XRP’s 80-Week Inflow Streak Shatters as Bitcoin and Crypto Funds Rake in $3.3B

After nearly two years of relentless inflows, XRP finally hits a wall—while Bitcoin and friends soak up institutional cash like a hedge fund at a tax loophole buffet.

The streak breaks

XRP’s 80-week inflow streak—once the darling of crypto ETFs—collapses as investors pivot toward greener pastures (or at least more volatile ones).

Big money moves

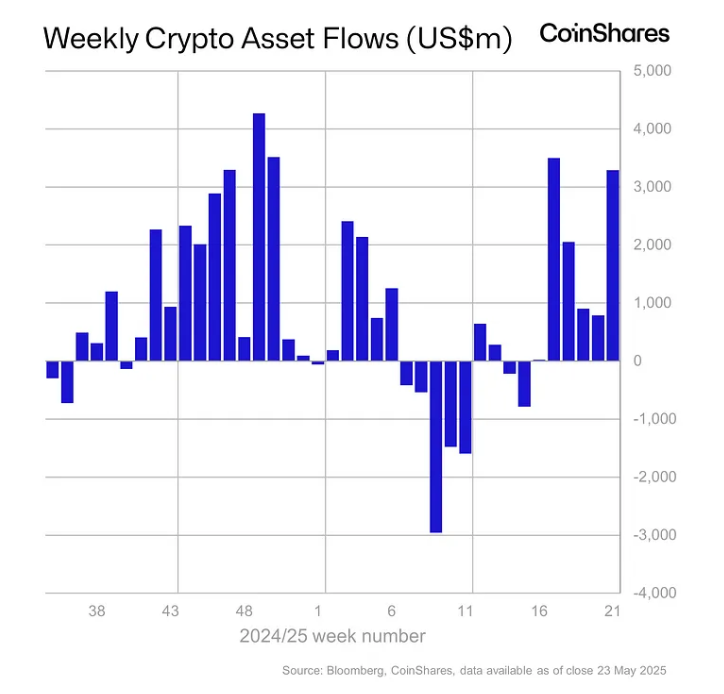

Meanwhile, Bitcoin and other digital asset products vacuum up $3.3 billion in fresh capital. Because nothing says ’mature asset class’ like triple-digit weekly inflows chasing the same speculative bets.

The cynical take

Wall Street’s latest crypto love affair proves one thing: when traditional finance finally ’gets it,’ you can bet they’ll overdo it. Again.

Crypto Investment Weekly FlowsCrypto Investment Weekly Flows

Meanwhile, the global cryptocurrency market cap grew 6% in the previous week to $3.5 trillion, driven by an altcoin resurgence and Bitcoin’s rally to price discovery. The pioneering cryptocurrency reached a new all-time high of $112,000 on May 22, extending recent bullish momentum.

Crypto Inflow Details

Bitcoin led inflows into crypto investment vehicles as the US spot exchange-traded funds amassed staggering amounts last week. Bitcoin funds saw a net weekly inflow of $2.98 billion, pushing month-to-date and year-to-date to $5.49 billion and $10.2 billion, respectively.

Meanwhile, Ethereum-based funds recorded a 15-week high net inflow of $326.2 million, as sentiments around the asset continue to improve. Solana and SUI products also saw net positive flows of $4.3 million and $2.9 million, with short Bitcoin attracting $12.7 million, its largest since December 2024.

However, investment vehicles tracking XRP, the fourth-largest cryptocurrency by market cap, saw their first outflow in 80 weeks. They saw a $37.2 million outflow last week, their highest on record, as investors fled from the asset amid its consolidation.

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) dominated proceedings for issuers. It saw a net inflow of $2.56 billion, with one of its daily performances last week beating the Vanguard S&P 500 ETF (VOO) for the first time.

The Fidelity Wise Origin Bitcoin Trust (FBTC) followed IBIT, attracting $210 million. Other funds, such as Ark Investments’ and Bitwise’s US Bitcoin ETFs, recorded net weekly inflows of $101 million and $48 million, respectively.

The US Leads Inflow by Region

By geographical distribution, the United States commanded the largest inflow with its $3.3 billion weekly positive flow. The US accounted for 98% of flows, while Germany, Hong Kong, and Australia provided the others.

Germany-based crypto funds attracted $41.5 million, Hong Kong $33.3 million, and Australia $10.9 million. Notably, this compensated for outflows from Switzerland, Sweden, and Brazil.

Crypto Investment Weekly FlowsCrypto Investment Weekly Flows

Meanwhile, the global cryptocurrency market cap grew 6% in the previous week to $3.5 trillion, driven by an altcoin resurgence and Bitcoin’s rally to price discovery. The pioneering cryptocurrency reached a new all-time high of $112,000 on May 22, extending recent bullish momentum.

Crypto Inflow Details

Bitcoin led inflows into crypto investment vehicles as the US spot exchange-traded funds amassed staggering amounts last week. Bitcoin funds saw a net weekly inflow of $2.98 billion, pushing month-to-date and year-to-date to $5.49 billion and $10.2 billion, respectively.

Meanwhile, Ethereum-based funds recorded a 15-week high net inflow of $326.2 million, as sentiments around the asset continue to improve. Solana and SUI products also saw net positive flows of $4.3 million and $2.9 million, with short Bitcoin attracting $12.7 million, its largest since December 2024.

However, investment vehicles tracking XRP, the fourth-largest cryptocurrency by market cap, saw their first outflow in 80 weeks. They saw a $37.2 million outflow last week, their highest on record, as investors fled from the asset amid its consolidation.

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) dominated proceedings for issuers. It saw a net inflow of $2.56 billion, with one of its daily performances last week beating the Vanguard S&P 500 ETF (VOO) for the first time.

The Fidelity Wise Origin Bitcoin Trust (FBTC) followed IBIT, attracting $210 million. Other funds, such as Ark Investments’ and Bitwise’s US Bitcoin ETFs, recorded net weekly inflows of $101 million and $48 million, respectively.

The US Leads Inflow by Region

By geographical distribution, the United States commanded the largest inflow with its $3.3 billion weekly positive flow. The US accounted for 98% of flows, while Germany, Hong Kong, and Australia provided the others.

Germany-based crypto funds attracted $41.5 million, Hong Kong $33.3 million, and Australia $10.9 million. Notably, this compensated for outflows from Switzerland, Sweden, and Brazil.