Kraken Research: A Dash of XRP Slashes Portfolio Risk While Boosting Returns

Forget gold—crypto’s dark horse just got a bullish upgrade. Kraken’s latest analysis reveals how even a modest XRP allocation can act as a portfolio shock absorber—while still packing upside.

The Ripple Effect

XRP’s low correlation to both Bitcoin and traditional assets makes it a rare hybrid: downside cushion during crypto winters, with enough liquidity to spike when altcoins catch bids. Kraken’s data shows a 5-10% allocation historically smoothed volatility by 12% versus BTC-only portfolios.

Bankers Hate This Trick

Meanwhile, Wall Street still charges 2% fees for ’diversified’ funds that underperform a basic ETH/XRP combo. The kicker? This isn’t complex DeFi wizardry—it’s straight-up asset allocation math even your CFA uncle could grasp.

The Bottom Line

XRP won’t moon like a meme coin, but it doesn’t need to. In a market where ’safe’ yields mean locking cash for 5% returns while inflation runs at 6%, a little Ripple goes a long way.

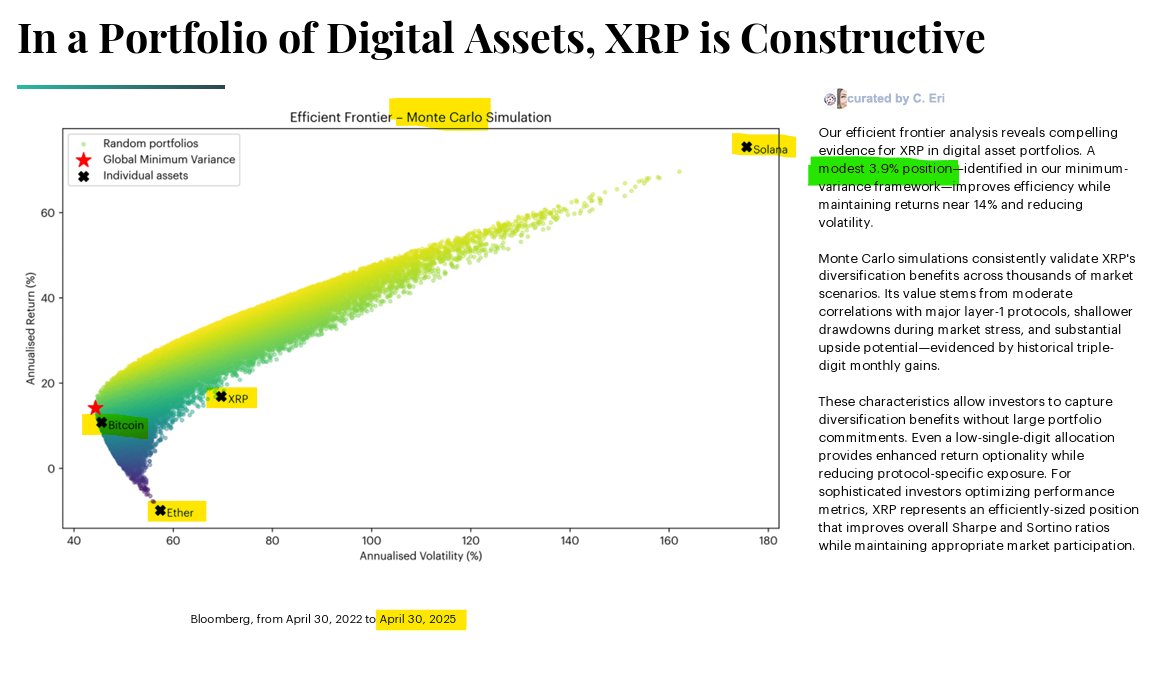

This level of exposure, determined within a minimum-variance framework, reportedly sustains annualized returns near 14% while also reducing portfolio volatility.

