Bitcoin ETFs Fuel Record $3.3 Billion Weekly Inflows into Crypto ETPs

Wall Street's embrace sends shockwaves through traditional finance.

The Institutional Floodgates Open

Bitcoin ETF approvals triggered the largest weekly capital injection into crypto exchange-traded products on record—$3.3 billion flooding in during just seven days. Traditional asset managers finally capitulated to client demand, creating the perfect storm of institutional liquidity meeting retail frenzy.

Mainstream Money Meets Digital Gold

BlackRock, Fidelity, and other legacy giants are now scrambling to capture market share in the crypto ETP space. Their previously skeptical research departments are suddenly publishing bullish price targets while their sales teams push digital asset products to formerly resistant wealth management clients. The irony isn't lost on anyone who remembers their 'blockchain not bitcoin' phase.

The New Allocation Strategy

Financial advisors who once dismissed crypto now face pressure to allocate 1-5% of client portfolios to digital assets. The ETF wrapper provides the compliance comfort they craved, while the performance provides the returns clients demanded. Pension funds and endowments are quietly building positions through these vehicles—no technical complexity, no custody concerns, just pure exposure.

Traditional finance finally found a way to profit from decentralization—by recentralizing it through familiar structures. The $3.3 billion question: will they kill what makes crypto valuable while trying to own it?

Key Insights:

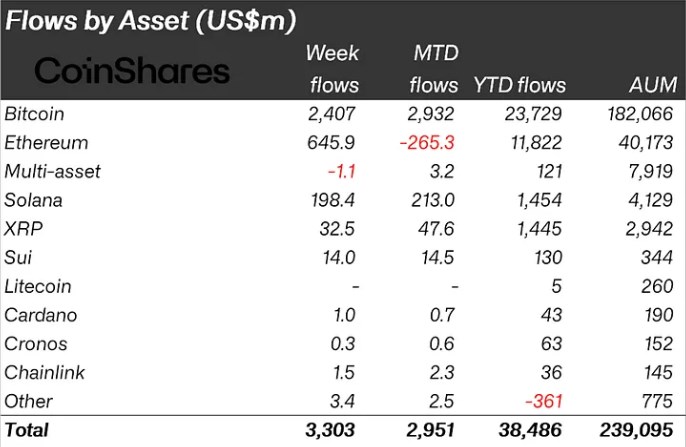

- Digital asset investment products recorded $3.3 billion in weekly inflows from Sept. 8 to 12.

- Bitcoin ETPs led with $2.4 billion inflows while Ethereum ended an eight-day outflow streak.

- Total assets under management reached $239 billion, approaching August’s all-time highs.

Digital asset exchange-traded products (ETPs) experienced their strongest weekly performance in months, attracting $3.3 billion in net inflows during the Sept. 8-12 period.

CoinShares reported that the surge followed weaker-than-expected US macroeconomic data that boosted investor appetite for crypto assets.

Total assets under management for crypto ETPs climbed to $239 billion by week’s end, marking the highest level since early August’s record $244 billion peak. The influx represented a sharp reversal from recent outflow trends that had pressured the sector.

Bitcoin ETF Drive Market Recovery

Bitcoin investment products captured the largest share of weekly inflows with $2.4 billion in net additions.

The figure marked Bitcoin ETPs’ strongest weekly performance since July and demonstrated renewed institutional confidence in the flagship cryptocurrency. US-based Bitcoin ETF dominated trading activity during the period.

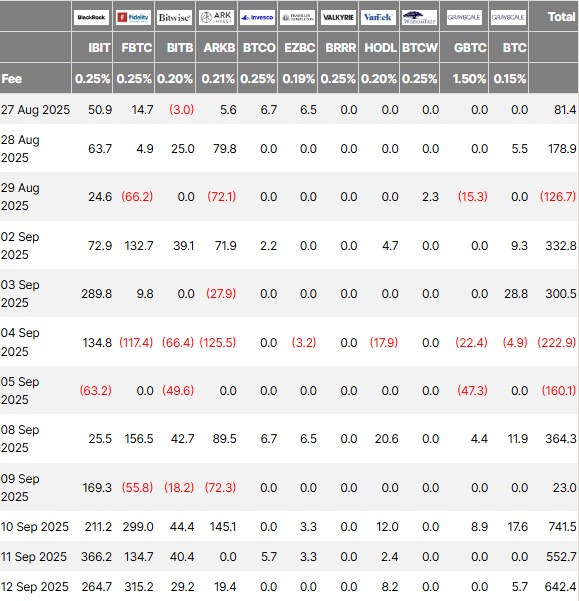

Farside Investors’ data indicated that BlackRock’s IBIT recorded $366.2 million in inflows on Sept. 11, its strongest single-day performance of the week.

