Dogecoin Soars as Historic First DOGE ETF Launches on US Exchanges - Here’s the Path Ahead

Meme coin meets mainstream finance as Dogecoin rockets upward following the groundbreaking debut of the first-ever DOGE ETF on U.S. exchanges.

The Institutional Embrace

Wall Street finally takes the doge seriously—or at least seriously enough to package it for retirement accounts. The ETF launch signals growing institutional acceptance despite the coin's meme origins, proving even joke assets can become legitimate investment vehicles when there's money to be made.

Trading Volumes Explode

Volume spikes across major exchanges as both retail and institutional players pile in. The ETF structure gives traditional investors exposure without the hassle of managing private keys—because remembering 24-word seed phrases remains too much effort for the average portfolio manager.

Regulatory Hurdles Cleared

Securities regulators approved the product after months of scrutiny, setting precedent for other cryptocurrency ETFs. The approval process moved faster than expected—perhaps regulators finally realized blocking dog-themed investments wasn't worth missing the next bull run.

Market Outlook: Beyond the Hype

While skeptics dismiss the move as another example of finance chasing trends, the ETF's successful launch demonstrates crypto's irreversible march toward institutionalization. Because nothing says 'mature asset class' like wrapping an internet joke in prospectus paperwork and charging management fees.

Dogecoin (DOGE) price rallied after days of declines. On Thursday, DOGE traded NEAR $0.28, up about 13% in a week’s span from a low of $0.25 on Tuesday.

The jump came as the first U.S.-listed Dogecoin ETF will begin trading on Thursday.

The REX Shares-Osprey dogecoin ETF (ticker DOJE) launched on Sep. 18, 2025, making DOGE the first memecoin with its own regulated ETF.

This ETF leverages the Investment Company Act of 1940 to speed approval, sidestepping the longer Securities Act review that held up other crypto ETFs.

Dogecoin (DOGE) Price Rises on ETF Debut

The ETF debut is seen as a turning point for Dogecoin. According to analysts, the DOJE launch “marks a pivotal moment” that could inject institutional capital and “mainstream legitimacy” into Dogecoin’s ecosystem.

In fact, one market watcher noted that Dogecoin is becoming a more mainstream asset now that it has a Wall Street fund.

He wrote, “DOGE becomes the first memecoin with its own ETF on Wall Street,” uplifting its status to a more seriously considered crypto and not just a simple meme token.

The REX-Osprey fund’s rapid approval has even been called a “regulatory end-around” by ETF experts (via 1940 Act filings).

Institutional buyers are already moving in. On Tuesday, CleanCore Solutions announced the purchase of 100 million additional DOGE, taking its holdings above 600 million.

These moves came “as regulatory clarity improves ahead of the anticipated approval of the first U.S.-listed spot Dogecoin ETF.”

In short, demand from institutional and corporate ROSE even before the ETF’s impact was seen.

Analysts Set Ambitious Dogecoin Price Targets

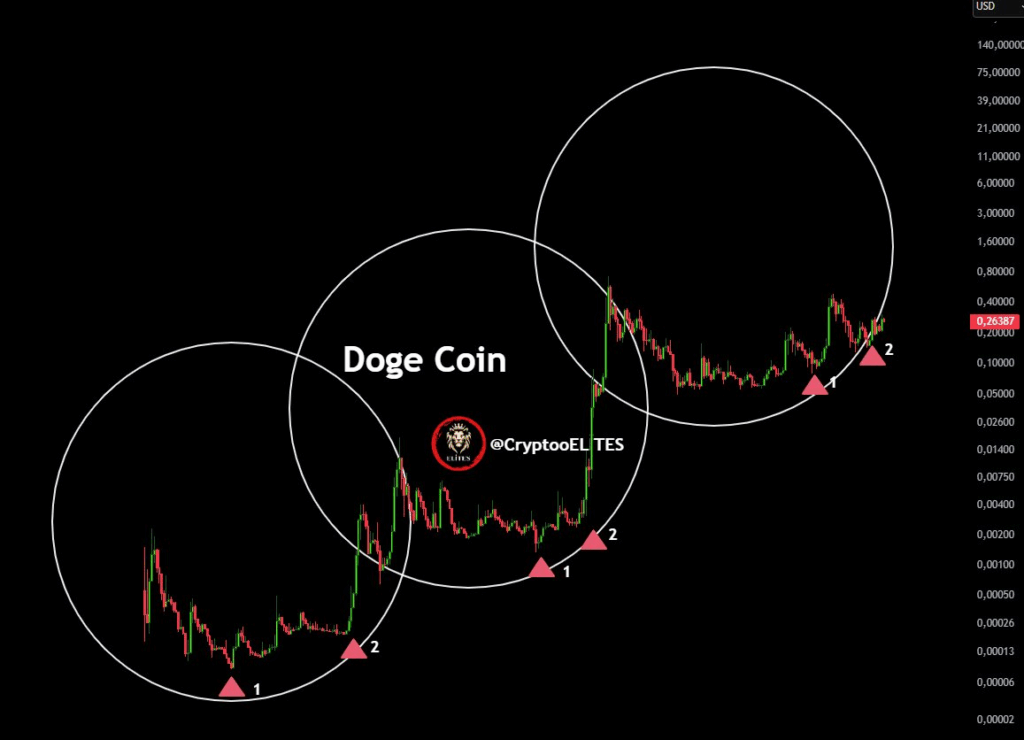

With the ETF live, analysts and traders are setting aggressive price targets. Many point to technical patterns and the promise of new capital flows.

One analyst charted a “bullish megaphone” setup for Doge and projected a breakout toward about $1.40, roughly a 400% gain from current levels.

TipRanks summarizes that “traders say the first Dogecoin ETF could push DOGE to $1.40, with some calling for as high as $5” if institutional money floods in.

A popular crypto trader, CryptoELlTES, explicitly tweeted, “My target for $DOGE is $5 after a Dogecoin ETF!” Reaching $5 from today’s $0.28 price WOULD imply a roughly 1,600% increase.

These high targets hinge on the assumption that Dogecoin will attract capital flows similar to earlier crypto ETFs. Of course, these are forecasts, not certainties.

Even so, the line of reasoning is that historically, spot ETFs drew big inflows in crypto, boosting prices.

Analysts note that DOJE could position DOGE “for a maturation phase, potentially unlocking billions in inflows” like prior U.S. spot crypto funds. If so, the market could see “massive price gains” for Dogecoin price ahead.

For now the DOGE ETF listing gives traders a new way to bet on it without holding the coin directly – another sign that large investors may take Dogecoin more seriously.

Dogecoin has a very volatile track record. It shot up as a speculative meme token in 2021 and reached a record high of about $0.73 in May 2021.

That peak made DOGE one of the top crypto coins by market cap at the time. The price then collapsed, and by mid-2022, DOGE fell over 90% from those highs.

After mostly trading sideways through 2023, a late-2024 rally took DOGE back up to roughly $0.48 in December 2024. Since then the trend turned down again