The simulations, which tested thousands of market scenarios, provide statistical support for XRP’s risk-adjusted performance. The analysis highlights XRP’s value as a portfolio diversifier, given its moderate correlations with major layer-1 assets like Bitcoin and Ethereum.

By not moving in lockstep with these dominant cryptocurrencies, XRP helps smooth portfolio volatility, especially during periods of elevated market stress.

Diversification and Risk Metrics Point to Strategic Allocation

In addition to lower correlation, Kraken’s research notes that XRP shows resilience during broad market drawdowns. Simulated portfolios with XRP included experienced shallower declines, suggesting reduced exposure to protocol-specific risks.

This resilience, combined with XRP’s historical upside, including prior triple-digit monthly gains, strengthens its positioning as a contributor to improved risk-adjusted returns.

Further, the report finds that small allocations to XRP lead to notable improvements in key portfolio performance metrics. Specifically, the Sharpe and Sortino ratios, used to measure risk-adjusted returns, show better results with XRP included.

Kraken emphasizes that large capital commitments are not necessary. Even low-single-digit allocations provide the intended diversification and efficiency gains. These findings reflect a broader application of XRP in retail and institutional portfolio structures.

Technical Analysis Supports Long-Term Price Structure

Meanwhile, a separate analysis from analyst "GalaxyBTC" outlines long-term technical patterns in XRP’s historical price cycles.

The review identifies two major consolidation periods: the 2014–2017 cycle, which lasted about 1,267 days, and the ongoing 2018–2025 cycle, which spans approximately 2,471 days. Following the earlier consolidation, XRP surged from $0.0067 to $3.84 after breaking out and retesting its trendline.

In early 2025, XRP mirrored this pattern by breaking out of the multi-year downtrend. As of now, XRP trades near $2.38. Galaxy suggests that this longer consolidation phase may lead to a stronger rally, with technical projections pointing toward a potential price target of $40, if historical structures repeat.

This level of exposure, determined within a minimum-variance framework, reportedly sustains annualized returns near 14% while also reducing portfolio volatility.

The simulations, which tested thousands of market scenarios, provide statistical support for XRP’s risk-adjusted performance. The analysis highlights XRP’s value as a portfolio diversifier, given its moderate correlations with major layer-1 assets like Bitcoin and Ethereum.

By not moving in lockstep with these dominant cryptocurrencies, XRP helps smooth portfolio volatility, especially during periods of elevated market stress.

Diversification and Risk Metrics Point to Strategic Allocation

In addition to lower correlation, Kraken’s research notes that XRP shows resilience during broad market drawdowns. Simulated portfolios with XRP included experienced shallower declines, suggesting reduced exposure to protocol-specific risks.

This resilience, combined with XRP’s historical upside, including prior triple-digit monthly gains, strengthens its positioning as a contributor to improved risk-adjusted returns.

Further, the report finds that small allocations to XRP lead to notable improvements in key portfolio performance metrics. Specifically, the Sharpe and Sortino ratios, used to measure risk-adjusted returns, show better results with XRP included.

Kraken emphasizes that large capital commitments are not necessary. Even low-single-digit allocations provide the intended diversification and efficiency gains. These findings reflect a broader application of XRP in retail and institutional portfolio structures.

Technical Analysis Supports Long-Term Price Structure

Meanwhile, a separate analysis from analyst "GalaxyBTC" outlines long-term technical patterns in XRP’s historical price cycles.

The review identifies two major consolidation periods: the 2014–2017 cycle, which lasted about 1,267 days, and the ongoing 2018–2025 cycle, which spans approximately 2,471 days. Following the earlier consolidation, XRP surged from $0.0067 to $3.84 after breaking out and retesting its trendline.

In early 2025, XRP mirrored this pattern by breaking out of the multi-year downtrend. As of now, XRP trades near $2.38. Galaxy suggests that this longer consolidation phase may lead to a stronger rally, with technical projections pointing toward a potential price target of $40, if historical structures repeat.