Fidelity’s FBTC added $315.2 million on Sept. 12, while Bitwise’s BITB contributed $168.2 million across multiple trading sessions.

Grayscale’s GBTC continued experiencing outflows, but at a reduced pace compared to previous weeks. The fund shed $222.9 million on Sept. 4 but posted smaller daily outflows throughout the Sept. 8-12 period.

Short-Bitcoin products recorded modest outflows during the week, reducing their combined assets under management to just $86 million.

The decline suggested a reduction in bearish sentiment among institutional investors.

Ethereum ETPs End Prolonged Outflow Streak

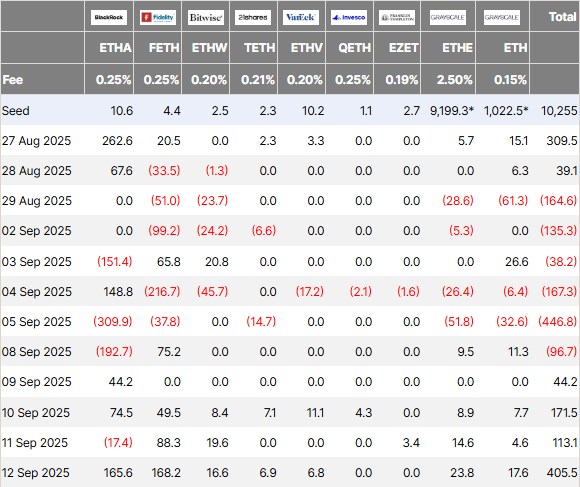

Ethereum investment products posted $646 million in weekly inflows, ending eight consecutive trading days of net outflows.

The reversal marked a significant shift in sentiment toward the second-largest cryptocurrency.

Ethereum ETPs recorded four straight days of inflows during the Sept. 8-12 period.

BlackRock’s ETHA led with $168.2 million in weekly additions, while Fidelity’s FETH contributed $88.3 million on Sept. 11 alone.

Grayscale’s ETHE continued to shed assets, but at a slower rate. The fund posted $167.3 million in outflows on Sept. 4 but reduced daily redemptions throughout the following week.

The Ethereum ETP recovery coincided with improved network fundamentals and anticipation of upcoming protocol upgrades. Institutional investors viewed recent price weakness as a buying opportunity.

Regional Investment Patterns Emerge

The US dominated global crypto ETP flows with $3.2 billion in weekly inflows. The figure represented 97% of total global additions and highlighted American institutional appetite for digital asset exposure.

Germany recorded the second-largest regional inflows at $160 million for the week. Friday marked Germany’s second-largest daily crypto ETP inflows on record, demonstrating growing European institutional adoption.

Switzerland bucked the global trend with $92 million in weekly outflows. The redemptions partially offset broader European gains but failed to dampen overall regional enthusiasm.

Canada contributed $14.1 million in weekly inflows while maintaining steady institutional participation. Hong Kong added $5.4 million during the period, suggesting modest Asian institutional interest.

Altcoins Gain Traction

Solana investment products posted their strongest week on record with $198 million in net inflows. Friday alone accounted for $145 million in additions, marking the largest single-day performance to date for solana ETPs.

Multi-asset crypto products recorded minimal activity with just $1.1 million in weekly outflows. The slight decline suggested investors preferred single-asset exposure during the period.

XRP-focused products attracted $32.5 million in weekly inflows while maintaining steady institutional interest. Smaller altcoin products, including sui and Chainlink, posted modest gains.

Aave and Avalanche products experienced minor outflows of $1.08 million and $0.66 million, respectively. The declines remained minimal compared to major cryptocurrency gains.

Market Outlook Strengthens

The $3.3 billion weekly influx pushed crypto ETP assets under management NEAR record territory. End-of-week price gains across cryptos supported portfolio valuations and encouraged additional institutional participation.

CoinShares data confirmed the week marked a decisive shift in institutional sentiment following months of mixed flows. Weaker US economic indicators appeared to drive safe-haven demand for digital assets among professional investors.

Bitcoin and Ethereum ETPs led the recovery with combined inflows exceeding $3 billion.

The concentration suggested institutional focus remained on established cryptocurrencies despite growing altcoin product availability.