Cardano rolls into 2025 with a staggering $1.1 billion treasury—proof that even in crypto, bureaucracies know how to hoard cash. Governance participation? Skyrocketing. On-chain activity? Let’s call it... aspirational.

The blockchain’s got the funds and the voter enthusiasm, but the real test is whether it can turn those numbers into real-world utility. Meanwhile, Wall Street still thinks ’DeFi’ is a typo.

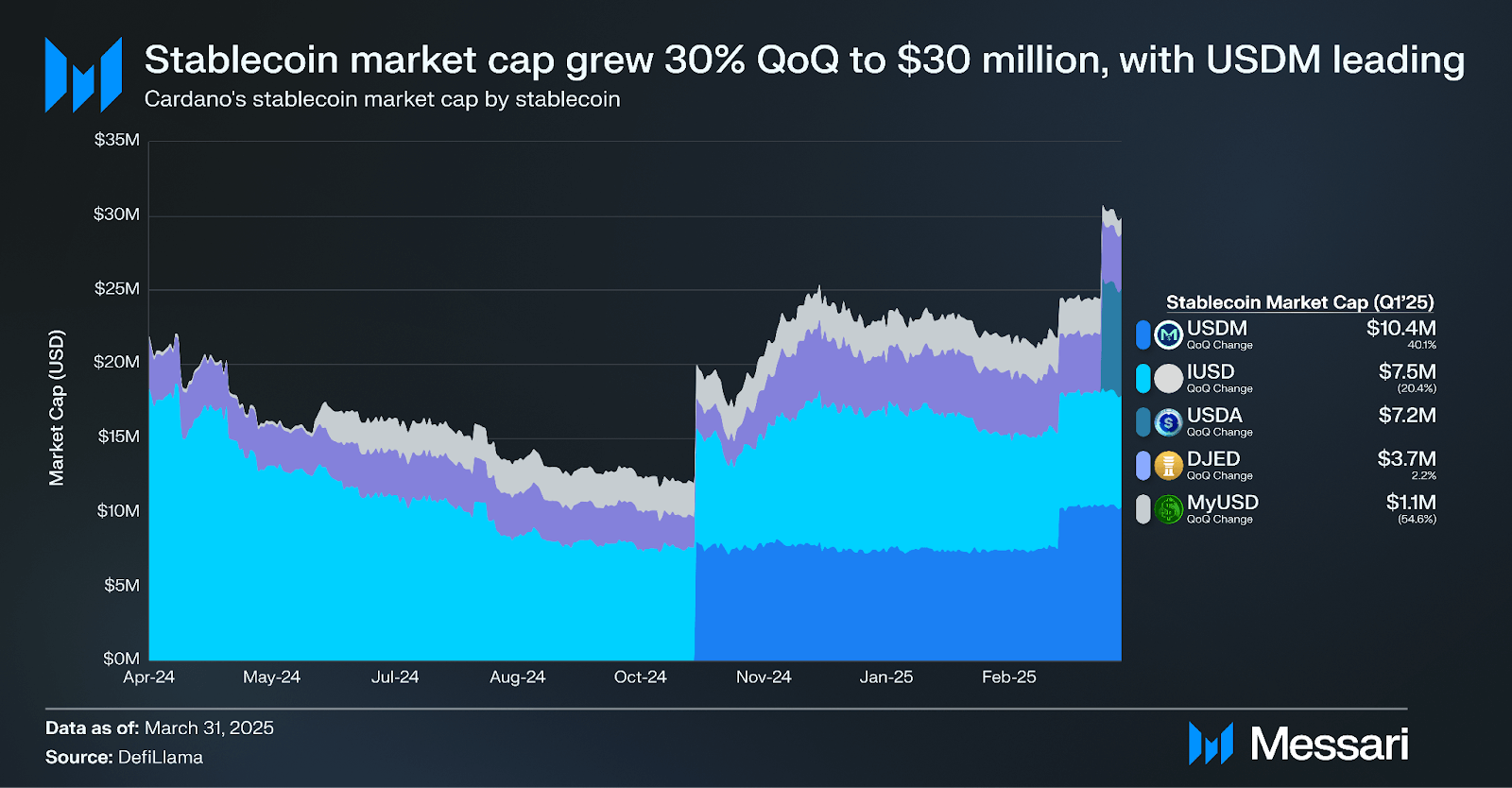

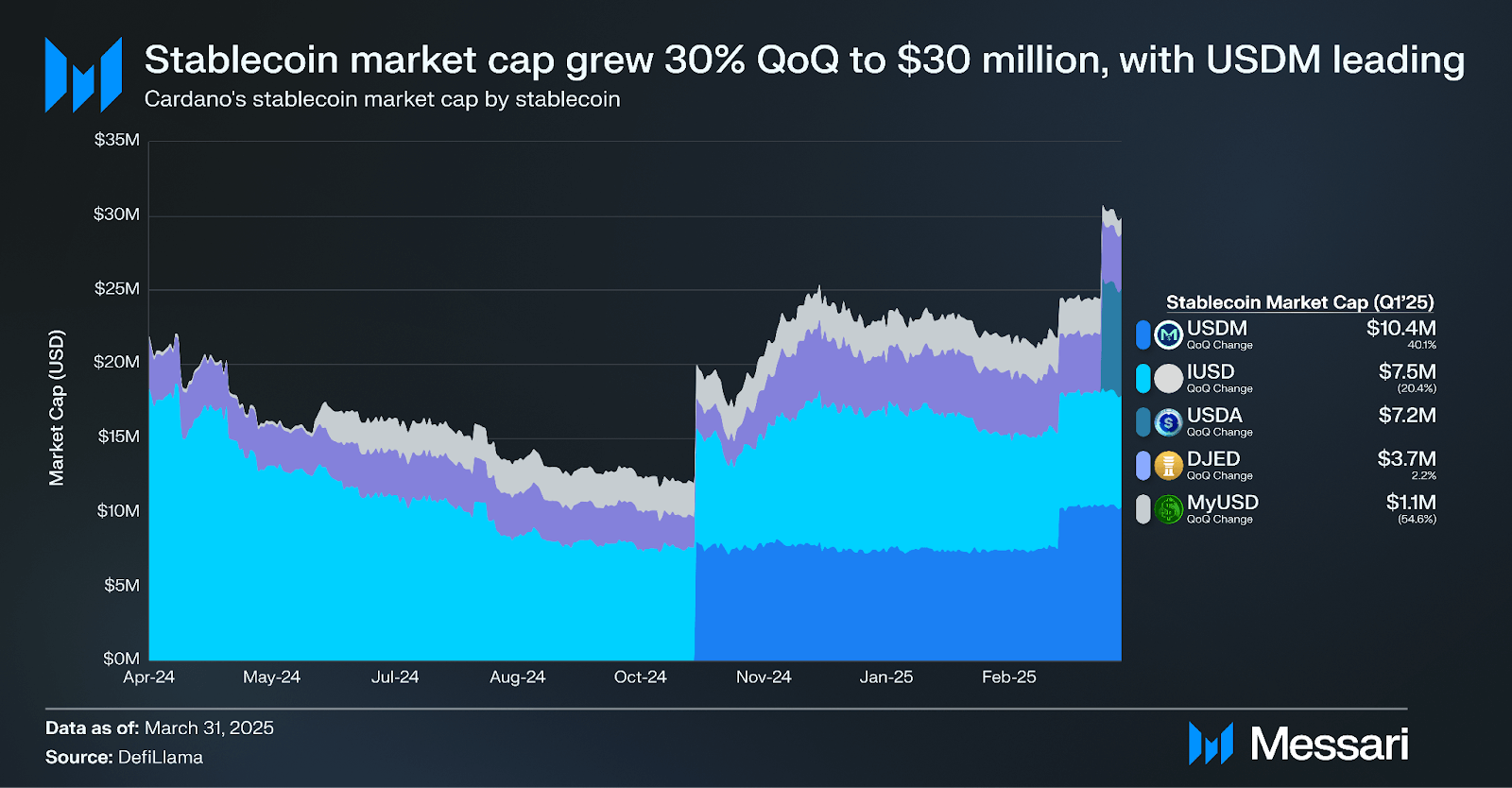

Stablecoins Surge While DeFi TVL Contracts

Meanwhile, Cardano’s DeFi Total Value Locked (TVL) fell by 29% QoQ to $319.3 million, underperforming the broader DeFi market, which declined by 26%.

However, a contrasting trend emerged in the stablecoin sector. Cardano’s total stablecoin market cap grew by 30%, reaching $30.2 million.

This growth was led by the USD-backed stablecoin USDM, which increased by 40%, and the newly launched fiat-backed stablecoin USDA, which quickly reached a $7.2 million market cap.

These contrasting trends in declining DEX activity alongside growing stablecoin adoption suggest a risk-off environment, where users prefer storing value in stable assets over engaging in active trading.

Top DeFi Protocols Adjust to Market Conditions

While TVL declined across major protocols, Cardano’s DeFi diversity score rose to 9. Minswap reclaimed the top spot with $77.4 million in TVL, overtaking Liqwid, which fell 38% to $70.3 million. Indigo, WingRiders, and Splash also experienced TVL declines but sustained active development and user engagement.

DEX aggregator DexHunter maintained its lead in volume and introduced new features such as

Leveraged trading and a developer API to support further ecosystem expansion.

