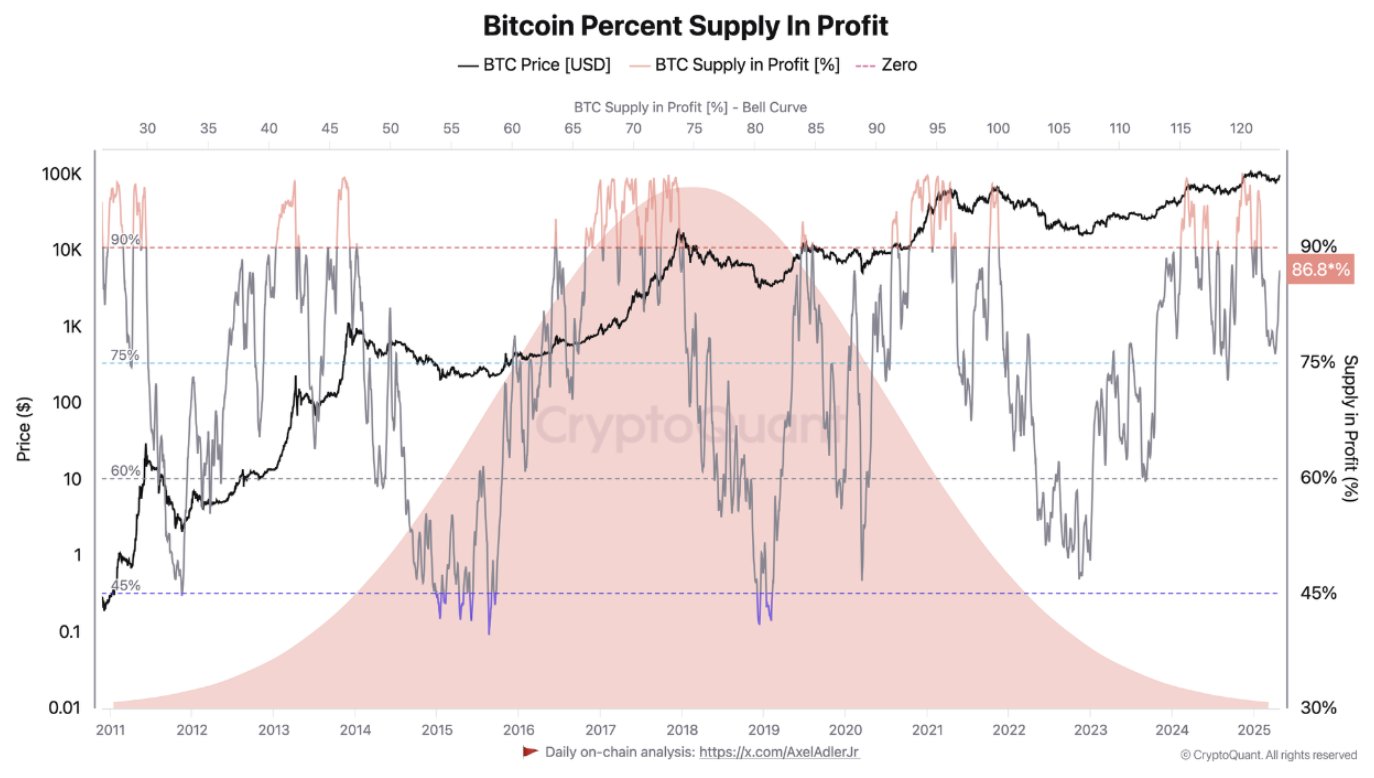

Bitcoin Supply in Profit Tops 90%—Here’s Why Traders Should Brace for Volatility

Bitcoin’s market just hit a psychological milestone: over 90% of circulating supply is now held at a profit. Cue the champagne pops from crypto bros—and the sideways glances from risk managers.

What happens when euphoria floods the market? History suggests a pullback. The last two times BTC profitability crossed this threshold (November 2021 and February 2024), corrections followed within weeks. This time? Macro conditions are tighter, ETF flows are erratic, and leverage is stacking like unstable Jenga blocks.

Key triggers to watch: Coinbase premiums flipping negative, Tether’s printing press going quiet, or—god forbid—another exchange ‘exploiter’ magically draining funds. Meanwhile, Wall Street’s new Bitcoin ETFs keep playing hot potato with inflows—because nothing says ‘mature asset class’ like daily 5% swings.

Bottom line: Profit-taking is inevitable. The only question is whether it’ll be a controlled burn or a dumpster fire. Pro tip: When your Uber driver starts explaining UTXO economics, it’s probably time to hedge.

Bitcoin Supply in Profit Chart | CryptoQuant

Furthermore, while the specifics on the end of the euphoria stage remain uncertain, Ki Youn Ju, the CEO of CryptoQuant, earlier suggested that the phase typically lasts between three and twelve months.

At the time of writing, BTC is trading at $94,893.

Bitcoin Supply in Profit Chart | CryptoQuant

Furthermore, while the specifics on the end of the euphoria stage remain uncertain, Ki Youn Ju, the CEO of CryptoQuant, earlier suggested that the phase typically lasts between three and twelve months.

At the time of writing, BTC is trading at $94,893.