Anchorage Goes Big: $1.2B Bitcoin Purchase Fuels Aggressive Stablecoin Strategy

Crypto's institutional darling just made a power move.

Anchorage Digital—the federally chartered crypto custodian—dropped $1.2 billion on Bitcoin this week, signaling a bullish pivot while quietly advancing its stablecoin ambitions. The purchase marks one of the largest single acquisitions by a regulated player this cycle.

Why the sudden appetite?

Insiders point to Anchorage's behind-the-scenes lobbying for a USD-pegged token rollout. Buying BTC at scale boosts treasury reserves while giving regulators 'proof' of responsible asset backing—a classic Wall Street playbook move, just with blockchain flavor.

The timing's no accident either. With BlackRock's ETF inflows slowing and Tether facing yet another 'operational review,' Anchorage smells blood in the water. Their bet? That institutions will pay premium fees for 'compliant' volatility hedges.

Of course, $1.2B barely moves Bitcoin's $600B+ market cap these days. But for a bank-approved custodian? That's the equivalent of yolo-ing a client's entire pension fund into a meme stock—only with 300% more PowerPoints about 'sound monetary policy.'

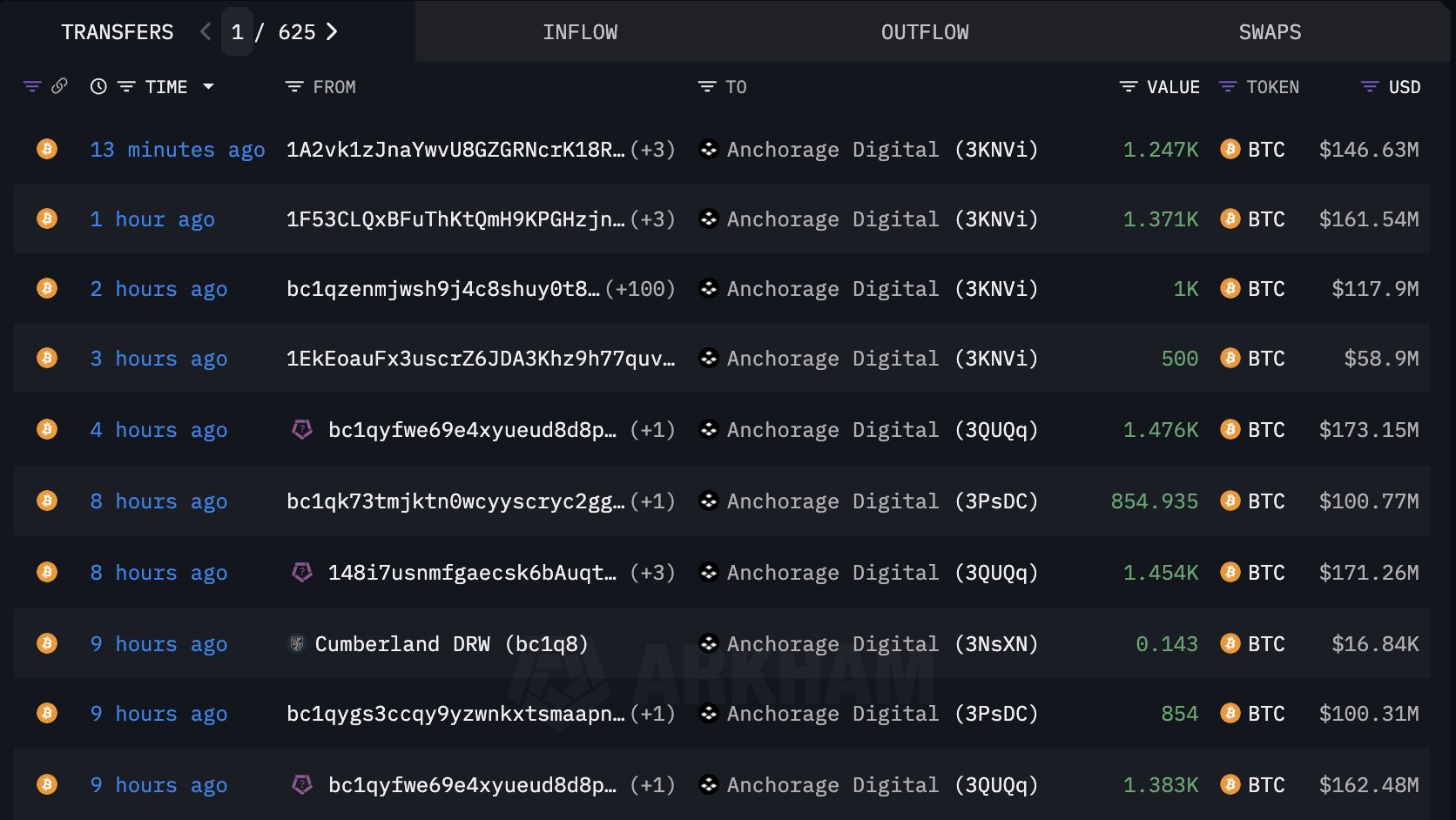

A snapshot of Anchorage Digital's latest Bitcoin transaction history

Once acquired, the assets are secured using cold storage and multi-signature wallets, consistent with Anchorage’s reputation as a regulated digital asset custodian serving banks, asset managers, and fintech firms.

Anchorage Eyes Leadership in Stablecoin Regulation

The Bitcoin buy coincides with Anchorage’s recent move into the regulated stablecoin space. Just last week, the firm announced a strategic partnership with Ethena Labs, the developer of USDtb and USDe stablecoins.

The partnership aims to bring USDtb, currently issued offshore, into the U.S. market under compliance with the GENIUS Act, a newly enacted federal law regulating stablecoin issuance.

As part of the agreement, Anchorage Digital Bank will issue USDtb in the United States, making it potentially the first stablecoin with a clear path to U.S. regulatory compliance. This move positions Anchorage as a key player in the push for institutional-grade, compliant digital dollar solutions.

