Solana Surges 5%: Long-Term Charts Reveal Bullish Signals

Solana just ripped past resistance—climbing 5% while legacy finance scratches its head.

Charting the momentum

Long-term technicals scream accumulation. Weekly candles hold above key moving averages—no fluke, just pure momentum.

Institutional eyes locked

Big money's circling. They see the scalability, the developer momentum, the entire ecosystem firing on all cylinders.

Where traditional finance sees risk, crypto sees runway. Another day, another reminder: banks are still debating internal blockchain pilots while real networks execute.

Key Insights:

- Solana price rose 5% to $211, but short-term signals show weak momentum and profit-taking.

- Exchange inflows and $472 million in long leverage raise the risk of a drop to $195–200.

- A golden cross on SOL/BTC points to a possible long-term rally toward $226, $247, and $300.

Solana price traded NEAR $211 after rising almost 5% during last 24 hours. Monthly gains were about 6.1%, while year-to-date growth stood at 65.5%. At first, this looks like strength.

But solana often fails to hold rallies. Profit-taking and heavy bets in derivatives have stopped many up moves before.

This rebound may not be different. Signals from charts and flows show weakness in the short term, even as long-term charts still give hope.

Short-Term Solana Price Outlook at Risk From Weak Momentum

Between August 14 and August 28, Solana price made a higher high. But the RSI, which tracks strength, made a lower high at the same time. This is called a bearish divergence.

In simple words, price went up, but buying power went down. This kind of bearish divergence often underlines waning buyer strength.

The next set of metrics confirms the outlook.

The Money Flow Index (MFI) also failed to reach levels from August 13, when Solana peaked near $209. That shows weaker buying than before.

The Chaikin Money Flow (CMF) stayed below zero, too. That means real money flowing into Solana stayed low, even while the solana price climbed.

Together, these signals show that the rebound may not last. If selling grows, the price could fall back to $195–200, a drop of about 5–7%.

Profit-Taking on Solana Price and Exchange Flows Add to Selling

Profit booking has been a key theme for Solana.

Glassnode data shared by analyst Ali showed traders took almost $1 billion in profits when Solana crossed $210. This matches Solana’s history: investors sell fast when they see gains, and rallies stop early.

Exchange flows add to the case. On September 2, more than $112 million worth of SOL was sent to exchanges. The next day, the figure slowed to $25 million, but the signal stayed clear.

Traders MOVE tokens to exchanges when they want to sell. It is worth mentioning that September 3 is still under development, and more selling pressure can be expected in time.

This means Solana faces selling pressure every time it jumps. If that continues, upside will stay capped near $220.

Derivatives Show Pressure, but Long-Term Signal Stays Positive

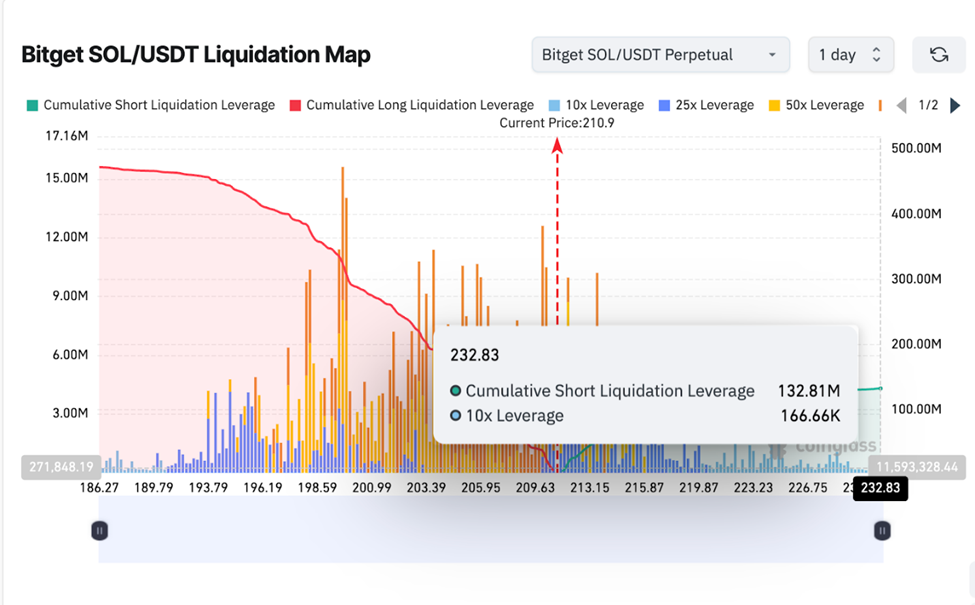

Derivatives data shows another risk. In the past day, Solana saw $472 million in long leverage building compared to $132 million in shorts. This shows traders are too positive.

