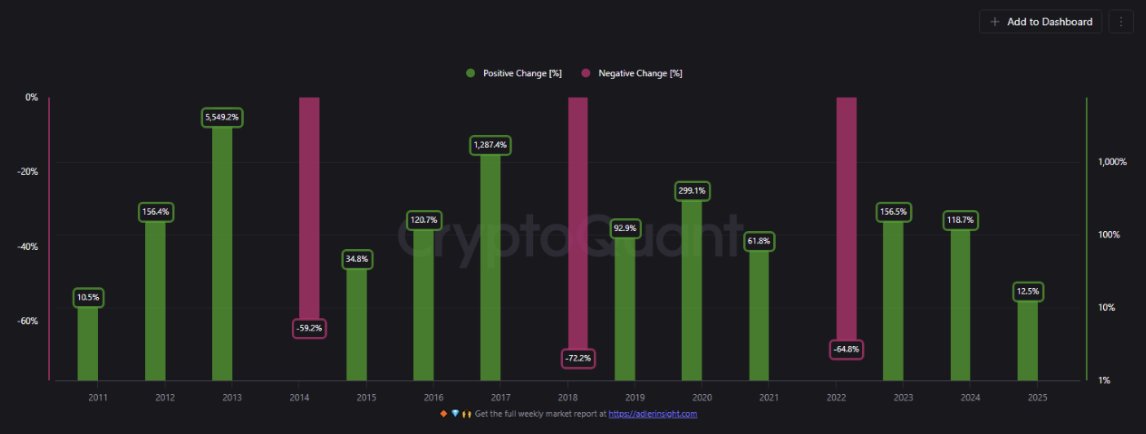

Bitcoin on Track for 120% Surge in 2025—Third-Year Boom Cycle Looms

Bitcoin’s price history doesn’t repeat, but it sure rhymes—and 2025’s third-year pattern could send it soaring.

The Halving Effect: Less Supply, More Demand

Post-halving years have consistently delivered triple-digit gains. Miners squeeze supply, while institutional FOMO kicks in—classic economics, if Wall Street ever bothered to read beyond their Bloomberg terminals.

Institutional Avalanche

Spot ETFs? Check. Corporate treasuries flipping BTC? Check. The ‘digital gold’ narrative isn’t just alive—it’s bulldozing through traditional finance’s skepticism like a bull in a Bear Stearns china shop.

Retail’s Late Arrival Party

Mainstream media will inevitably wake up—right after the 100% rally. By then, your Uber driver will be explaining Satoshi’s whitepaper between rides.

The Cynic’s Corner

Sure, 120% sounds outrageous—until you remember banks charge 20% APR on credit cards and call it ‘loyalty rewards.’

Bitcoin cyclical chart | CryptoQuant

On-Chain Metrics and Open Interest Delta

Meanwhile, another significant metric being examined is the 180-day Open Interest (OI) Delta.

According to crypto analytics platform Alphractal data, the OI Delta has recently turned negative, indicating that more Leveraged positions closed than opened over the past few months. Major contributors to this decline include platforms like Bitget and CME, which together have seen over $10 billion in reduced open interest.

Historically, a negative OI Delta has coincided with local market bottoms as observed in 2021 and 2023, often preceding significant price rebounds. A reversal in this trend, turning the OI Delta positive, could signal a renewed bullish phase.

Bitcoin cyclical chart | CryptoQuant

On-Chain Metrics and Open Interest Delta

Meanwhile, another significant metric being examined is the 180-day Open Interest (OI) Delta.

According to crypto analytics platform Alphractal data, the OI Delta has recently turned negative, indicating that more Leveraged positions closed than opened over the past few months. Major contributors to this decline include platforms like Bitget and CME, which together have seen over $10 billion in reduced open interest.

Historically, a negative OI Delta has coincided with local market bottoms as observed in 2021 and 2023, often preceding significant price rebounds. A reversal in this trend, turning the OI Delta positive, could signal a renewed bullish phase.