Ethereum (ETH) Price Trajectory: Where It’s Headed As Solana Gains Serious Pace

Ethereum faces mounting pressure as Solana's blistering rally steals the spotlight—traders are scrambling to reposition while the old guard watches nervously.

The Scaling Showdown

Solana's network activity surges—transaction volumes hit unprecedented levels while Ethereum's gas fees remain stubbornly high. Developers are voting with their code, migrating to faster chains despite Ethereum's established ecosystem. Market momentum shifts daily, creating whiplash for hodlers clinging to legacy positions.

The Institutional Calculus

Big money rotates toward efficiency—Solana's throughput advantages attract algorithmic traders and institutional flow that once exclusively favored Ethereum. The narrative flip catches many fund managers off guard, forcing painful portfolio rebalancing. Traditional finance veterans smirk—watching crypto's internal competition feels like déjà vu from every other asset class war.

Price Dynamics Unleashed

Technical indicators flash warning signs for ETH dominance as SOL breaches key resistance levels. Retail FOMO amplifies the move—social media erupts with SOL memes while Ethereum maximalists cite 'long-term fundamentals.' Volatility spikes across both assets, creating opportunities for traders savvy enough to navigate the cross-chain chaos.

Just another day in crypto—where technological progress and tribal loyalty collide, leaving billion-dollar consequences in their wake. Remember: in markets, being early feels identical to being wrong—until suddenly it doesn't.

Ethereum dominance previously led the charge, especially in July and August, as altcoin season kicked in. While it cools down, where is ethereum (ETH) price headed?

The market dynamics have since shifted with Solana experiencing a dominance resurgence while Ethereum seemingly slowed down.

For reference, Ethereum dominance only ticked up by 1.8% last week while solana dominance achieved an impressive 12% weekly uptick.

This outcome significantly influenced how the two cryptocurrencies performed. SOL price pulled off a 17% weekly gain while ETH price rallied by slightly over 7% during the same period.

A clear sign that liquidity rotation was taking place and this time trickling down the hierarchy.

But the big question was whether the same trend would prevail. If so, then ETH price could struggle to push above the $5,000 price milestone.

However, it was worth noting that this latest recovery did favor Ethereum price, which pushed as high as $4,768.

Despite being outshone by Solana, ETH price did demonstrate a demand resurgence from key areas.

For example, institutional demand made a solid comeback during the week, after previously experiencing a streak of outflows in the first half of the week.

Ethereum Exchange Flows, Key Metrics Underscore Bullish Confidence For Price

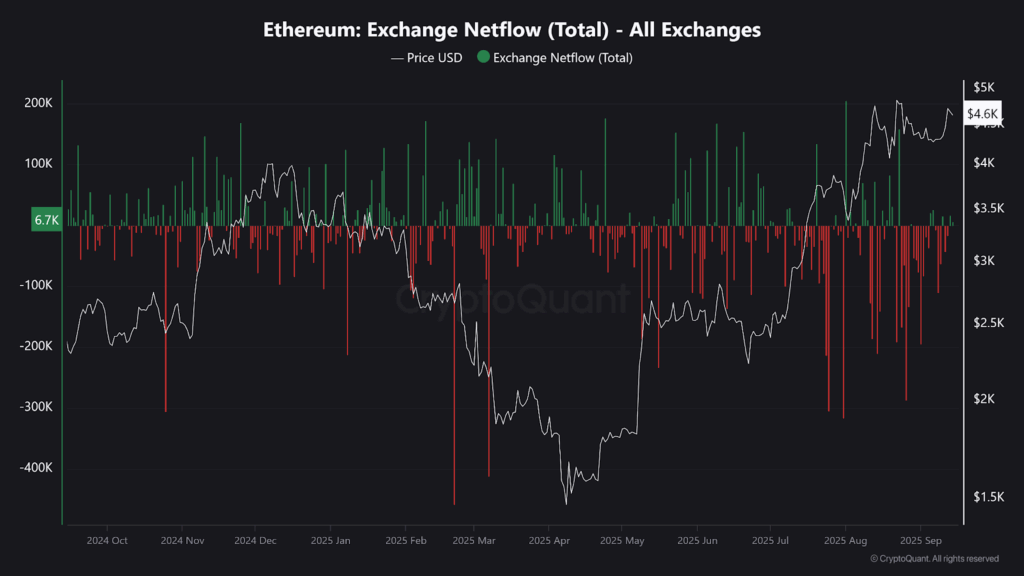

A few other Ethereum data sets also aligned with the return of institutional demand. For example, ETH exchange netflows revealed elevated exchange outflows in favour of longer-term storage.

This usually happens when long-term bullish confidence is high.

Ethereum performance data also revealed that staking inflows were on the rise. This signaled rising confidence in the cryptocurrency’s long-term potential.

It was not all smooth sailing, though, largely because of one major observation. The Ethereum validator exit queue recently pushed to new highs, raising concerns that validators were engaging in a flight to safety.

Some also speculated that the Ethereum validator exit queue was mainly driven by profit-taking.

Somewhat similar to how Bitcoin miners sell some of their BTC along the way, especially after the price achieves a significant uptick. The validator exit queue surged to 2.6 million ETH as of 13 September.

A substantial amount, which could potentially trigger significant sell pressure. However, the exit queue also has a 45-day waiting period, which may defer any potential short-term sell pressure.

In fact, it might be the reason why validators are pulling their funds. That way, they will have access while ETH prices remain high.

Ethereum Smart Money Continues to Seek More Exposure

Interestingly, recent sell pressure was absorbed as demand prevailed. Moreover, just because validators were pulling out a substantial amount of ETH did not mean that they had plans to sell immediately.

Recent market data also showed that Ethereum whales were accumulating the cryptocurrency.

Addresses holding over 10,000 ETH have been aggressively adding to their wallets in the last few months.

Aggressive demand from the whale cohort fortified ETH’s bullish resolve. This may explain why the latest bearish episodes were limited and characterized by accumulation and bullish recovery.

In other words, whales have been treading the pullbacks as opportunities to acquire more ETH at discounted prices.

As far as network performance was concerned, it was business as usual for Ethereum. Weekly net inflows into the network last week amounted to $2.5 billion.

This was higher compared to the previous 2 weeks, during which the markets experienced some uncertainty and a noteworthy ethereum price pullback.