Bitcoin Primed for Rally as Global Money Supply Swells—Top Analyst Doubles Down

Global M2 expansion hits ludicrous speed—and Bitcoin’s the only asset with a seatbelt. Here’s why the smart money’s stacking sats while central banks print their way to oblivion.

The liquidity tsunami nobody’s talking about

Money printer go brrr? Try supersonic. With M2 growing faster than a DeFi degenerate’s leverage position, that ’digital gold’ narrative starts looking less like hype and more like prophecy.

Institutions vs. inflation: BTC eats both

BlackRock’s ETF inflows aren’t just bullish—they’re a hedge against the greatest monetary experiment in history. Meanwhile, your savings account earns less than a crypto scammer’s conscience.

Watch the charts, not the headlines. When the liquidity dam breaks, Bitcoin won’t ask for permission to moon—it’ll send a ’thanks for the liquidity’ postcard from ATH land.

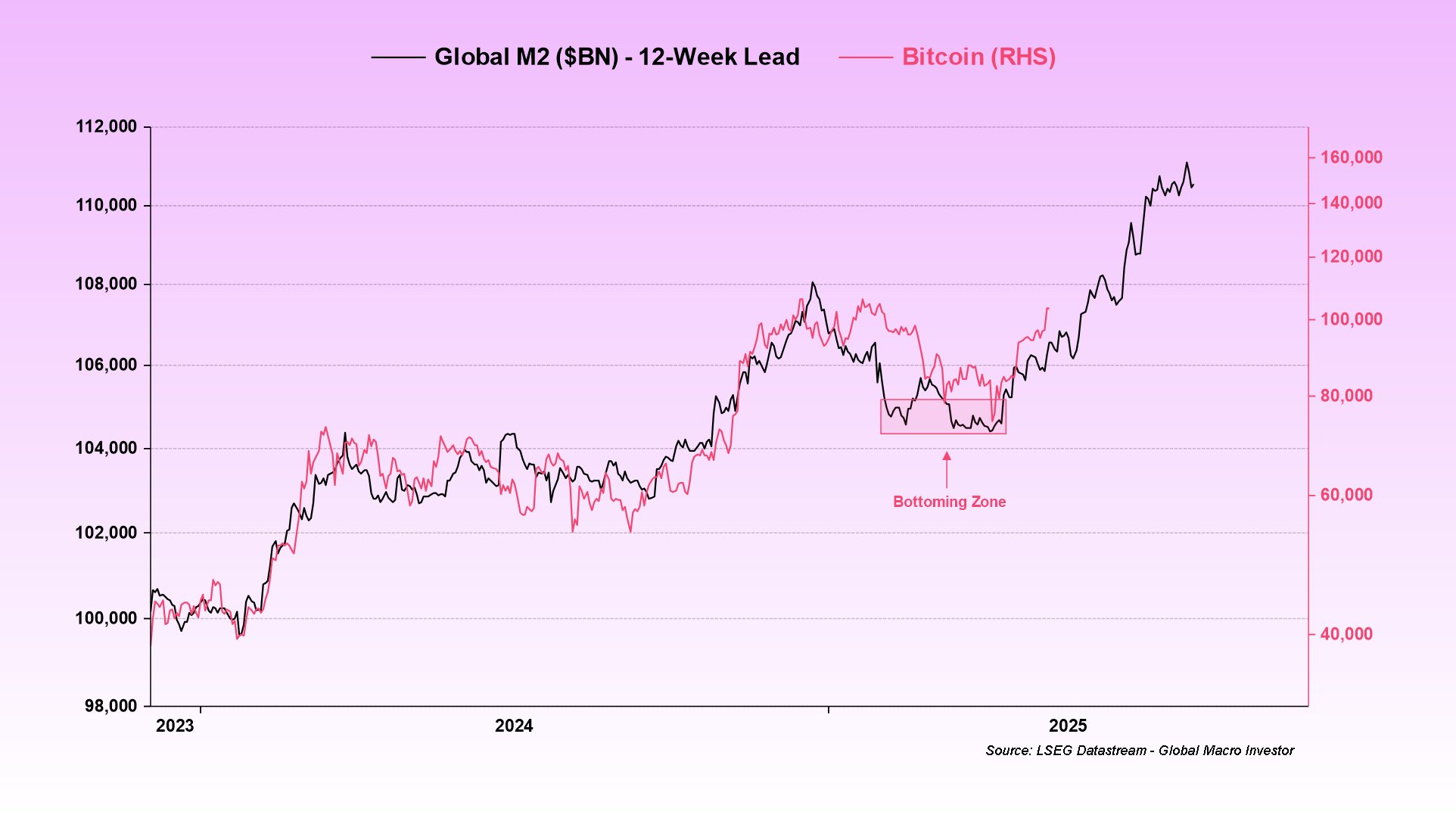

From early 2023 to early 2024, global M2 steadily climbed from around $98 trillion to just above $108 trillion. Bitcoin’s price action mirrored this rise, with a notable rally over $100,000 by late 2024.

