BlackRock’s $561M Crypto Pivot: Bitcoin Out, Ethereum In

Wall Street’s trillion-dollar whale makes a power play—dumping Bitcoin to double down on Ethereum. Is this institutional FOMO or just another hedge fund reshuffle?

The move reeks of classic finance theatrics—sell high, buy higher, and let retail investors foot the volatility bill. Meanwhile, crypto degens shrug and keep stacking satoshis.

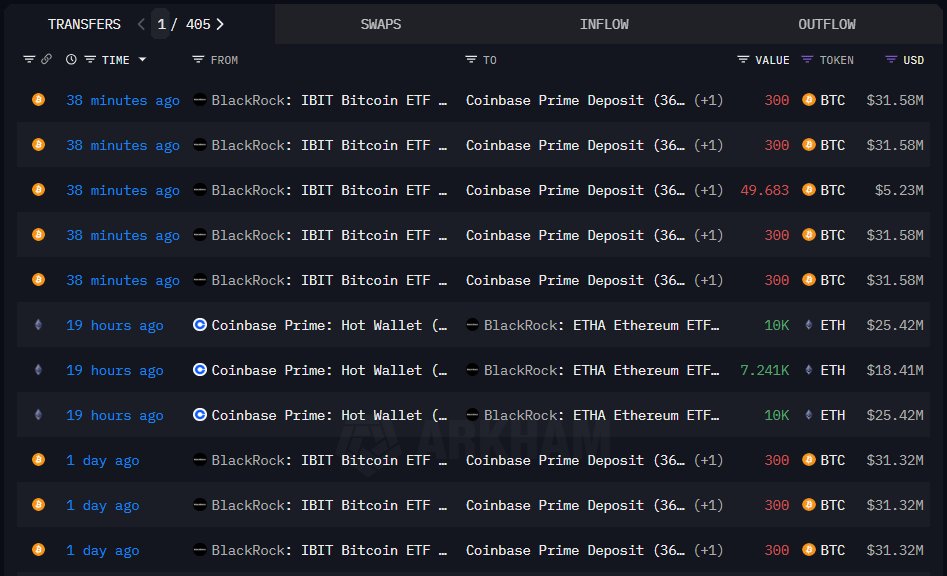

Snapshot of BlackRock Bitcoin and ethereum transactions

Why Is BlackRock Selling Bitcoin?

Notably, the amount of Bitcoin BlackRock sold aligns almost perfectly with the outflow figures recorded by its iShares Bitcoin Trust over the past two days. On Monday, BlackRock’s Bitcoin spot ETF posted a $130.4 million outflow. On Friday, May 30, it recorded a $430.8 million outflow, bringing the two-day total to $561 million.

During this same period, the overall U.S. Bitcoin spot ETF market experienced consecutive daily outflows starting last Thursday, totaling a $1.23 billion net drain.

These negative trends followed ten consecutive days of positive flows into U.S. Bitcoin ETFs. The shift coincided with Bitcoin reaching an all-time high of approximately $112,000 in May before undergoing a retracement.

Amid this retrace, investors grew cautious and began offloading their positions, as evidenced by outflows from BlackRock and other ETF managers. Notably, BTC’s price dipped to around $103,000 before rebounding slightly to $106,600 at press time, up 2.5% over the past 24 hours.

Despite BlackRock liquidating over half a billion dollars’ worth of Bitcoin in two days, its total Bitcoin spot ETF flows since inception remain strong at $48.439 billion. Meanwhile, its entire BTC holdings stand at 661,142 tokens, worth approximately $70 billion.

Ethereum ETFs Remain Positive

While the Bitcoin spot ETF market has recently seen heavy outflows, Ethereum ETFs have shown a different trend. Ethereum spot ETFs have now maintained 11 consecutive days of positive inflows, led entirely by BlackRock.

Yesterday, total Ethereum ETF inflows stood at $78.2 million, with BlackRock contributing $48.4 million and Fidelity adding $29.8 million. All other Ethereum issuers reported zero flows.

Historically, inflows into Ethereum spot ETFs have largely come from BlackRock and Fidelity, with occasional contributions from Bitwise and Grayscale.

Snapshot of BlackRock Bitcoin and ethereum transactions

Why Is BlackRock Selling Bitcoin?

Notably, the amount of Bitcoin BlackRock sold aligns almost perfectly with the outflow figures recorded by its iShares Bitcoin Trust over the past two days. On Monday, BlackRock’s Bitcoin spot ETF posted a $130.4 million outflow. On Friday, May 30, it recorded a $430.8 million outflow, bringing the two-day total to $561 million.

During this same period, the overall U.S. Bitcoin spot ETF market experienced consecutive daily outflows starting last Thursday, totaling a $1.23 billion net drain.

These negative trends followed ten consecutive days of positive flows into U.S. Bitcoin ETFs. The shift coincided with Bitcoin reaching an all-time high of approximately $112,000 in May before undergoing a retracement.

Amid this retrace, investors grew cautious and began offloading their positions, as evidenced by outflows from BlackRock and other ETF managers. Notably, BTC’s price dipped to around $103,000 before rebounding slightly to $106,600 at press time, up 2.5% over the past 24 hours.

Despite BlackRock liquidating over half a billion dollars’ worth of Bitcoin in two days, its total Bitcoin spot ETF flows since inception remain strong at $48.439 billion. Meanwhile, its entire BTC holdings stand at 661,142 tokens, worth approximately $70 billion.

Ethereum ETFs Remain Positive

While the Bitcoin spot ETF market has recently seen heavy outflows, Ethereum ETFs have shown a different trend. Ethereum spot ETFs have now maintained 11 consecutive days of positive inflows, led entirely by BlackRock.

Yesterday, total Ethereum ETF inflows stood at $78.2 million, with BlackRock contributing $48.4 million and Fidelity adding $29.8 million. All other Ethereum issuers reported zero flows.

Historically, inflows into Ethereum spot ETFs have largely come from BlackRock and Fidelity, with occasional contributions from Bitwise and Grayscale.