Bitcoin Primed for Explosive Rally—CNBC Analyst Predicts "Early Fireworks" to $142K

Brace for liftoff—Bitcoin's next parabolic move could ignite sooner than anyone expected.

CNBC contributor sees a perfect storm brewing for BTC's next bull run, with technicals and sentiment aligning for a potential moonshot to $142,000. Here's what's fueling the frenzy.

The Halving Effect: Supply Shock Looms

With the last Bitcoin halving still rippling through markets, the stage is set for classic crypto economics: dwindling supply meets institutional FOMO. (Wall Street's late as usual—just now realizing digital gold won't wait for their compliance meetings.)

Technical Breakout Confirmed

Key resistance levels shattered. On-chain metrics flashing green. This isn't hopium—it's math. The $142K target comes from historical fractal patterns repeating as BTC eats traditional assets' lunch.

Institutional Avalanche Begins

BlackRock's ETF was just the start. Now pension funds and sovereign wealth managers are quietly accumulating—because nothing says "hedge against inflation" like an asset that outperforms their entire legacy portfolio.

Warning: Volatility Ahead

Remember—this is crypto. The road to six figures won't be straight up. But for traders who stomach the dips? The fireworks might come early this cycle.

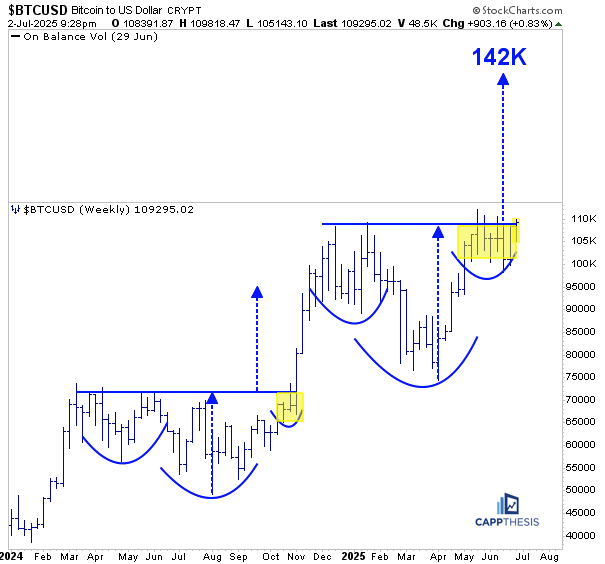

Bitcoin to $142,000/Frank Cappelleri

For perspective, the left shoulder took form from Bitcoin’s price action between late December 2024 and January 2025. Specifically, BTC surged to a high of $108,287, retraced to $89,200 by mid-January, before hitting a new all-time high of $109,350 on January 20.

Meanwhile, the head formed with Bitcoin’s drop to $74,441 on April 7, a day after the market experienced its largest single-day liquidation. According to reports, more than 7,500 BTC, worth over $500 million, were liquidated across major exchanges on April 6.

Bitcoin is currently on the right shoulder. Notably, this right shoulder formed when it rallied to the ATH of $112,000 in May and then dropped to $98,330 last month. So far, Bitcoin has rebounded from this low to its current price of close to $110,000.

Interestingly, Bitcoin currently trends close to the pattern’s neckline and is on the verge of breaking out if current bullish momentum persists. Cappelleri predicts a target of $142,000, a 29% uptick from the current market price, upon breakout.

Moreover, a fuel to the analyst’s assurance that Bitcoin would rally to the new ATH is its performance following a breakout from a similar structure. BTC rally from $68,750 in November to December’s high of $108,287 came after a breakout from an inverse H&S pattern.

Global Liquidity Fueling Optimism

Remarkably, the rapidly growing global liquidity further fuels the optimism that Bitcoin could surge extensively. The global M2 money supply reached a new all-time high of $55.48 trillion yesterday, as more capital became available for investment.

Analyst "Ak47" shared in a tweet yesterday that this uptick suggests more appetite for risk assets, which would favor Bitcoin. Citing the correlation between BTC's price and the global M2, she noted that the crypto leader is eyeing a nearly 60% surge to $175,000.

Bitcoin to $142,000/Frank Cappelleri

For perspective, the left shoulder took form from Bitcoin’s price action between late December 2024 and January 2025. Specifically, BTC surged to a high of $108,287, retraced to $89,200 by mid-January, before hitting a new all-time high of $109,350 on January 20.

Meanwhile, the head formed with Bitcoin’s drop to $74,441 on April 7, a day after the market experienced its largest single-day liquidation. According to reports, more than 7,500 BTC, worth over $500 million, were liquidated across major exchanges on April 6.

Bitcoin is currently on the right shoulder. Notably, this right shoulder formed when it rallied to the ATH of $112,000 in May and then dropped to $98,330 last month. So far, Bitcoin has rebounded from this low to its current price of close to $110,000.

Interestingly, Bitcoin currently trends close to the pattern’s neckline and is on the verge of breaking out if current bullish momentum persists. Cappelleri predicts a target of $142,000, a 29% uptick from the current market price, upon breakout.

Moreover, a fuel to the analyst’s assurance that Bitcoin would rally to the new ATH is its performance following a breakout from a similar structure. BTC rally from $68,750 in November to December’s high of $108,287 came after a breakout from an inverse H&S pattern.

Global Liquidity Fueling Optimism

Remarkably, the rapidly growing global liquidity further fuels the optimism that Bitcoin could surge extensively. The global M2 money supply reached a new all-time high of $55.48 trillion yesterday, as more capital became available for investment.

Analyst "Ak47" shared in a tweet yesterday that this uptick suggests more appetite for risk assets, which would favor Bitcoin. Citing the correlation between BTC's price and the global M2, she noted that the crypto leader is eyeing a nearly 60% surge to $175,000.