However, mid-2024 saw a temporary pause in M2 growth, which coincided with Bitcoin entering a range-bound phase, dipping below $80,000. This phase, described as a “bottoming zone,” marked a consolidation period that aligned closely with the M2 stagnation.

Since late 2024, global M2 has resumed a sharp upward trajectory, now exceeding $111 trillion. Based on the existing 12-week lead relationship, this recent rise may signal continued Bitcoin strength into mid-2025.

Bittel stated that the recent surge in global M2 indicates further upside for Bitcoin in the weeks ahead, noting, "We’re going higher."

Alternative View: Bitcoin as a Leading Signal

Meanwhile, Benjamin Cohen has questioned the narrative that Bitcoin lags liquidity. On X, he challenged the offset-based approach often used in liquidity charts. He noted that applying a three- to four-month M2 lead fails to align with Bitcoin’s 2021 and 2017 tops, both of which occurred before M2 peaked.

Instead, Cohen proposed that Bitcoin could lead liquidity trends. Under this framework, the 2021 Bitcoin peak aligns directly with M2’s later rise, while Bitcoin’s summer 2022 lows correspond with a delayed M2 bottom. He noted the FTX collapse extended Bitcoin’s decline beyond the liquidity signal’s timing.

This perspective implies Bitcoin’s current surge could suggest an upcoming contraction in global M2, rather than continued expansion. This interpretation challenges the prevailing assumption and raises new questions about Bitcoin’s role in macroeconomic forecasting.

Impact of DXY and Market Implications

As Cohen expands his analysis, he suggests that movements in the U.S. Dollar Index (DXY) could explain changes in global M2. Because global M2 largely reflects dollar strength, a rising DXY could reduce global liquidity. He traced DXY’s trajectory from late 2024 and anticipates a rally back to its 20-week simple moving average before further declines in 2026.

According to Cohen, if Bitcoin is indeed leading liquidity, a DXY rebound may push global M2 lower into the summer. This development could impact crypto markets more broadly, especially altcoin-to-Bitcoin pairs. Historically, these pairs tend to weaken when the dollar strengthens, suggesting a potential downtrend in alternative assets relative to Bitcoin.

From early 2023 to early 2024, global M2 steadily climbed from around $98 trillion to just above $108 trillion. Bitcoin’s price action mirrored this rise, with a notable rally over $100,000 by late 2024.

However, mid-2024 saw a temporary pause in M2 growth, which coincided with Bitcoin entering a range-bound phase, dipping below $80,000. This phase, described as a “bottoming zone,” marked a consolidation period that aligned closely with the M2 stagnation.

Since late 2024, global M2 has resumed a sharp upward trajectory, now exceeding $111 trillion. Based on the existing 12-week lead relationship, this recent rise may signal continued Bitcoin strength into mid-2025.

Bittel stated that the recent surge in global M2 indicates further upside for Bitcoin in the weeks ahead, noting, "We’re going higher."

Alternative View: Bitcoin as a Leading Signal

Meanwhile, Benjamin Cohen has questioned the narrative that Bitcoin lags liquidity. On X, he challenged the offset-based approach often used in liquidity charts. He noted that applying a three- to four-month M2 lead fails to align with Bitcoin’s 2021 and 2017 tops, both of which occurred before M2 peaked.

Instead, Cohen proposed that Bitcoin could lead liquidity trends. Under this framework, the 2021 Bitcoin peak aligns directly with M2’s later rise, while Bitcoin’s summer 2022 lows correspond with a delayed M2 bottom. He noted the FTX collapse extended Bitcoin’s decline beyond the liquidity signal’s timing.

This perspective implies Bitcoin’s current surge could suggest an upcoming contraction in global M2, rather than continued expansion. This interpretation challenges the prevailing assumption and raises new questions about Bitcoin’s role in macroeconomic forecasting.

Impact of DXY and Market Implications

As Cohen expands his analysis, he suggests that movements in the U.S. Dollar Index (DXY) could explain changes in global M2. Because global M2 largely reflects dollar strength, a rising DXY could reduce global liquidity. He traced DXY’s trajectory from late 2024 and anticipates a rally back to its 20-week simple moving average before further declines in 2026.

According to Cohen, if Bitcoin is indeed leading liquidity, a DXY rebound may push global M2 lower into the summer. This development could impact crypto markets more broadly, especially altcoin-to-Bitcoin pairs. Historically, these pairs tend to weaken when the dollar strengthens, suggesting a potential downtrend in alternative assets relative to Bitcoin.