Bitcoin to $200K? Market Guru Drops Bombshell Price Target Timeline

Brace for impact—a top crypto analyst just mapped Bitcoin’s path to a $200,000 valuation. We break down the bullish case (and the inevitable Wall Street eye-roll).

The Road to Six Figures

Halving cycles, institutional FOMO, and that classic crypto volatility could rocket BTC past its previous ATH by late 2025—if history rhymes. Spoiler: past performance guarantees nothing except hedge fund skepticism.

The Fine Print

Regulatory hurdles, macro meltdowns, and the occasional exchange implosion might delay the party. But for true believers? This prediction’s either genius or another entry for ’Crypto Twitter’s Greatest Misses.’

Bitcoin Following Yellow Trendline | Intuit Trading

Notably, several analysts have also projected a bitcoin run to $200K. For instance, Dan Gambardello also argued last month that the bottom is in, predicting a rally to $200K. Further, leading asset manager Bitwise also predicted a BTC upsurge to $200K by year-end. Bernstein analysts also expect Bitcoin to reach $200K by the end of this year.

Analysts Growing Increasingly Bullish

Meanwhile, amid the recent recovery, analysts are now growing increasingly bullish. For one, Ki Young Ju, founder of CryptoQuant, admitted he was wrong when he suggested the Bitcoin bull run was over back in March.

https://twitter.com/ki_young_ju/status/1920738436887310582

According to him, the market is currently absorbing new liquidity, and the 4-year cycle theory might be useless now as the Bitcoin market grows incredibly diverse. Still, he insisted that most indicators are not showing clear bullish or bearish signals but lying around the borderlines.

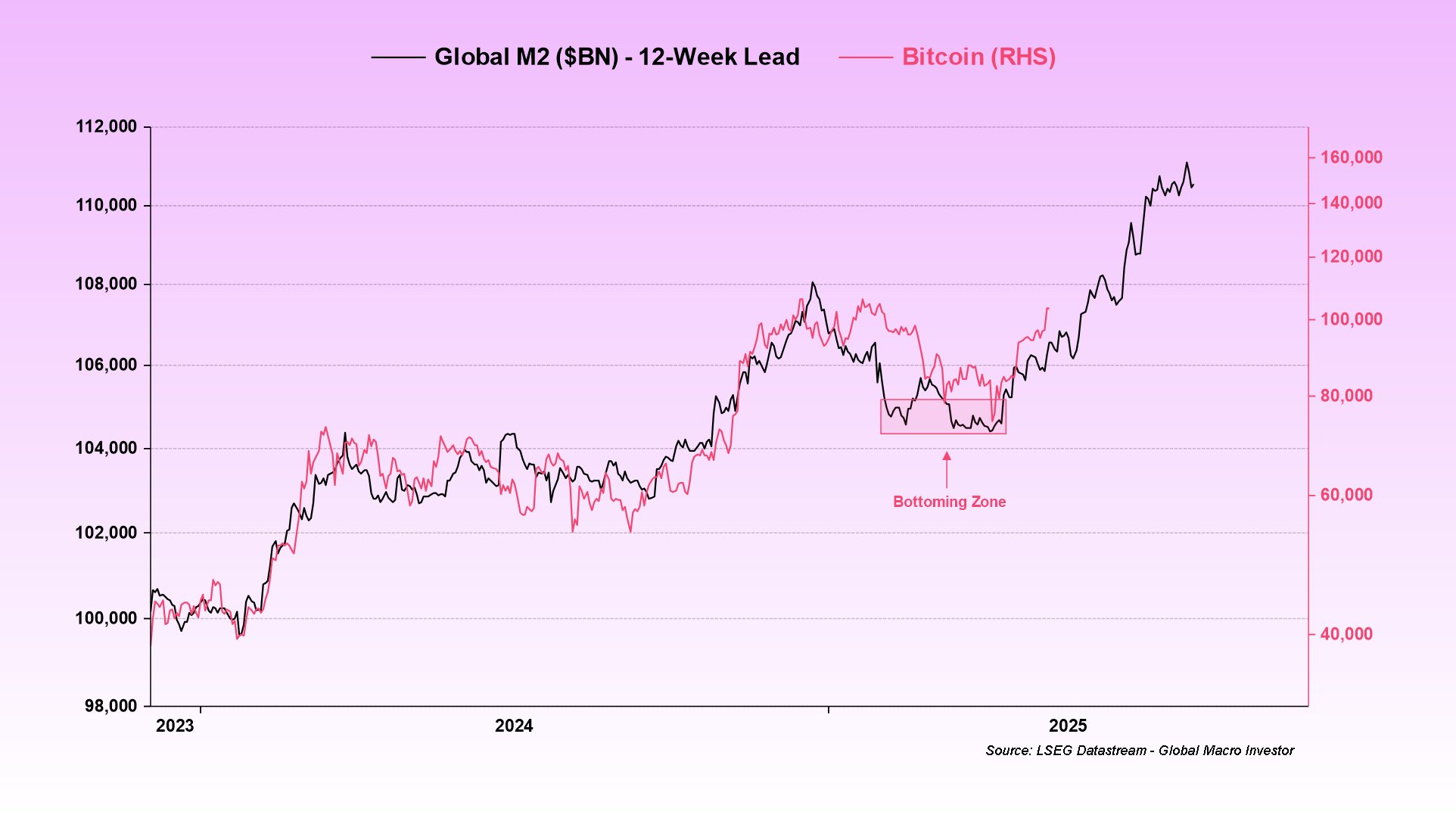

Also, Julien Bittel, a Chartered Financial Analyst and Head of Macro Research at GMI, provided an update to the Bitcoin chart against the Global M2 supply chart. Interestingly, the comparison shows that Bitcoin has continued to follow the trajectory of the M2 money supply since 2023.

Bitcoin Following Yellow Trendline | Intuit Trading

Notably, several analysts have also projected a bitcoin run to $200K. For instance, Dan Gambardello also argued last month that the bottom is in, predicting a rally to $200K. Further, leading asset manager Bitwise also predicted a BTC upsurge to $200K by year-end. Bernstein analysts also expect Bitcoin to reach $200K by the end of this year.

Analysts Growing Increasingly Bullish

Meanwhile, amid the recent recovery, analysts are now growing increasingly bullish. For one, Ki Young Ju, founder of CryptoQuant, admitted he was wrong when he suggested the Bitcoin bull run was over back in March.

https://twitter.com/ki_young_ju/status/1920738436887310582

According to him, the market is currently absorbing new liquidity, and the 4-year cycle theory might be useless now as the Bitcoin market grows incredibly diverse. Still, he insisted that most indicators are not showing clear bullish or bearish signals but lying around the borderlines.

Also, Julien Bittel, a Chartered Financial Analyst and Head of Macro Research at GMI, provided an update to the Bitcoin chart against the Global M2 supply chart. Interestingly, the comparison shows that Bitcoin has continued to follow the trajectory of the M2 money supply since 2023.