Ripple’s Stealth Play: XRP Community Exposes Ties to $11T Treasury Clearing System

Ripple’s army of loyalists just cracked open a vault-worthy revelation—their favorite blockchain might have backdoor access to the $11 trillion US Treasury clearing network. Talk about a plot twist Wall Street didn’t see coming.

Buried connections surface

The XRP community—never shy about playing digital detective—unearthed what appears to be Ripple’s hidden on-ramp to the motherlode of institutional money flows. Because nothing says ’disruption’ like quietly building bridges to the very system you’re supposed to replace.

Finance’s old guard won’t sweat... yet

While the discovery sends crypto Twitter into euphoria, traditional clearinghouses will likely keep sipping their bourbon undisturbed—for now. After all, moving trillions requires more than just tech; it needs regulators to play along. And we know how they love their paperwork.

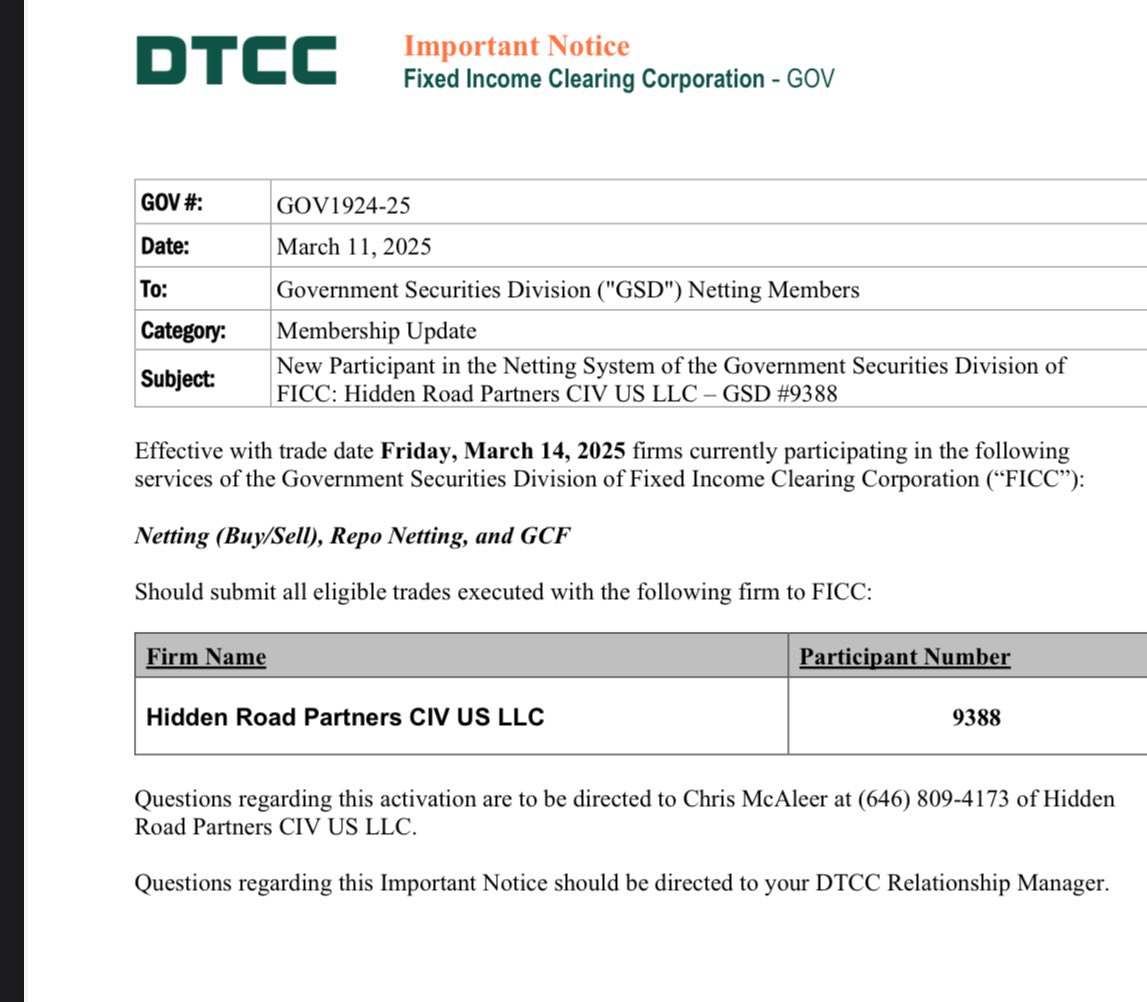

DTCC notice for Hidden Road membership

GSD’s recent performance highlights the significance of this membership. Notably, it hit a record $9.2 trillion in daily volume on September 3, 2024, surpassing the previous high of $8.8 trillion in July.

More recently, FICC confirmed clearing over $11 trillion in U.S. Treasury trades as of April 9, 2025, a new all-time high.

The surge in activity comes in the wake of the SEC’s 2023 mandate requiring expanded central clearing for U.S. Treasury transactions. Before the rule’s finalization in December 2023, FICC’s average daily volumes hovered around $4.5 trillion. By the end of that year, they rose to $7.2 trillion, and in 2024, they breached $10.4 trillion on peak days.

Firms like Hidden Road are capitalizing on this trend. Ripple disclosed that Hidden Road clears over $3 trillion annually for more than 300 institutional clients. However, before the acquisition, settlement delays were a pain point.

XRP’s Place in Hidden Road’s Trillion-Dollar Market

Ripple aims to resolve this through integration with the XRP Ledger, which will handle post-trade operations. Specifically, XRPL will enable five-second settlements and greater transparency.

Expectedly, this has sparked renewed speculation in the XRP community. Some enthusiasts believe that if the system adopts XRP for settlement, even for $1.5 billion daily, the token’s price would jump to $30. However, Ripple’s latest blog post clarified that XRP will not be for settlement.

