Dogecoin Open Interest Defies Gravity—Hits $1.62B While Price Tanks

Wall Street’s meme-stock energy has fully metastasized into crypto. Despite Dogecoin’s price shedding value like a shiba inu in summer, open interest just blasted past $1.62 billion—a clear sign traders are doubling down on volatility.

Here’s the twist: This isn’t retail FOMO. Derivatives data shows whales are building leveraged positions, likely betting on a narrative-driven pump (Elon tweets, anyone?). Meanwhile, spot markets keep bleeding—classic ’buy the rumor, sell the news’ behavior.

Pro tip: When open interest and price diverge this hard, buckle up. Either we’re about to witness a spectacular short squeeze... or another case of ’number go up’ logic getting wrecked by actual market mechanics. Bonus cynicism: At least the exchanges are raking in fees while degenerates gamble with JPEG money.

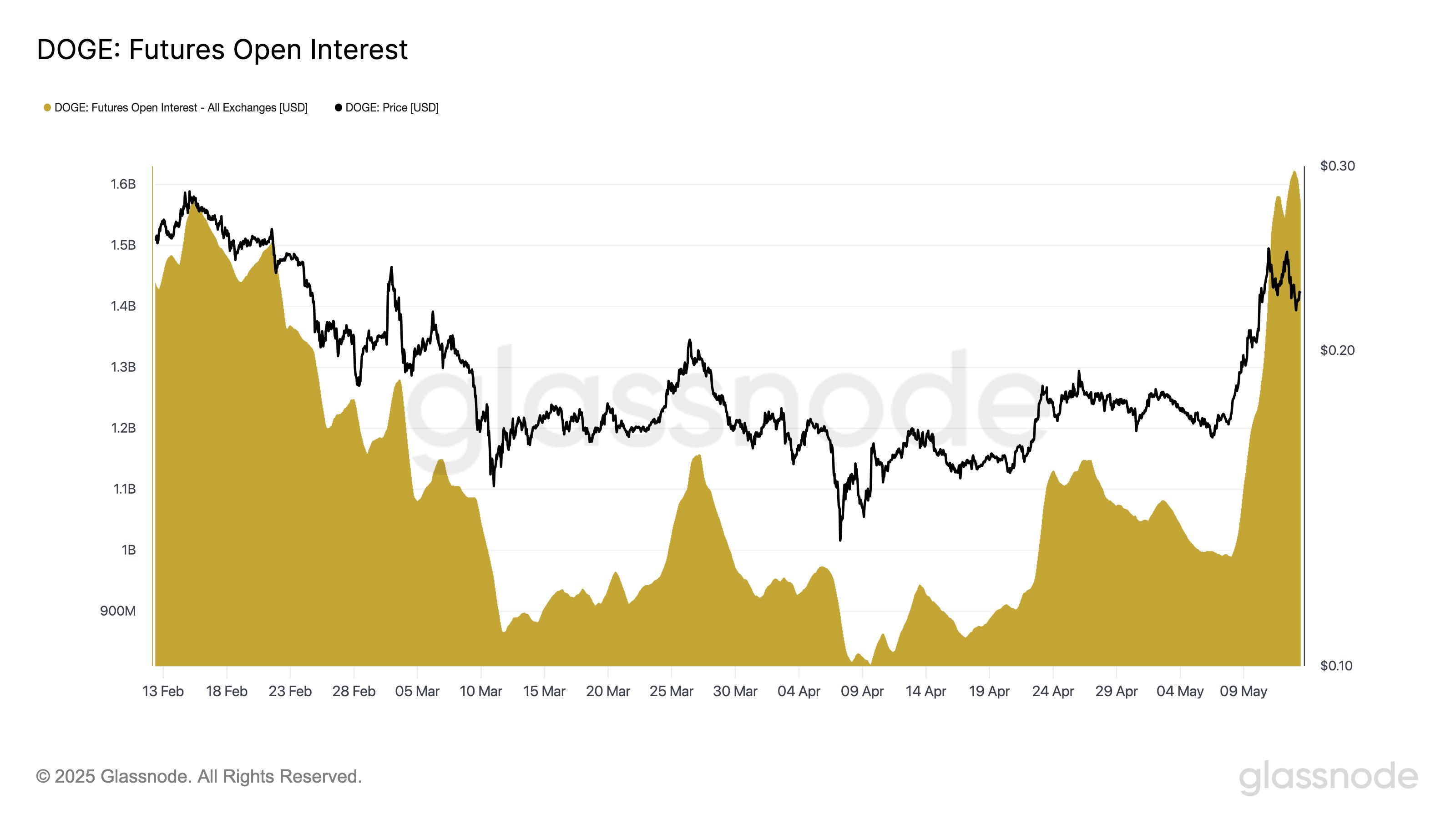

In earlier months, from mid-February to early March, Dogecoin experienced a brief rally above $0.23, accompanied by increased futures activity.

However, as DOGE’s price began to decline in subsequent weeks, futures open interest mirrored this downturn, eventually bottoming below $900 million by April. This correlation showed traders’ cautious stance during declining or uncertain market conditions.

The dynamics have shifted dramatically from late April when Dogecoin’s price surged from around $0.15 to nearly $0.25 by early May then cooled down at the $0.22 level.

Importantly, Dogecoin open interest has continued to increase, from $989 million to $1.62 billion this week, even after the price pulled back. Glassnode says this indicates persistent speculative positioning, a setup the analytic platform believes is worth monitoring.

Notably, this rise in speculative activity can lead to heightened volatility. If bearish sentiment dominates, it may pressure the price lower. However, if too many traders are short, a short squeeze could trigger a sharp rebound. Long term, persistent speculation without fundamental growth may undermine price stability and investor confidence.

Positive Funding Rates Indicate Bullish Sentiment

Meanwhile, the funding rate history for Dogecoin from Coinglass demonstrates a positive trend across major cryptocurrency exchanges as of May 13, 2025. Exchanges such as Bitmex, HTX, Gate.io, and Bitget reported funding rates at 0.0100%.

In earlier months, from mid-February to early March, Dogecoin experienced a brief rally above $0.23, accompanied by increased futures activity.

However, as DOGE’s price began to decline in subsequent weeks, futures open interest mirrored this downturn, eventually bottoming below $900 million by April. This correlation showed traders’ cautious stance during declining or uncertain market conditions.

The dynamics have shifted dramatically from late April when Dogecoin’s price surged from around $0.15 to nearly $0.25 by early May then cooled down at the $0.22 level.

Importantly, Dogecoin open interest has continued to increase, from $989 million to $1.62 billion this week, even after the price pulled back. Glassnode says this indicates persistent speculative positioning, a setup the analytic platform believes is worth monitoring.

Notably, this rise in speculative activity can lead to heightened volatility. If bearish sentiment dominates, it may pressure the price lower. However, if too many traders are short, a short squeeze could trigger a sharp rebound. Long term, persistent speculation without fundamental growth may undermine price stability and investor confidence.

Positive Funding Rates Indicate Bullish Sentiment

Meanwhile, the funding rate history for Dogecoin from Coinglass demonstrates a positive trend across major cryptocurrency exchanges as of May 13, 2025. Exchanges such as Bitmex, HTX, Gate.io, and Bitget reported funding rates at 0.0100%.