Bitcoin Crushes All Fiat in 2025: Bank of America Data Confirms It’s the Undisputed King of Currencies

Move over, dollar—Bitcoin just lapped the entire monetary system.

Bank of America's latest research drops the mic: BTC isn't just outperforming traditional currencies this year, it's humiliating them. While central bankers play whack-a-mole with inflation, Satoshi's invention keeps printing generational wealth.

The numbers don't lie. No sovereign currency comes close to Bitcoin's blistering 2025 rally—not the euro, not the yen, certainly not the Argentine peso (but let's be honest, that bar was underground).

Here's the kicker: this isn't some altcoin casino win. Bitcoin's market structure—decentralized, predictable issuance, global liquidity—is finally getting recognized as superior money. Even Wall Street's spreadsheet jockeys can't ignore the compounding returns.

Of course, legacy finance will keep dismissing it... right up until their pension funds start begging for BTC exposure. Tick tock, bankers.

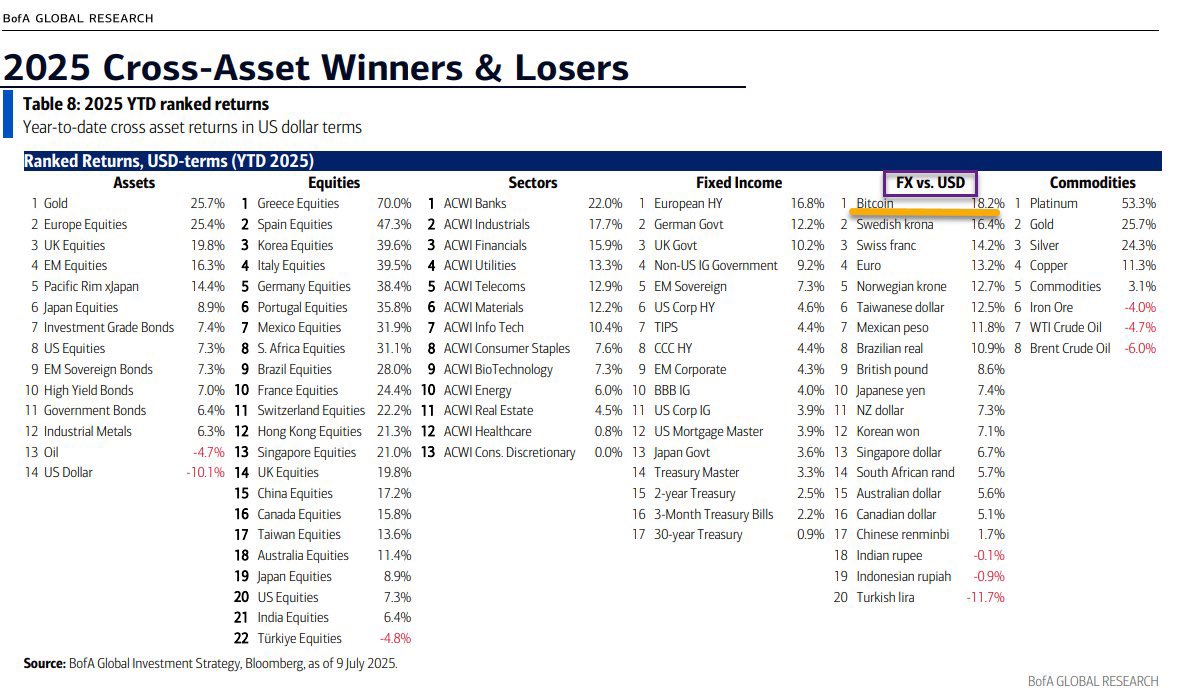

YTD Cross-Asset Rankings | Bank of America

Interestingly, this start suggests that the US dollar has depreciated more against Bitcoin than against any other currency globally, making it a better hedge against inflation and devaluation. Rich Dad Poor Dad author Robert Kiyosaki echoes this belief, reiterating on several occasions that it is better to save in Bitcoin than in “fake fiat.”

BofA Classifies Bitcoin as a Currency

As established earlier, BofA classified Bitcoin under the currency section rather than as an asset. Head of research at VanEck, Matthew Sigel, further highlighted this classification in a tweet today.

Notably, this is a step in the right direction for Bitcoin, as many, including BofA, saw it as a bubble. Investment firm Tephra Digital noted that BTC only appeared in the asset bubble charts of BofA’s chief investment strategist, Michael Hartnett.

However, Hartnett classified Bitcoin among the most essential technological disruptions in the last 1,000 years in June. Now, BofA has added Bitcoin to the currency section in its cross-asset report.

Meanwhile, if Bitcoin is placed in the asset section, it would rank as the fourth-best. Gold leads the category with 25.7%, while the Europe Equities and UK Equities stand next with 25.4% and 19.8%, respectively.

Notably, the evolving view of Bitcoin among major financial players highlights its emerging institutional use case. The pioneering cryptocurrency has transcended its nascent reputation of “scams” and “bubbles” to become a mainstream asset.

Currently, Bitcoin ranks among the top six assets globally. Furthermore, many countries and corporate firms now see Bitcoin as a worthy reserve asset. Aside from the United States, Pakistan and Kazakhstan are considering a Bitcoin reserve creation, while firms like Strategy, GameStop, and Metaplanet have adopted BTC as their primary corporate treasury assets.

YTD Cross-Asset Rankings | Bank of America

Interestingly, this start suggests that the US dollar has depreciated more against Bitcoin than against any other currency globally, making it a better hedge against inflation and devaluation. Rich Dad Poor Dad author Robert Kiyosaki echoes this belief, reiterating on several occasions that it is better to save in Bitcoin than in “fake fiat.”

BofA Classifies Bitcoin as a Currency

As established earlier, BofA classified Bitcoin under the currency section rather than as an asset. Head of research at VanEck, Matthew Sigel, further highlighted this classification in a tweet today.

Notably, this is a step in the right direction for Bitcoin, as many, including BofA, saw it as a bubble. Investment firm Tephra Digital noted that BTC only appeared in the asset bubble charts of BofA’s chief investment strategist, Michael Hartnett.

However, Hartnett classified Bitcoin among the most essential technological disruptions in the last 1,000 years in June. Now, BofA has added Bitcoin to the currency section in its cross-asset report.

Meanwhile, if Bitcoin is placed in the asset section, it would rank as the fourth-best. Gold leads the category with 25.7%, while the Europe Equities and UK Equities stand next with 25.4% and 19.8%, respectively.

Notably, the evolving view of Bitcoin among major financial players highlights its emerging institutional use case. The pioneering cryptocurrency has transcended its nascent reputation of “scams” and “bubbles” to become a mainstream asset.

Currently, Bitcoin ranks among the top six assets globally. Furthermore, many countries and corporate firms now see Bitcoin as a worthy reserve asset. Aside from the United States, Pakistan and Kazakhstan are considering a Bitcoin reserve creation, while firms like Strategy, GameStop, and Metaplanet have adopted BTC as their primary corporate treasury assets.