RLUSD Takes the Lead as Collateral Asset

Instead, Ripple confirmed that its stablecoin RLUSD will be collateral on Hidden Road’s platform. Since the XRP Ledger will be for infrastructure and post-trade processing, XRP’s place will be in transaction fees.

However, this revelation sparked debate within the XRP community. Some argue that RLUSD may be overtaking XRP as Ripple’s flagship asset in enterprise use cases.

DTCC notice for Hidden Road membership

GSD’s recent performance highlights the significance of this membership. Notably, it hit a record $9.2 trillion in daily volume on September 3, 2024, surpassing the previous high of $8.8 trillion in July.

More recently, FICC confirmed clearing over $11 trillion in U.S. Treasury trades as of April 9, 2025, a new all-time high.

The surge in activity comes in the wake of the SEC’s 2023 mandate requiring expanded central clearing for U.S. Treasury transactions. Before the rule’s finalization in December 2023, FICC’s average daily volumes hovered around $4.5 trillion. By the end of that year, they rose to $7.2 trillion, and in 2024, they breached $10.4 trillion on peak days.

Firms like Hidden Road are capitalizing on this trend. Ripple disclosed that Hidden Road clears over $3 trillion annually for more than 300 institutional clients. However, before the acquisition, settlement delays were a pain point.

XRP’s Place in Hidden Road’s Trillion-Dollar Market

Ripple aims to resolve this through integration with the XRP Ledger, which will handle post-trade operations. Specifically, XRPL will enable five-second settlements and greater transparency.

Expectedly, this has sparked renewed speculation in the XRP community. Some enthusiasts believe that if the system adopts XRP for settlement, even for $1.5 billion daily, the token’s price would jump to $30. However, Ripple’s latest blog post clarified that XRP will not be for settlement.

RLUSD Takes the Lead as Collateral Asset

Instead, Ripple confirmed that its stablecoin RLUSD will be collateral on Hidden Road’s platform. Since the XRP Ledger will be for infrastructure and post-trade processing, XRP’s place will be in transaction fees.

However, this revelation sparked debate within the XRP community. Some argue that RLUSD may be overtaking XRP as Ripple’s flagship asset in enterprise use cases.