Brace for Impact: Bitcoin Primed for New ATH After Final Consolidation Phase—Analyst Predicts ’Fun’ Is Coming

Bitcoin's coiled spring is tightening—again. After months of sideways action, analysts see the crypto king gearing up for a historic breakout.

The calm before the storm?

Market watchers note Bitcoin's eerie stability near key support levels, a textbook setup before major moves. 'This consolidation isn't boredom—it's potential energy,' remarks one trading desk head.

ATH in the crosshairs

With institutional flows quietly accumulating and retail FOMO still subdued, the stage looks set for a clean assault on previous highs. Only this time, Wall Street's algos might beat Reddit traders to the punch.

The cynical footnote

Of course, some hedge funds will inevitably claim they 'called the bottom'—right after repositioning their quarter-end performance reports.

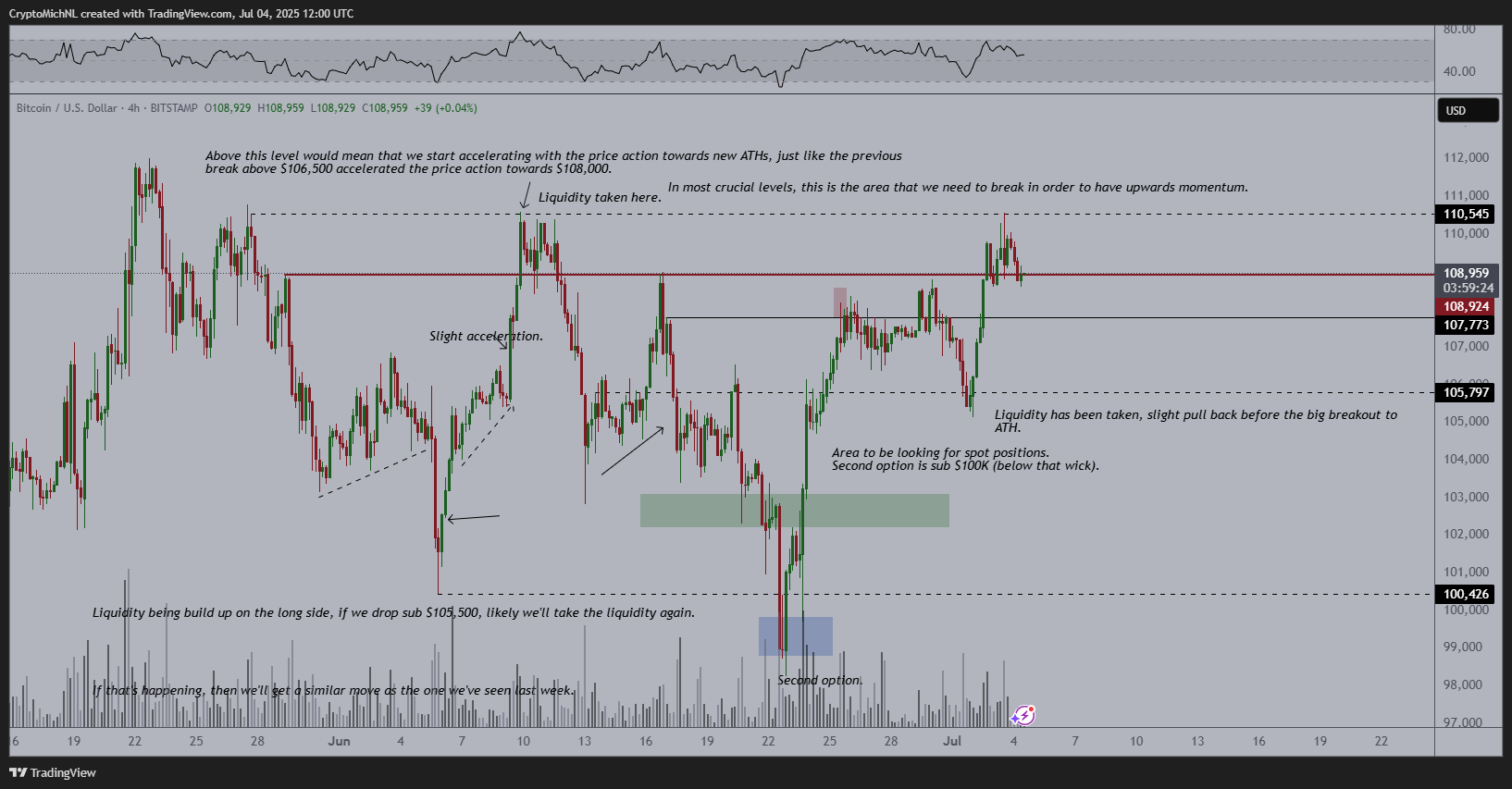

However, the analyst views this phase of price consolidation as a crucial preparation for a potential breakout. The market appears hesitant but is gathering momentum for the next move. According to van de Poppe, if bitcoin breaks above the $110K resistance, fun will come in, as it is the key trigger for Bitcoin to accelerate towards new ATHs.

Liquidity Zones Driving Price Action

Meanwhile, liquidity zones play an essential role in Bitcoin’s movement. The analysis notes that liquidity has been absorbed around $105,797, before rebounding to the current level.

The presence of these liquidity zones may contribute to Bitcoin’s next significant move once the $110K resistance is broken.

Key Price Levels and Targets

Also, the chart identifies important levels to watch, such as $102,900, which could be a key area for potential spot positions. A second target zone is between $99,000 and $100,000, where liquidity may be absorbed before Bitcoin pushes higher.

If Bitcoin’s price drops below $105,500, it could trigger a retest of the liquidity, leading to a potential upward move, much like the price action seen last week. At the time, the price fell below $99,000 on June 22, then recovered to trade above $108,000 by June 26. In that scenario, the price would absorb liquidity and potentially move upward.