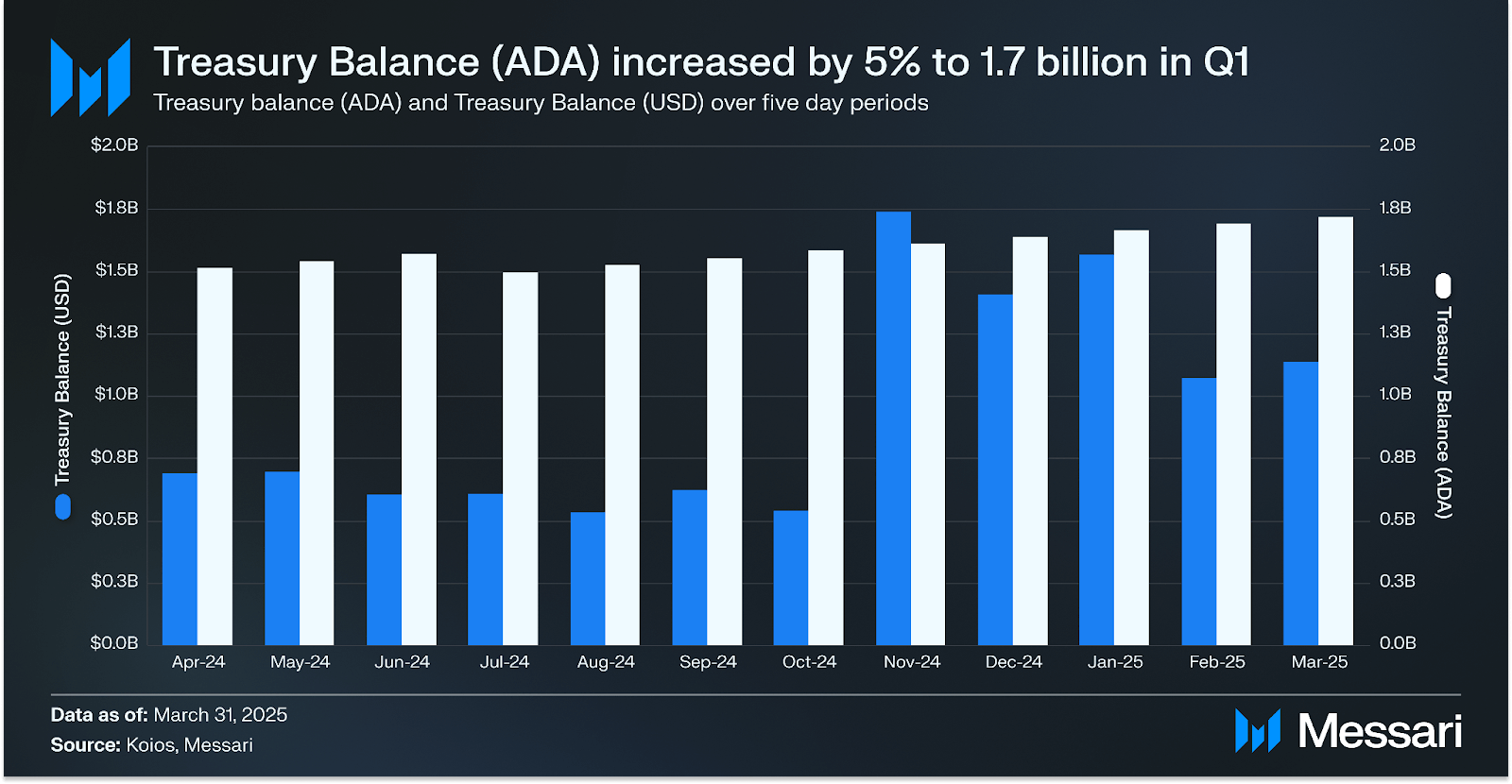

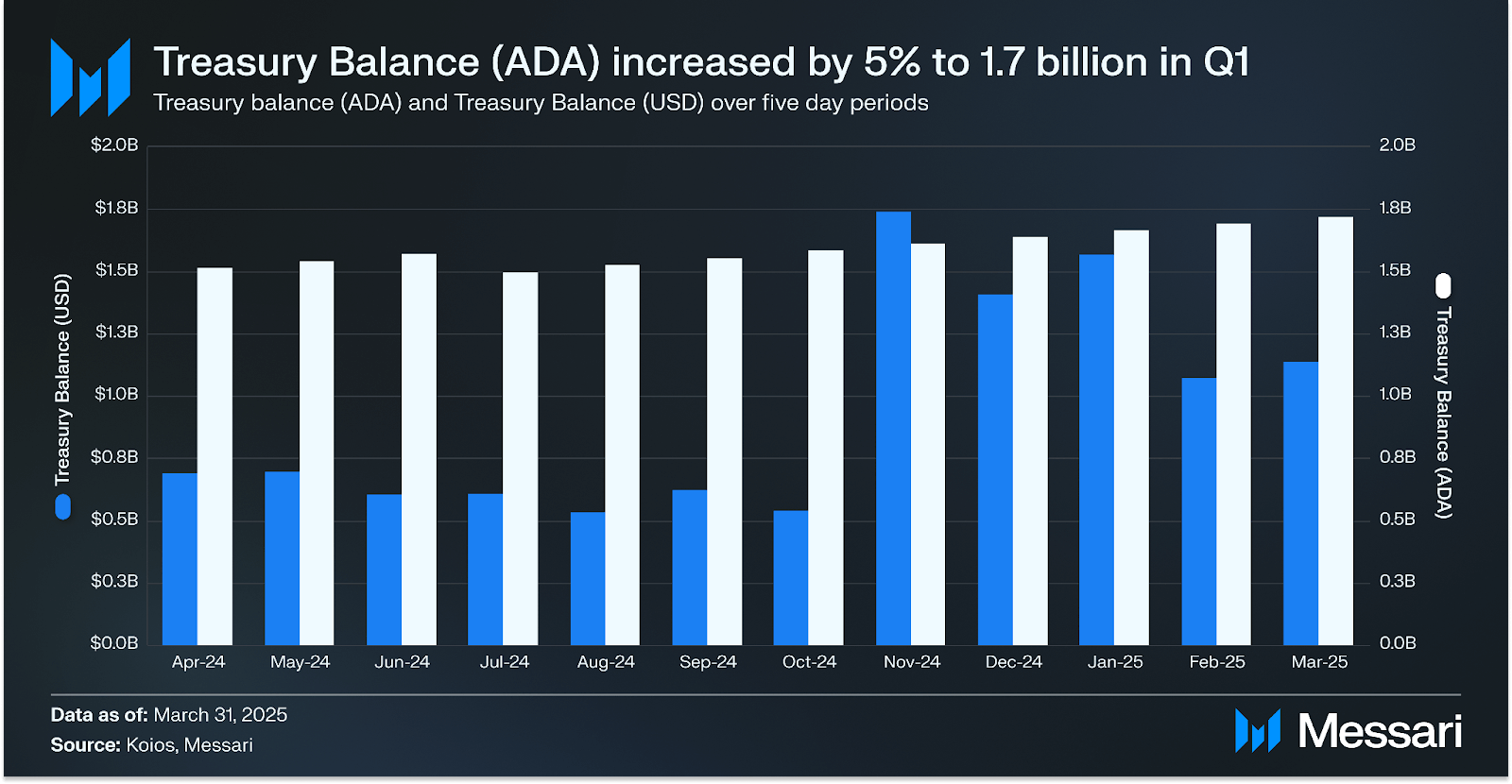

Treasury Grows in ADA Terms, Declines in USD

Cardano’s treasury balance increased by 5% QoQ to 1.7 billion ADA, though its value in USD declined 19% to $1.1 billion due to the drop in ADA’s price.

With governance now in the community’s hands, 20% of all network fees are allocated to the treasury. This serves as a key funding source for development initiatives voted on by DReps and other governance participants.

By the end of Q1,

Cardano had completed a fundamental transition in its decision-making process, transferring governance keys from IOG, the Cardano Foundation, and EMURGO to the community. Eight specialized Intersect committees now support on-chain governance actions.

