BlackRock’s $5B Bitcoin Bet: $4.23B Pile Revealed in Latest SEC Filing

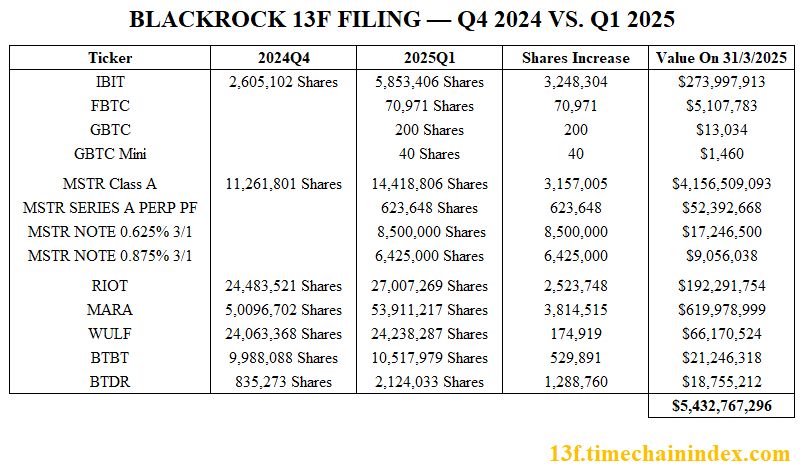

BlackRock just flashed its crypto cards—and it’s holding a royal flush. The asset manager’s latest SEC filing reveals a staggering $5 billion exposure to Bitcoin-linked equities, with a single strategy accounting for $4.23 billion of the stack.

Wall Street’s quiet accumulation of crypto exposure continues as institutional players build positions while retail traders chase memecoins. The filing shows BlackRock’s conviction hasn’t wavered despite Bitcoin’s recent volatility—proving once again that smart money plays the long game.

Funny how the same firms that once called Bitcoin ’rat poison’ now can’t get enough of the digital rodent. The irony tastes better than a 10x leverage position.

Bitcoin Mining Stocks See Big Inflows

The asset manager also expanded its footprint in Bitcoin mining firms. Its holdings in Marathon Digital (MARA) surged from 50 million to 53.9 million shares, now valued at $619.9 million.

Similarly, BlackRock’s position in Riot Platforms (RIOT) increased by 2.5 million shares, bringing the total value to $192.3 million.

Bitdeer Technologies (BTDR) grew more than 150%, from 835,000 to 2.1 million shares. Other miners like TeraWulf (WULF) and Bit Digital (BTBT) also saw modest increases, bringing BlackRock’s total mining allocation to over $950 million.

Institutional Conviction Rising

The Q1 2025 13F filing reflects BlackRock’s growing conviction in Bitcoin’s long-term value proposition. With over $5.4 billion in strategic Bitcoin-related positions, the world’s largest asset manager is clearly not fading the ongoing institutional FOMO surrounding Bitcoin.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) now holds 607,685.5 BTC, worth over $57.16 billion. Since its inception, the ETF has attracted $43.68 billion in investment.

Bitcoin Mining Stocks See Big Inflows

The asset manager also expanded its footprint in Bitcoin mining firms. Its holdings in Marathon Digital (MARA) surged from 50 million to 53.9 million shares, now valued at $619.9 million.

Similarly, BlackRock’s position in Riot Platforms (RIOT) increased by 2.5 million shares, bringing the total value to $192.3 million.

Bitdeer Technologies (BTDR) grew more than 150%, from 835,000 to 2.1 million shares. Other miners like TeraWulf (WULF) and Bit Digital (BTBT) also saw modest increases, bringing BlackRock’s total mining allocation to over $950 million.

Institutional Conviction Rising

The Q1 2025 13F filing reflects BlackRock’s growing conviction in Bitcoin’s long-term value proposition. With over $5.4 billion in strategic Bitcoin-related positions, the world’s largest asset manager is clearly not fading the ongoing institutional FOMO surrounding Bitcoin.

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) now holds 607,685.5 BTC, worth over $57.16 billion. Since its inception, the ETF has attracted $43.68 billion in investment.