When markets lean too far in one direction, small drops can cause a chain of forced selling. That makes falls even steeper. In Solana’s case, the long bias, which often shows positive sentiments, can also lead to a long squeeze: a phenomenon in which a minor price drop can cause a cascade of dips.

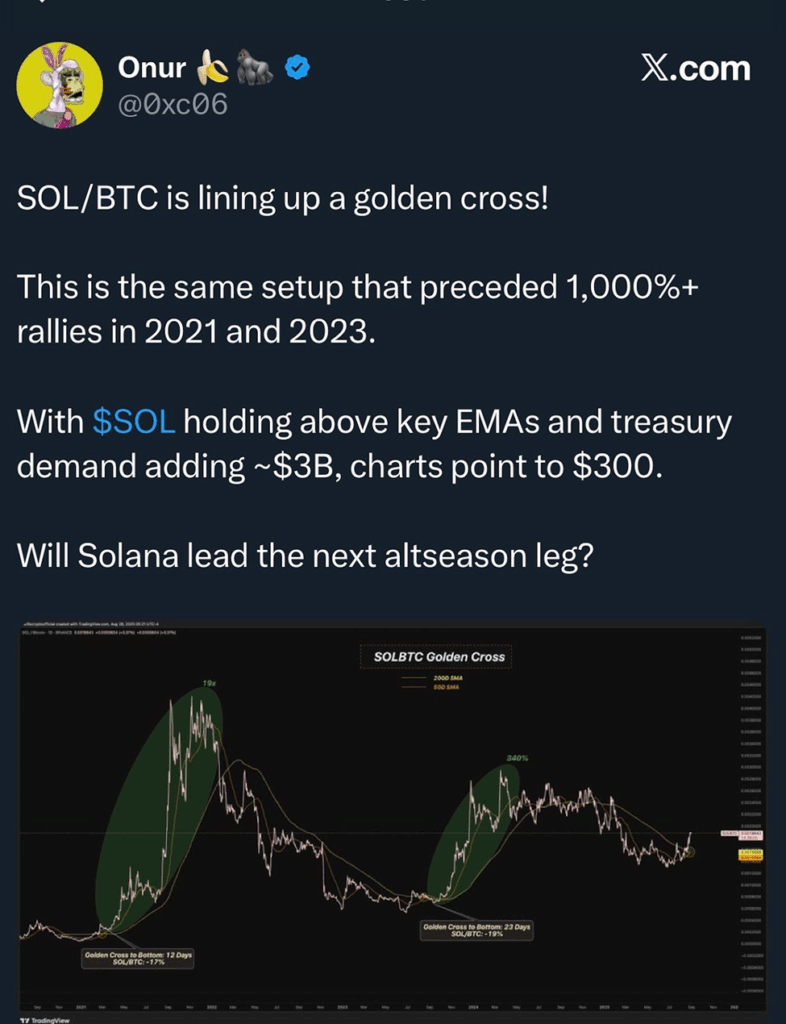

Still, not all is bearish. Analyst Onur pointed out that SOL/BTC is setting up a golden cross. This is when the 50-day moving average goes above the 200-day. The same move came before 1,000% rallies in both 2021 and 2023.

With treasury demand adding about $3 billion and Solana holding above key moving averages, some analysts see a path to $300. Near-term upside targets stand at $226 and $247. This means if Solana breaks resistance, it could rise another 7–17% from current levels.

Solana’s rebound to $211 faces short-term risks. Weak momentum, profit-taking, and heavy long positions could push the Solana price back to $195–200, a downside of 5–7%.

But the longer view is less negative. The golden cross setup on SOL/BTC hints at a possible large rally ahead. If momentum shifts, Solana could aim for $226, then $247, and even $300 in the coming months. That WOULD be an upside of 7–40%.

In short, the Solana price rebound may stall in the short term, but the long-term charts still point higher.