CryptoQuant Analyst Drops Bombshell: The Exact Moment Bitcoin Long-Term Holders Could Cash Out

Bitcoin's diamond hands might finally be ready to fold—but not yet.

When HODLers Flip: The Tipping Point

CryptoQuant's latest analysis suggests long-term Bitcoin holders are nearing a historic sell signal. These veteran investors—who weathered crashes, memes, and Elon's tweets—typically move in predictable cycles. And the data says their patience has an expiration date.

The Whale Watch Begins

Market veterans know these players control the game. When they start dumping, altcoins tremble and leverage traders get liquidated. The last time this cohort sold en masse? Right before the 2022 nuclear winter.

Timing Is Everything (Except in Crypto)

No exact dates—because markets hate certainty—but the metrics show we're entering the danger zone. Ironically, this potential sell-off would come just as Wall Street finally 'discovers' Bitcoin (again). Typical finance—always late to the party but first to call the Uber.

Bitcoin Long-Term Holders Realized Profit and Loss | CryptoQuant

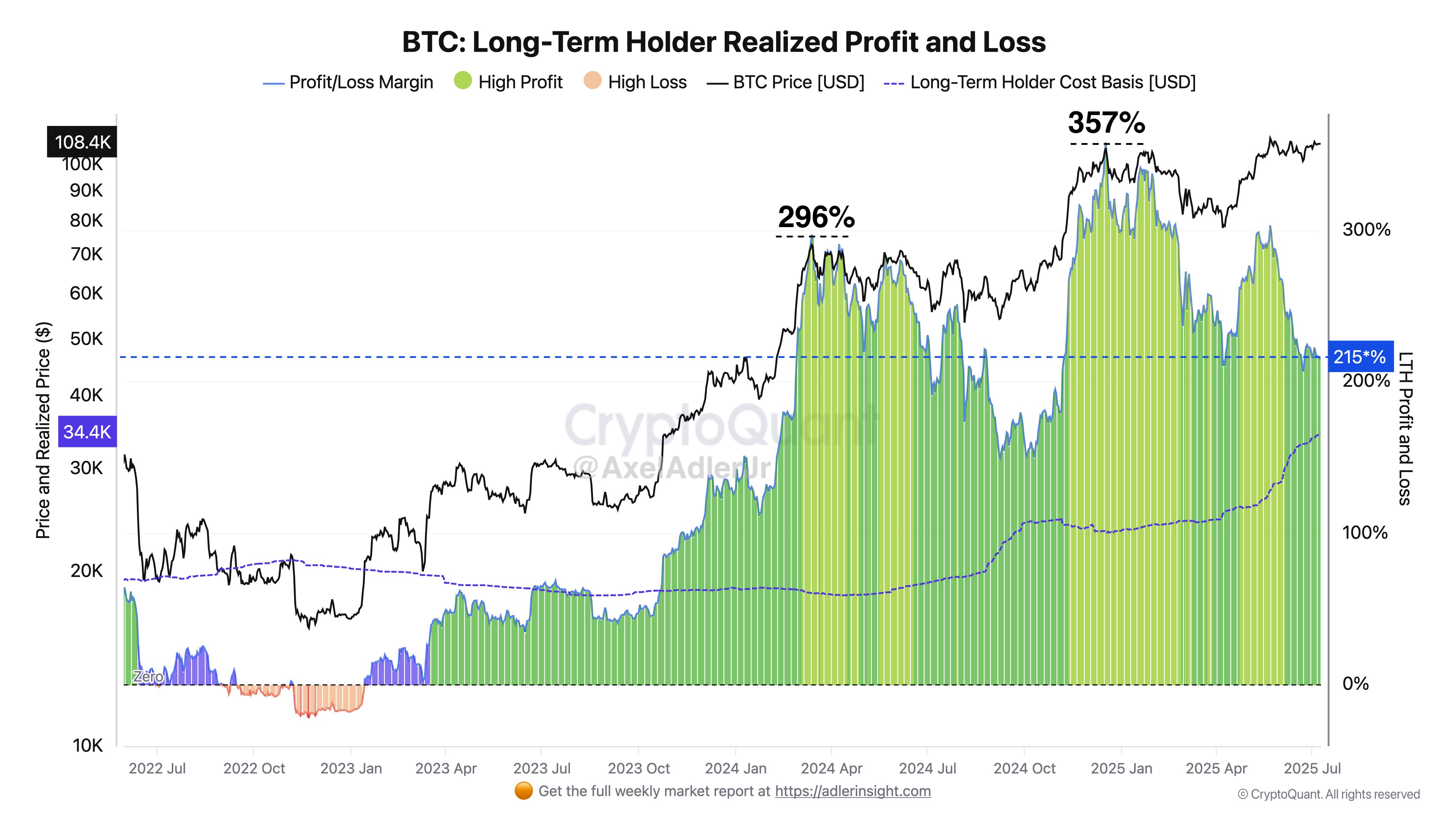

Another instance came during the rally between November 2024 and January 2025, fueled by political momentum. During this period, bitcoin pushed past the $100,000 milestone and hit an all-time high of about $106,000 on Dec. 17, 2024.

At that price level, LTHs were sitting on a 357% profit. The spike triggered another round of heavy selling, which again led to a decline in both Bitcoin's price and their profit ratio.

