Bitcoin Price Primed for Liftoff: Here’s Why the Only Direction Is Up

Bitcoin isn’t just bouncing—it’s gearing up for a full-blown breakout. Forget sideways action; the king of crypto has one trajectory left, and it’s vertical. Here’s why.

The Halving Effect: Scarcity Meets Demand

Supply cuts hit harder than a bear market. With the latest halving slashing miner rewards, Bitcoin’s inflation rate now trails gold. Institutions? They’re stacking sats like there’s no tomorrow.

ETF Avalanche Fuels the Fire

Wall Street’s stampede into Bitcoin ETFs has turned a trickle of demand into a flood. BlackRock’s fund alone gobbled up 20K BTC in a week—while traditional finance still pretends to ‘understand the tech.’

Macro Tailwinds: Dollar Weakness, Crypto Strength

With the Fed’s money printer coughing back to life, hard assets win. Bitcoin’s 2025 correlation with gold hit 0.8—but with 10x the upside volatility.

So buckle up. The only thing heavier than Bitcoin’s momentum? The regret of those still waiting for a ‘dip.’

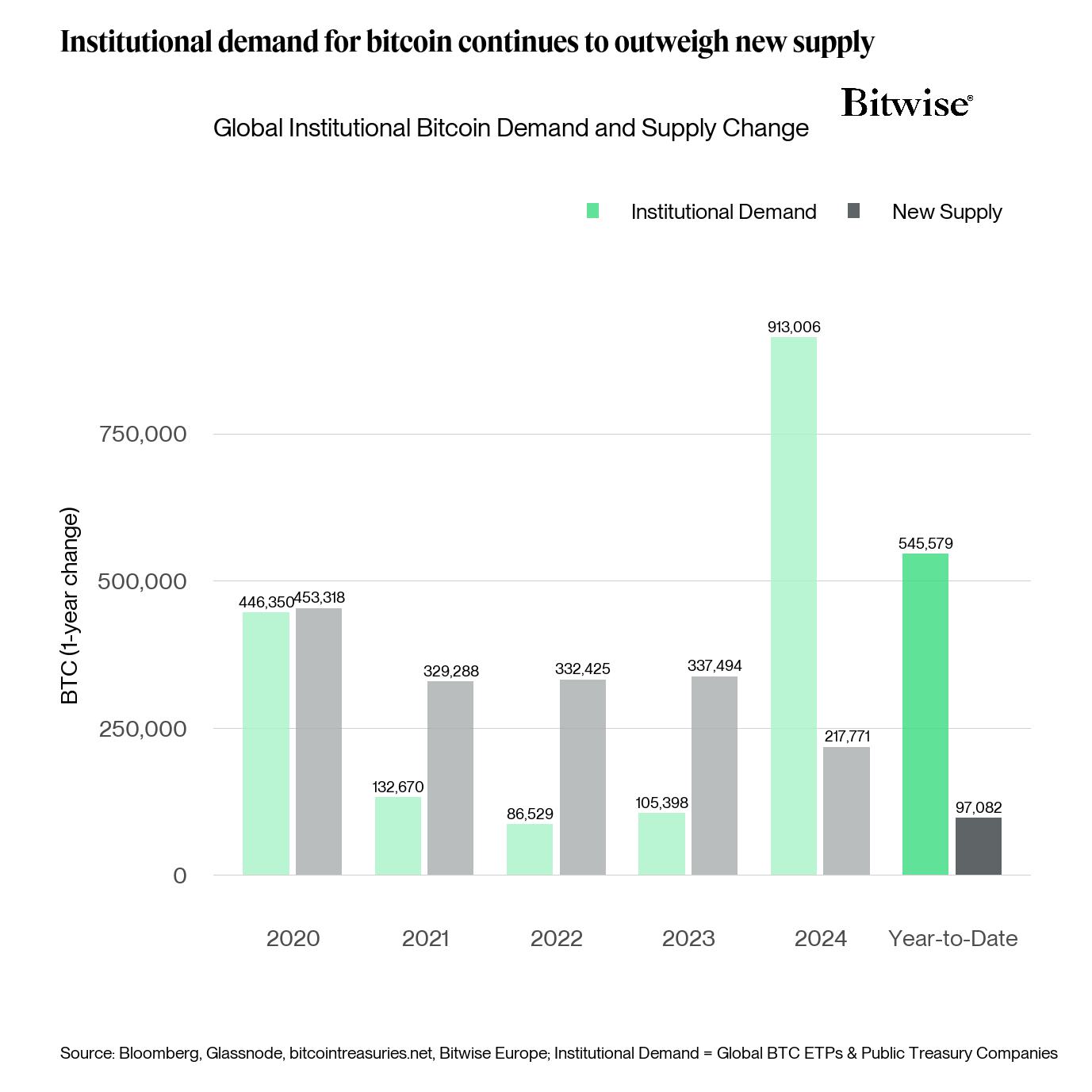

Global Institutional bitcoin Demand and Supply Change | Bitwise

Things changed in 2024. Specifically, after the halving cut new Bitcoin production to 217,771 BTC, institutions picked up 913,006 BTC, more than four times the available supply. This year, the trend has grown stronger. So far in 2025, institutions have procured 545,579 BTC, while miners have produced just 97,082 BTC. The gap keeps widening.

Dragosch pointed out that if institutions keep buying at this rate, there simply won't be enough Bitcoin to go around.

Data from Bitcoin Treasuries confirms this growing accumulation trend. By the end of 2024, private companies, public firms, and ETFs held a combined 2,252,936 BTC. Specifically, private companies owned 271,735 BTC, public companies held 694,147 BTC, and ETFs and other fund products controlled 1,287,054 BTC.

Today, just eight months into 2025, these holdings have grown significantly. Notably, private companies now hold 292,375 BTC, an increase of 20,650 BTC. Public companies have added 360,316 BTC, bringing their total to 1,054,463 BTC. ETFs and similar funds now hold 1,468,330 BTC, after buying another 181,276 BTC this year.

Global Institutional bitcoin Demand and Supply Change | Bitwise

Things changed in 2024. Specifically, after the halving cut new Bitcoin production to 217,771 BTC, institutions picked up 913,006 BTC, more than four times the available supply. This year, the trend has grown stronger. So far in 2025, institutions have procured 545,579 BTC, while miners have produced just 97,082 BTC. The gap keeps widening.

Dragosch pointed out that if institutions keep buying at this rate, there simply won't be enough Bitcoin to go around.

Data from Bitcoin Treasuries confirms this growing accumulation trend. By the end of 2024, private companies, public firms, and ETFs held a combined 2,252,936 BTC. Specifically, private companies owned 271,735 BTC, public companies held 694,147 BTC, and ETFs and other fund products controlled 1,287,054 BTC.

Today, just eight months into 2025, these holdings have grown significantly. Notably, private companies now hold 292,375 BTC, an increase of 20,650 BTC. Public companies have added 360,316 BTC, bringing their total to 1,054,463 BTC. ETFs and similar funds now hold 1,468,330 BTC, after buying another 181,276 BTC this year.