USD Losing Reserve Currency Status: How Bitcoin Could Skyrocket as the New Safe Haven

The dollar's throne is cracking—and Bitcoin stands ready to claim the crown.

When the world's reserve currency stumbles, investors don't just panic. They pivot. And right now, all signs point toward Bitcoin as the prime beneficiary of a dollar decline.

Why Bitcoin Benefits From Dollar Weakness

Unlike traditional hedges like gold, Bitcoin offers something unique: absolute scarcity, borderless transfer, and zero reliance on any single government's monetary policy. No central bank can print more BTC. No politician can freeze your holdings—unless they crack your private key, which even the IRS struggles to do reliably.

A Shift Already in Motion

We’re not talking theory. Countries are already diversifying reserves away from the dollar. Corporations are stacking BTC as treasury assets. High-net-worth individuals are allocating chunks of their portfolios into digital gold. It’s not if—it’s how fast.

What Happens Next?

If the dollar loses its reserve status, expect volatility, then validation. Short-term panic could trigger sell-offs. Long-term? Bitcoin becomes the go-to store of value in a multipolar financial world. Banks will finally have to offer real custody solutions—not the half-baked, over-fee'd 'innovations' they’ve rolled out so far.

So while traditional finance scrambles to protect its margins, Bitcoin just sits there. Immutable. Neutral. Waiting. Funny how the 'barbarous relic' of the 2020s might just save portfolios in the 2030s.

Key Takeaways:

- The US dollar is losing its reserve currency status.

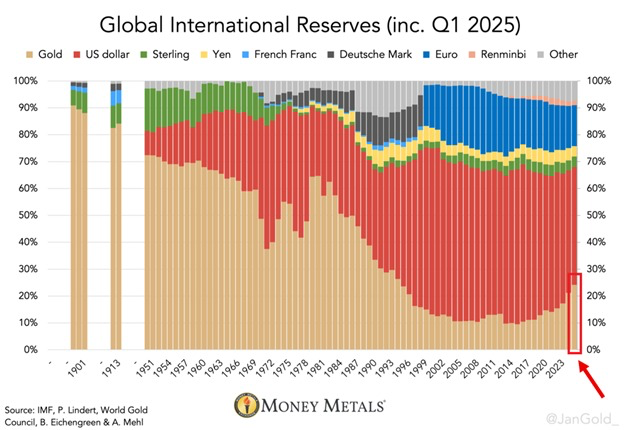

- The USD is down to 42% of global reserves, while gold is rapidly rising.

- As digital gold grows in appeal, the 21st century won’t be dollar-denominated.

The dollar is losing its reserve currency status. USD is now down to 42% of global reserves, while Gold is rapidly rising. According to The Kobeissi Letter, which provides leading commentary on global capital markets, gold is quickly replacing fiat currencies as a reserve currency.

What are the implications for the broader economy, and how does a dwindling dollar worldwide affect Bitcoin and crypto?

The Rise of Gold as a Reserve Currency

American entrepreneur, angel investor, and creator of “The Network State,” Balaji Srinivasan, broke it down. He explained that amid this shifting economic panorama, “digital gold,” like Bitcoin, is becoming the reserve currency of the individual, while gold is returning as the reserve currency of the state.

The numbers certainly back this up. Gold’s share of global international reserves ROSE by 3% in quarter one this year alone to reach 24%, almost one-quarter of global reserves, and the highest level in 30 years. At the same time, the dollar has declined by 2 percentage points to 42%, its lowest level since the mid-1990s.

With demand for gold at historic highs, it begs the question of who is buying, and more specifically, which countries? Balaji points to a May 2025 post by the Federal Reserve Bank of New York that acknowledged that a “small number” of countries were switching to gold.

What the bank neglected to say, however, was that the small number actually included three global powerhouses, the BRIC countries Russia, India, and China.

The Eroding Appeal of the USD

Why does this matter? The dollar losing reserve currency status is, according to Balaji, a “huge deal.” While “America made things” in 1950, in 2025, “it only prints things.” he doubles down by saying that the only competitive exports of the United States today are the dollar and tech:

“And tariffs, sanctions, trade war, and printing are eroding the dollar.”

At the same time, the price of gold and other precious metals like silver is rising. As The Coin Republic reported yesterday, gold was up by over $35 and looked set to break its all-time high. Today, that level has been breached, with gold already blasting through the $3,500 barrier.

Beyond the uncertain macro outlook driving investors to the traditional safe-haven asset, the major driver in gold price, according to Balaji, is the BRICS.

The sanctions imposed on Russia in the wake of its Ukrainian invasion only served to erode the store-of-value function of the dollar. It opened the eyes of nations worldwide. If their dollar holdings can be frozen at will, it is not a SAFE place to store wealth. Moreover, with nagging inflation, the purchasing power of the dollar is eroding.

What Does This Mean for Bitcoin and Crypto?

The dollar’s decline as the global reserve currency has implications for bitcoin and the broader crypto market. As trust in fiat erodes and gold returns as the preferred reserve of nation-states, “digital gold” is likely to arise as a more practical, modern alternative.

With Bitcoin adoption accelerating amid the dollar’s decline and persistent inflation, crypto assets are now widely viewed as a hedge against currency depreciation, especially in countries facing economic instability.

Corporations have already taken note from MicroStrategy to Metaplanet, busily accumulating Bitcoin for their treasuries. As well as, prominent investment managers like BlackRock have acknowledged digital assets’ role in the new system. CEO Larry Fink even publicly stated that Bitcoin could become the next reserve currency.

As the dollar-dominated global order wanes, Bitcoin’s scarcity, durability, and portability will prove its superiority to both fiat and gold, and cement its role as a “digital reserve” for the world.