Now, despite Bitcoin currently trading at over $109,000, higher than it did back in December 2024, Adler noted that LTHs are now only up about 215% on average. This gap between price and profit ratio comes from a change in their cost basis.

Price at Which Bitcoin Long-Term Holders Could See 300% Profit

For context, in December 2024, LTHs had an average entry price of $23,314. This figure has now climbed to $34,400 because many of them bought more Bitcoin at higher prices. While the current market price is higher, their increased cost basis has reduced their overall returns.

Notably, for Bitcoin long-term holders to reach a 300% profit at the current cost basis of $34,400, Bitcoin would need to hit $137,600. This price represents a 25% increase from current levels. As a result, if Bitcoin could see another upsurge that might push it toward $137,000 before a roadblock occurs.

According to Adler, until this happens, the market remains in a range where Bitcoin long-term holders may either continue to take profits gradually or prepare for a sharper round of selling once the threshold is met.

Bitcoin Warming up for a Market Shift

Meanwhile, in a parallel report today, Adler said Bitcoin usually sets a new all-time high within 50 days of the previous one, provided the market avoids a correction deeper than 20%.

https://twitter.com/AxelAdlerJr/status/1942840302353441226

So far, 47 days have passed since the last record high, and Bitcoin hasn't seen any major pullback. The market analyst believes that if volatility remains low, Bitcoin could break its previous high of around $112,000 within the next seven days.

