Bitcoin Long-Term Holders See Unrealized Profits Plummet to October 2024 Levels—Is a Price Crash Next?

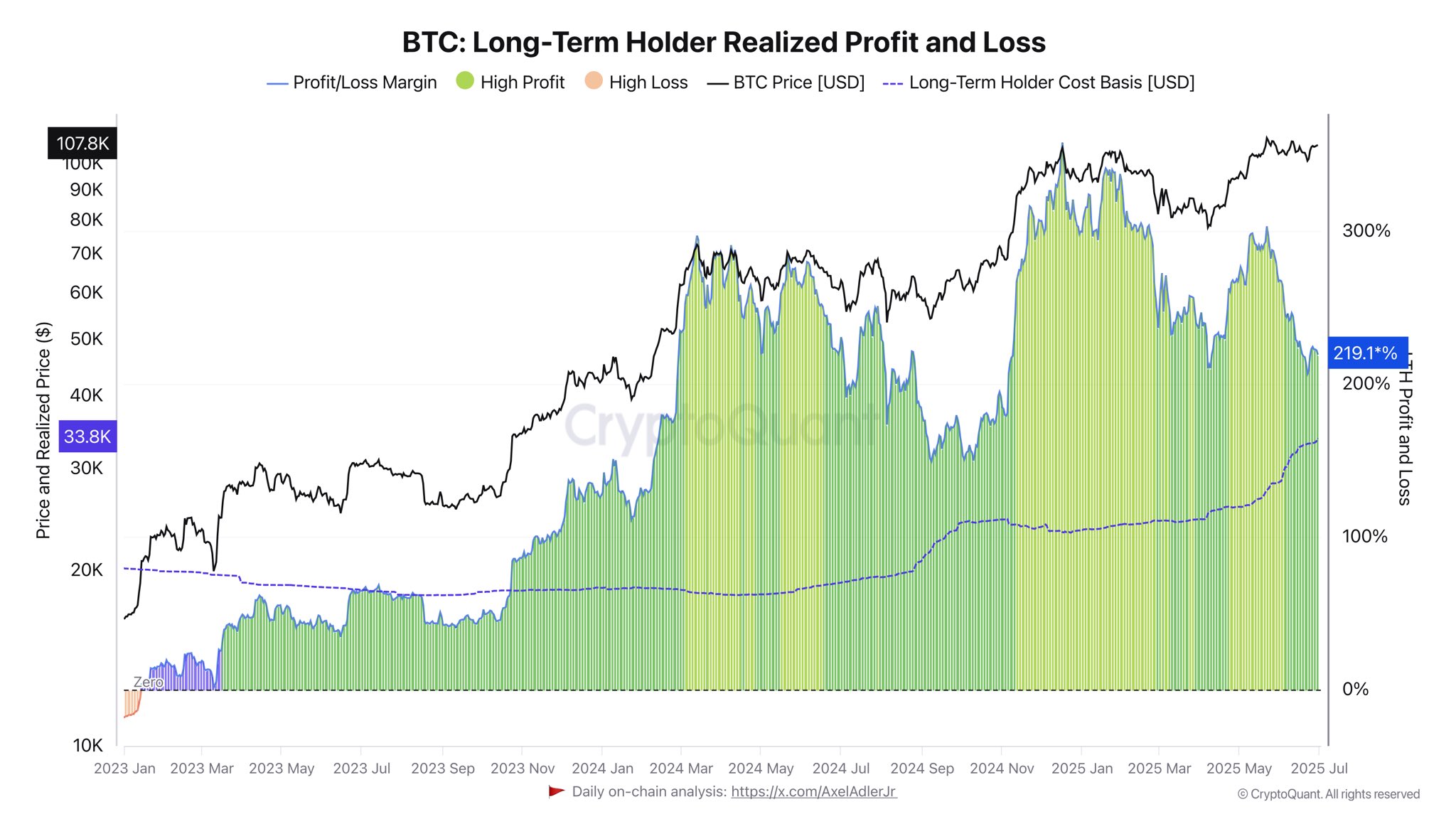

Bitcoin's long-term holders (LTH) are staring at their worst unrealized profit levels since October 2024—a grim signal that could spell trouble for BTC's price trajectory.