Market Context: Bitcoin Hits High, Then Eases

The accumulation came just days after Bitcoin surged to an all-time high of $123,091 on July 14. Since then, prices have cooled slightly, with Bitcoin trading at $118,000 at the time of writing. The cryptocurrency is still up 9.7% over the past month, though it has slipped 0.3% in the last week.

This timing suggests Anchorage may have acted during a market pullback, likely leveraging a short-term pricing window to achieve long-term gains. Meanwhile, other prominent institutions like Strategy have even announced new investments of over $2.46 billion in BTC.

A snapshot of Anchorage Digital's latest Bitcoin transaction history

Once acquired, the assets are secured using cold storage and multi-signature wallets, consistent with Anchorage’s reputation as a regulated digital asset custodian serving banks, asset managers, and fintech firms.

Anchorage Eyes Leadership in Stablecoin Regulation

The Bitcoin buy coincides with Anchorage’s recent move into the regulated stablecoin space. Just last week, the firm announced a strategic partnership with Ethena Labs, the developer of USDtb and USDe stablecoins.

The partnership aims to bring USDtb, currently issued offshore, into the U.S. market under compliance with the GENIUS Act, a newly enacted federal law regulating stablecoin issuance.

As part of the agreement, Anchorage Digital Bank will issue USDtb in the United States, making it potentially the first stablecoin with a clear path to U.S. regulatory compliance. This move positions Anchorage as a key player in the push for institutional-grade, compliant digital dollar solutions.

Market Context: Bitcoin Hits High, Then Eases

The accumulation came just days after Bitcoin surged to an all-time high of $123,091 on July 14. Since then, prices have cooled slightly, with Bitcoin trading at $118,000 at the time of writing. The cryptocurrency is still up 9.7% over the past month, though it has slipped 0.3% in the last week.

This timing suggests Anchorage may have acted during a market pullback, likely leveraging a short-term pricing window to achieve long-term gains. Meanwhile, other prominent institutions like Strategy have even announced new investments of over $2.46 billion in BTC.