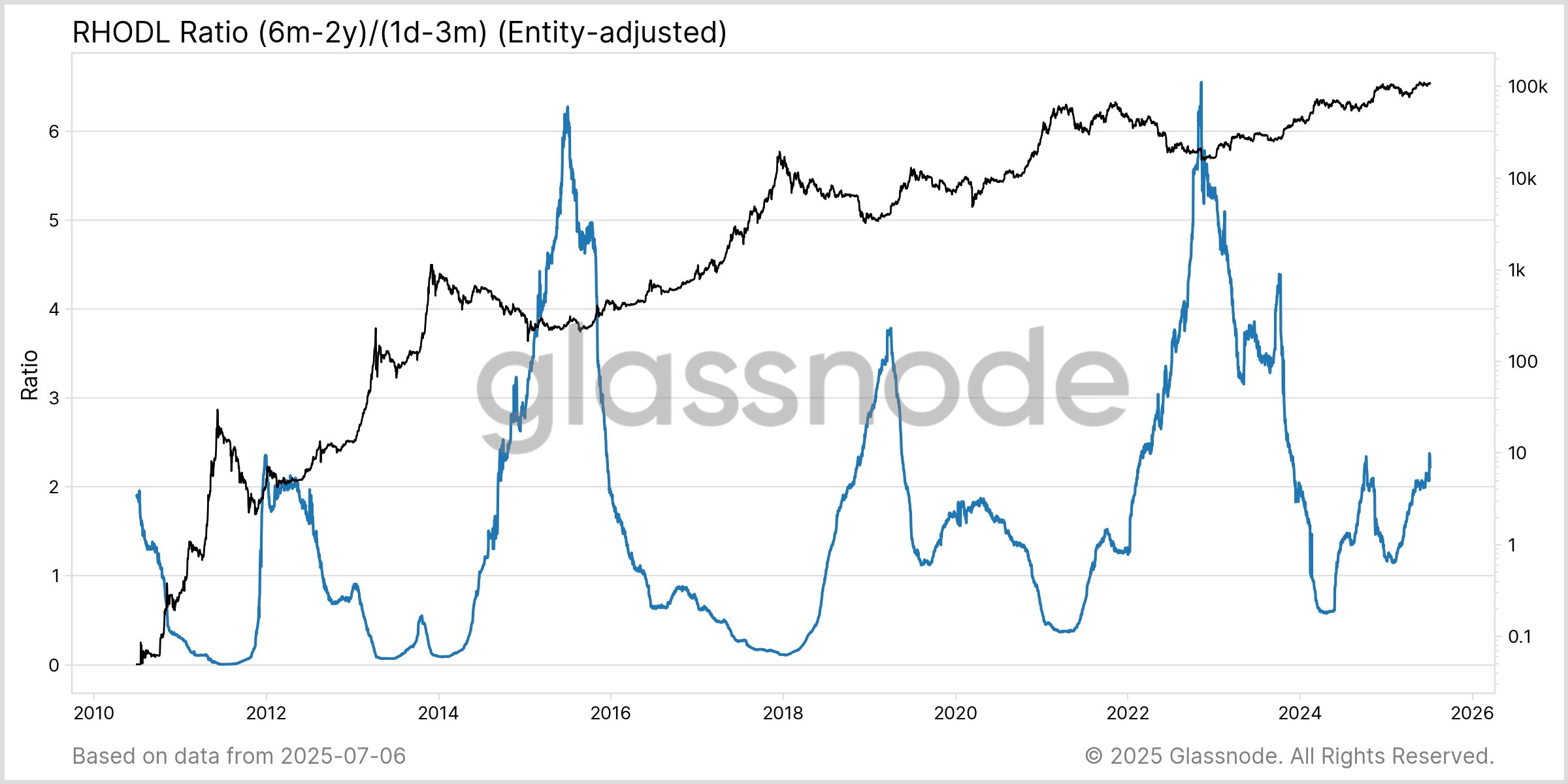

Also, blockchain analytics firm Glassnode noted today that Bitcoin's RHODL Ratio just reached its highest point in this cycle. This change shows that a growing share of Bitcoin wealth now sits with holders who entered during the current cycle, while activity among short-term holders remains quiet.

Bitcoin Long-Term Holders Realized Profit and Loss | CryptoQuant

Another instance came during the rally between November 2024 and January 2025, fueled by political momentum. During this period, bitcoin pushed past the $100,000 milestone and hit an all-time high of about $106,000 on Dec. 17, 2024.

At that price level, LTHs were sitting on a 357% profit. The spike triggered another round of heavy selling, which again led to a decline in both Bitcoin's price and their profit ratio.

Now, despite Bitcoin currently trading at over $109,000, higher than it did back in December 2024, Adler noted that LTHs are now only up about 215% on average. This gap between price and profit ratio comes from a change in their cost basis.

Price at Which Bitcoin Long-Term Holders Could See 300% Profit

For context, in December 2024, LTHs had an average entry price of $23,314. This figure has now climbed to $34,400 because many of them bought more Bitcoin at higher prices. While the current market price is higher, their increased cost basis has reduced their overall returns.

Notably, for Bitcoin long-term holders to reach a 300% profit at the current cost basis of $34,400, Bitcoin would need to hit $137,600. This price represents a 25% increase from current levels. As a result, if Bitcoin could see another upsurge that might push it toward $137,000 before a roadblock occurs.

According to Adler, until this happens, the market remains in a range where Bitcoin long-term holders may either continue to take profits gradually or prepare for a sharper round of selling once the threshold is met.

Bitcoin Warming up for a Market Shift

Meanwhile, in a parallel report today, Adler said Bitcoin usually sets a new all-time high within 50 days of the previous one, provided the market avoids a correction deeper than 20%.

https://twitter.com/AxelAdlerJr/status/1942840302353441226

So far, 47 days have passed since the last record high, and Bitcoin hasn't seen any major pullback. The market analyst believes that if volatility remains low, Bitcoin could break its previous high of around $112,000 within the next seven days.

Also, blockchain analytics firm Glassnode noted today that Bitcoin's RHODL Ratio just reached its highest point in this cycle. This change shows that a growing share of Bitcoin wealth now sits with holders who entered during the current cycle, while activity among short-term holders remains quiet.