liquidity pools. Market makers are already repositioning—watch for violent swings as whales play ping-pong with the order books.

Wall Street’s still trying to price ETH like a stock while devs rewrite the rules of finance. The only certainty? Volatility ahead—strap in.

For instance, Tom Lee, chairman of BitMine and co-founder of Fundstrat, has made his bullish stance on ethereum clear. In a recent podcast, he suggested that ETH could soon outpace Bitcoin in terms of value.

Lee is projecting that Ethereum could reach as high as $7,000 to $15,000 by the end of the year. Meanwhile, BitMine believes the price of ETH could reach $60,000 in a few years. The ongoing buying pressure from institutions increasingly fuels this outlook.

ETH Treasuries Gaining Steam

BitMine’s aggressive accumulation is setting the stage for an "Ethereum MicroStrategy" era, where corporate treasuries continue to pile into the network.

Already, numerous institutional investors have disclosed their strategies for continued accumulation and staking of Ethereum.

SharpLink and The Ether Machine have been among the leading firms building substantial ETH treasuries alongside BitMine. Just last week, SharpLink announced a $200 million capital raise to purchase ETH tokens.

While The Ether Machine's ETH holdings are worth $1.52 billion, SharpLink’s ETH holdings now exceed $2.63 billion.

For instance, Tom Lee, chairman of BitMine and co-founder of Fundstrat, has made his bullish stance on ethereum clear. In a recent podcast, he suggested that ETH could soon outpace Bitcoin in terms of value.

Lee is projecting that Ethereum could reach as high as $7,000 to $15,000 by the end of the year. Meanwhile, BitMine believes the price of ETH could reach $60,000 in a few years. The ongoing buying pressure from institutions increasingly fuels this outlook.

ETH Treasuries Gaining Steam

BitMine’s aggressive accumulation is setting the stage for an "Ethereum MicroStrategy" era, where corporate treasuries continue to pile into the network.

Already, numerous institutional investors have disclosed their strategies for continued accumulation and staking of Ethereum.

SharpLink and The Ether Machine have been among the leading firms building substantial ETH treasuries alongside BitMine. Just last week, SharpLink announced a $200 million capital raise to purchase ETH tokens.

While The Ether Machine's ETH holdings are worth $1.52 billion, SharpLink’s ETH holdings now exceed $2.63 billion.