Chainlink Fuels Historic CBDC-Stablecoin Bridge Linking Hong Kong and Australia

Decentralized oracle network Chainlink just cracked open the future of cross-border payments—and left traditional SWIFT transfers in the dust.

The Silk Road 2.0?

Hong Kong and Australia's central banks are piloting a blockchain-powered corridor using Chainlink's CCIP protocol. No more waiting days for settlements—this system moves value at the speed of the internet, with programmable triggers that'd make a TradFi quant sweat.

Stablecoins Eat Their Lunch

The test pairs a Hong Kong CBDC with an AUD-pegged stablecoin, proving that fiat-backed tokens can play nice with government-issued digital money. Take that, crypto purists.

As banks scramble to stay relevant, one thing's clear: the financial middlemen charging 3% for moving digits between spreadsheets should start updating their LinkedIn profiles.

Chainlink’s Role in Cross-Border Payments

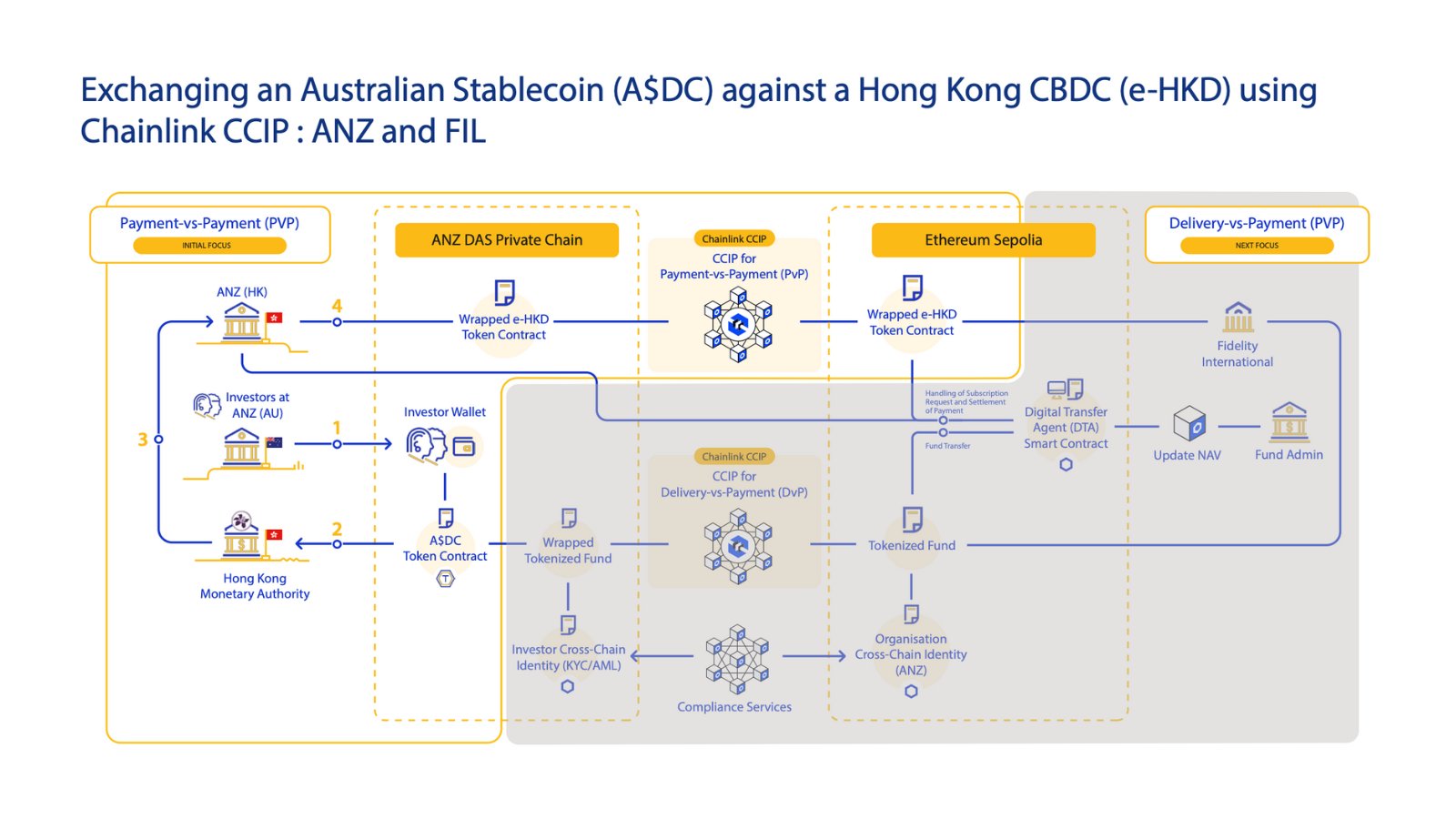

At the heart of this milestone was Chainlink’s Cross-Chain Interoperability Protocol, which allowed the exchange between the two digital assets. The transaction used the Australian Stablecoin issued by the Australia and New Zealand Banking Group alongside the e-HKD.

This integration was key in demonstrating how blockchain-based infrastructure can enhance the efficiency and security of international payments. Chainlink’s protocol effectively bridged the gap between different blockchain networks, providing a seamless experience for all parties involved.

Involvement of Financial Giants

The pilot's success was further strengthened by the involvement of major financial institutions. Visa, Fidelity International, ANZ, and China Asset Management Company participated in the transaction framework.

Each of these players contributed to the pilot's execution and success, reinforcing the growing collaboration between traditional finance and decentralized technologies. This partnership highlights how established financial players are beginning to adopt and integrate blockchain and digital currency solutions into their existing systems.

Expansion of Blockchain Use in Traditional Finance

This pilot also comes when traditional financial institutions show increasing interest in blockchain and Web3 technologies. Recently, JP Morgan concluded its first transaction on a public chain, signaling a deeper commitment to the Web3 space.

Using Chainlink’s technology to connect private and public networks, JP Morgan’s transaction with tokenized U.S. Treasuries on ONDO Finance demonstrates how blockchain is reshaping traditional finance.

Chainlink’s Role in Cross-Border Payments

At the heart of this milestone was Chainlink’s Cross-Chain Interoperability Protocol, which allowed the exchange between the two digital assets. The transaction used the Australian Stablecoin issued by the Australia and New Zealand Banking Group alongside the e-HKD.

This integration was key in demonstrating how blockchain-based infrastructure can enhance the efficiency and security of international payments. Chainlink’s protocol effectively bridged the gap between different blockchain networks, providing a seamless experience for all parties involved.

Involvement of Financial Giants

The pilot's success was further strengthened by the involvement of major financial institutions. Visa, Fidelity International, ANZ, and China Asset Management Company participated in the transaction framework.

Each of these players contributed to the pilot's execution and success, reinforcing the growing collaboration between traditional finance and decentralized technologies. This partnership highlights how established financial players are beginning to adopt and integrate blockchain and digital currency solutions into their existing systems.

Expansion of Blockchain Use in Traditional Finance

This pilot also comes when traditional financial institutions show increasing interest in blockchain and Web3 technologies. Recently, JP Morgan concluded its first transaction on a public chain, signaling a deeper commitment to the Web3 space.

Using Chainlink’s technology to connect private and public networks, JP Morgan’s transaction with tokenized U.S. Treasuries on ONDO Finance demonstrates how blockchain is reshaping traditional finance.