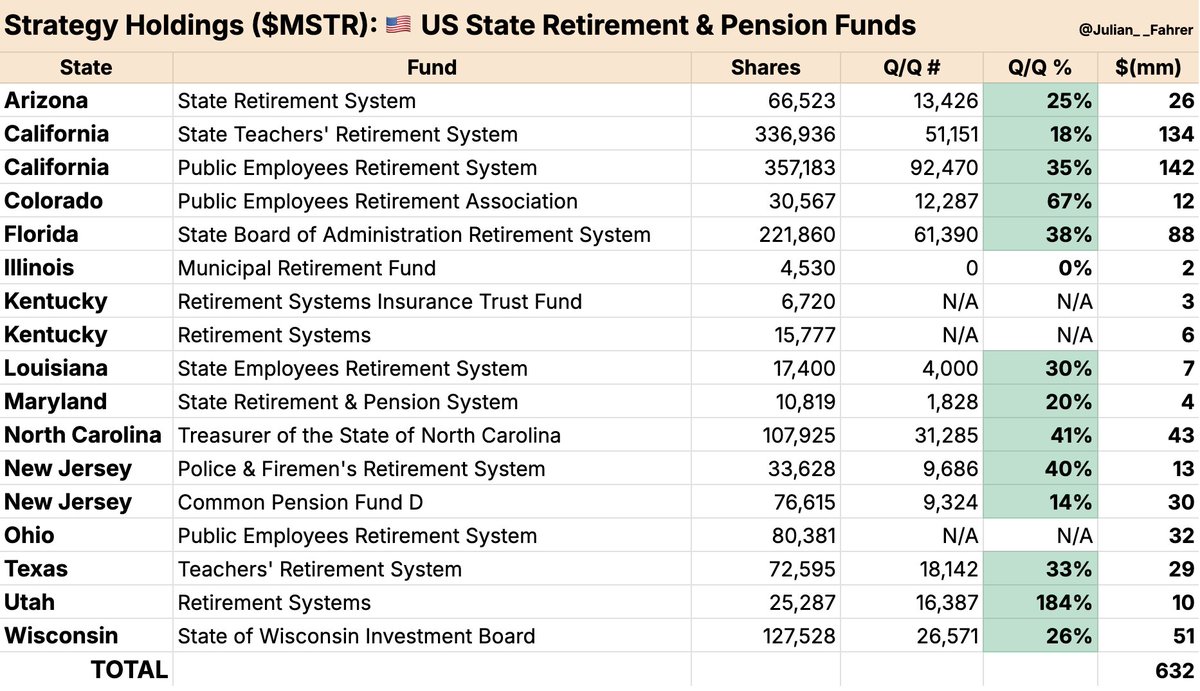

14 US States Bet Big on Bitcoin—$632M in MicroStrategy Stock Now Held by Public Funds

State treasuries are diving headfirst into crypto—without buying a single Bitcoin directly. How? By loading up on Michael Saylor’s MicroStrategy stock, now held by 14 states as a backdoor BTC play.

Public pension funds and investment portfolios have quietly amassed $632 million worth of MSTR shares, effectively turning government coffers into leveraged Bitcoin proxies. The move highlights institutional FOMO—even as regulators keep ‘protecting’ investors from the asset itself.

Wall Street’s old guard would call this reckless. The states call it hedging. Meanwhile, Saylor just keeps stacking sats on taxpayers’ dime.

Spreadsheet showing U.S. state exposure to bitcoin MSTR by Julian Fahrer

Interestingly, some of these states are pursuing legislation to permit the investment of state funds directly in Bitcoin and strategic BTC reserves. Notably, data from Bitcoin Laws shows that 47 crypto-related bills have been introduced across 26 U.S. states, with 37 currently active.

Some, like New Hampshire, have achieved success. Governor Kelly Ayotte signed into law earlier this month a bill permitting up to 5% of the state treasury to be invested in Bitcoin. However, in states like Florida, similar initiatives have failed.

Others, like Arizona, are seeing partial success, with support for unclaimed asset applications but rejection of state treasury investment in Bitcoin.

Bitcoin Exposure by Proxy Becoming Mainstream

Despite the cautious approach still prevalent among many states, this influx of state-managed public funds into MSTR signals a new level of Bitcoin adoption among institutional and government-managed entities.

While direct crypto ownership by these entities remains rare, the strategic use of Bitcoin-aligned equities offers a regulatory-compliant and familiar method for gaining exposure.

Spreadsheet showing U.S. state exposure to bitcoin MSTR by Julian Fahrer

Interestingly, some of these states are pursuing legislation to permit the investment of state funds directly in Bitcoin and strategic BTC reserves. Notably, data from Bitcoin Laws shows that 47 crypto-related bills have been introduced across 26 U.S. states, with 37 currently active.

Some, like New Hampshire, have achieved success. Governor Kelly Ayotte signed into law earlier this month a bill permitting up to 5% of the state treasury to be invested in Bitcoin. However, in states like Florida, similar initiatives have failed.

Others, like Arizona, are seeing partial success, with support for unclaimed asset applications but rejection of state treasury investment in Bitcoin.

Bitcoin Exposure by Proxy Becoming Mainstream

Despite the cautious approach still prevalent among many states, this influx of state-managed public funds into MSTR signals a new level of Bitcoin adoption among institutional and government-managed entities.

While direct crypto ownership by these entities remains rare, the strategic use of Bitcoin-aligned equities offers a regulatory-compliant and familiar method for gaining exposure.