Essentially, Cardano is now one of the few blockchains operating with a live constitutional governance model, involving voters, SPOs, and elected representatives in ongoing decision-making.

Despite market headwinds that suppressed token prices and activity, Cardano’s Q1 achievements point to growing maturity, laying the groundwork for a more resilient decentralized future.

Stablecoins Surge While DeFi TVL Contracts

Meanwhile, Cardano’s DeFi Total Value Locked (TVL) fell by 29% QoQ to $319.3 million, underperforming the broader DeFi market, which declined by 26%.

However, a contrasting trend emerged in the stablecoin sector. Cardano’s total stablecoin market cap grew by 30%, reaching $30.2 million.

This growth was led by the USD-backed stablecoin USDM, which increased by 40%, and the newly launched fiat-backed stablecoin USDA, which quickly reached a $7.2 million market cap.

These contrasting trends in declining DEX activity alongside growing stablecoin adoption suggest a risk-off environment, where users prefer storing value in stable assets over engaging in active trading.

Stablecoins Surge While DeFi TVL Contracts

Meanwhile, Cardano’s DeFi Total Value Locked (TVL) fell by 29% QoQ to $319.3 million, underperforming the broader DeFi market, which declined by 26%.

However, a contrasting trend emerged in the stablecoin sector. Cardano’s total stablecoin market cap grew by 30%, reaching $30.2 million.

This growth was led by the USD-backed stablecoin USDM, which increased by 40%, and the newly launched fiat-backed stablecoin USDA, which quickly reached a $7.2 million market cap.

These contrasting trends in declining DEX activity alongside growing stablecoin adoption suggest a risk-off environment, where users prefer storing value in stable assets over engaging in active trading.