Bitcoin’s Derivatives Market is Cautiously Optimistic

Elsewhere, the Bitcoin derivatives market shows a cautiously optimistic outlook, with a slight pullback in volume (-39.36%) and open interest (-6.32%). This could signal a stabilization phase after recent market activity. The Long/Short ratio of 0.9585 suggests a slightly bearish tilt, with more traders holding short positions, particularly on platforms like Binance (0.5627) and OKX (0.49).

However, the analyst views this phase of price consolidation as a crucial preparation for a potential breakout. The market appears hesitant but is gathering momentum for the next move. According to van de Poppe, if bitcoin breaks above the $110K resistance, fun will come in, as it is the key trigger for Bitcoin to accelerate towards new ATHs.

Liquidity Zones Driving Price Action

Meanwhile, liquidity zones play an essential role in Bitcoin’s movement. The analysis notes that liquidity has been absorbed around $105,797, before rebounding to the current level.

The presence of these liquidity zones may contribute to Bitcoin’s next significant move once the $110K resistance is broken.

Key Price Levels and Targets

Also, the chart identifies important levels to watch, such as $102,900, which could be a key area for potential spot positions. A second target zone is between $99,000 and $100,000, where liquidity may be absorbed before Bitcoin pushes higher.

If Bitcoin’s price drops below $105,500, it could trigger a retest of the liquidity, leading to a potential upward move, much like the price action seen last week. At the time, the price fell below $99,000 on June 22, then recovered to trade above $108,000 by June 26. In that scenario, the price would absorb liquidity and potentially move upward.

Bitcoin’s Derivatives Market is Cautiously Optimistic

Elsewhere, the Bitcoin derivatives market shows a cautiously optimistic outlook, with a slight pullback in volume (-39.36%) and open interest (-6.32%). This could signal a stabilization phase after recent market activity. The Long/Short ratio of 0.9585 suggests a slightly bearish tilt, with more traders holding short positions, particularly on platforms like Binance (0.5627) and OKX (0.49).