Peter Brandt Doubles Down on Bitcoin—But Warns Bull Run Hinges on This Critical Price Level

Veteran trader Peter Brandt just flashed a big green light for Bitcoin bulls—with one glaring caveat. The market’s next explosive move depends on whether BTC can smash through a key resistance wall.

The Make-or-Break Zone

Brandt’s charts point to a do-or-die price threshold (spoiler: it’s not the all-time high). Fail to breach it, and even the most diamond-handed HODLers might sweat. Clear it? Cue the ‘number go up’ memes.

Traders vs. Fundamentals: The Eternal Circus

Meanwhile, Wall Street’s latest ‘crypto expert’ just discovered moving averages—right after their third consecutive liquidation. Some things never change.

One thing’s certain: Brandt’s betting on Bitcoin’s resilience. Whether the market agrees? That’s the trillion-dollar question.

Bitcoin Analysis/Peter Brandt

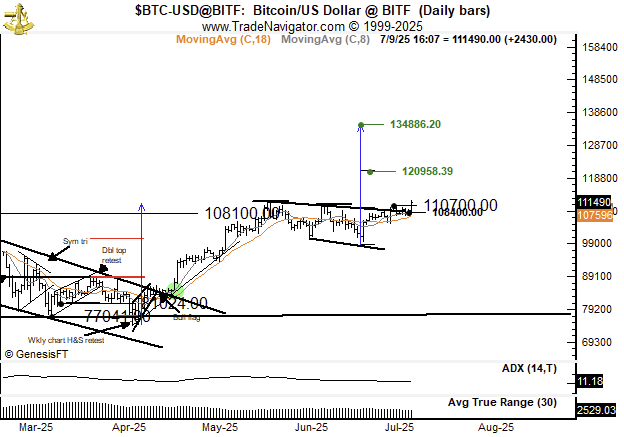

Recall that Brandt had earlier projected Bitcoin’s price to reach a high of $150,000 this cycle. He highlighted that this could happen on or before August this year.

Caution Amid Ecstasy

While Brandt remains a bull, he warned that things could go south quickly for Bitcoin. Among his reasons for the caution is the high morphology of the expanding inverted pattern.

He emphasized that the triangle has a higher mortality rate than most other bullish patterns, such as the horizontal pennant. This suggests that while bitcoin appears to be breaking out, the weak-willed momentum from the inverted triangle means that bears can still take over.

Further, he concluded that a drop to $107,000 would invalidate the bullish pattern and spark further downsides. Notably, the price mark is not far from Bitcoin’s current price, confirming that there is now a thin line between sustained momentum and a bearish reversal.

Remarkably, Brandt has always been cautious in his trading approach, viewing the market from different angles. In June, he predicted that Bitcoin could crash a staggering 75%, similar to its 2022 price action. Notably, this would take BTC’s price to around the late $20,000s.

Bitcoin Analysis/Peter Brandt

Recall that Brandt had earlier projected Bitcoin’s price to reach a high of $150,000 this cycle. He highlighted that this could happen on or before August this year.

Caution Amid Ecstasy

While Brandt remains a bull, he warned that things could go south quickly for Bitcoin. Among his reasons for the caution is the high morphology of the expanding inverted pattern.

He emphasized that the triangle has a higher mortality rate than most other bullish patterns, such as the horizontal pennant. This suggests that while bitcoin appears to be breaking out, the weak-willed momentum from the inverted triangle means that bears can still take over.

Further, he concluded that a drop to $107,000 would invalidate the bullish pattern and spark further downsides. Notably, the price mark is not far from Bitcoin’s current price, confirming that there is now a thin line between sustained momentum and a bearish reversal.

Remarkably, Brandt has always been cautious in his trading approach, viewing the market from different angles. In June, he predicted that Bitcoin could crash a staggering 75%, similar to its 2022 price action. Notably, this would take BTC’s price to around the late $20,000s.