Why this matters: When LTHs bleed, the market trembles. These diamond-handed investors typically weather storms, but their current pain suggests deeper structural stress. If they start selling, brace for impact.

The cynical take: Wall Street's latest 'BTC is digital gold' narrative looks shakier than a Lehman Brothers balance sheet. Meanwhile, crypto natives know the real game—volatility never sleeps.

Bottom line: This isn't FUD. It's math. And right now, the numbers scream caution.

BTC LTH Realized Profit and Loss | CryptoQuant

Bitcoin Price if It Reclaims Past Profit Margins

Notably, from this cost basis, bitcoin would need to rise to $135,200 to bring the MVRV ratio back to 300%, the same level seen in March. To match the 357% margin from December, the price would have to hit $154,400.

With this data, it is logical to conclude that the current unrealized profit level remains far below what investors saw during major tops in the cycle. If the market follows past patterns, Bitcoin likely hasn't peaked yet.

Darkfost's observations line up with what seasoned trader Peter Brandt predicted. Back in October 2024, Brandt said Bitcoin could top out at $135,000. However, in May 2025, after reassessing the market conditions, he adjusted his target to between $120,000 and $150,000, with a likely peak sometime between August and September 2025.

This updated projection fits into the price range Bitcoin needs to reach to restore those earlier MVRV ratios of 300% to 357%. The overlap confirms the view that the market still has more upside left.

Historical Bitcoin LTH Profit Margins

Meanwhile, historical numbers also show how low the current ratio is. For instance, in the 2017/2018 cycle, as Bitcoin hit $19,500 at its top in December 2017, long-term holders saw unrealized profits soar to 4,000%.

During the 2020/2021 cycle, in April 2021, profits for LTHs hit 1,229% when Bitcoin reached $63,000. However, this was not even the peak of that cycle. Bitcoin pushed to a new all-time high of around $68,000 in November 2021, but by then, LTH unrealized profits had fallen to 348%.

These figures show how low current profit levels still are. While 220% sounds big, it is modest in the context of past cycles. If long-term holders are going to enjoy the same kind of windfalls they did in the past, the price will need to climb back to the $135,200–$154,400 range in the months ahead.

Currently, Bitcoin changes hands at $107,045, trading flat over the past 24 hours.

BTC LTH Realized Profit and Loss | CryptoQuant

Bitcoin Price if It Reclaims Past Profit Margins

Notably, from this cost basis, bitcoin would need to rise to $135,200 to bring the MVRV ratio back to 300%, the same level seen in March. To match the 357% margin from December, the price would have to hit $154,400.

With this data, it is logical to conclude that the current unrealized profit level remains far below what investors saw during major tops in the cycle. If the market follows past patterns, Bitcoin likely hasn't peaked yet.

Darkfost's observations line up with what seasoned trader Peter Brandt predicted. Back in October 2024, Brandt said Bitcoin could top out at $135,000. However, in May 2025, after reassessing the market conditions, he adjusted his target to between $120,000 and $150,000, with a likely peak sometime between August and September 2025.

This updated projection fits into the price range Bitcoin needs to reach to restore those earlier MVRV ratios of 300% to 357%. The overlap confirms the view that the market still has more upside left.

Historical Bitcoin LTH Profit Margins

Meanwhile, historical numbers also show how low the current ratio is. For instance, in the 2017/2018 cycle, as Bitcoin hit $19,500 at its top in December 2017, long-term holders saw unrealized profits soar to 4,000%.

During the 2020/2021 cycle, in April 2021, profits for LTHs hit 1,229% when Bitcoin reached $63,000. However, this was not even the peak of that cycle. Bitcoin pushed to a new all-time high of around $68,000 in November 2021, but by then, LTH unrealized profits had fallen to 348%.

These figures show how low current profit levels still are. While 220% sounds big, it is modest in the context of past cycles. If long-term holders are going to enjoy the same kind of windfalls they did in the past, the price will need to climb back to the $135,200–$154,400 range in the months ahead.

Currently, Bitcoin changes hands at $107,045, trading flat over the past 24 hours.