Bitcoin Bulls Pull Back: The 7-Day Retreat Explained

Bitcoin's rally hits a wall—here's what knocked the bulls off their stride.

Regulatory Headwinds Bite

Fresh rumblings from global regulators sent shockwaves through crypto markets. Uncertainty around future policy shifts triggered caution among institutional players.

Technical Resistance Holds Firm

Key resistance levels proved tougher than expected. Without enough buying pressure to break through, momentum stalled—and profit-taking followed.

Macroeconomic Jitters Return

Traditional finance woes spilled over. Rising treasury yields and inflation fears had investors reallocating—because why hold volatile digital gold when safe havens pay 5%?

Whales Take Profits

Large holders quietly cashed out near local tops. Their exits created selling pressure that retail traders couldn't absorb—classic crypto wealth transfer in action.

The pullback isn't a collapse—just a reminder that even bull markets need to breathe. And that Wall Street still loves taking profits from Main Street's convictions.

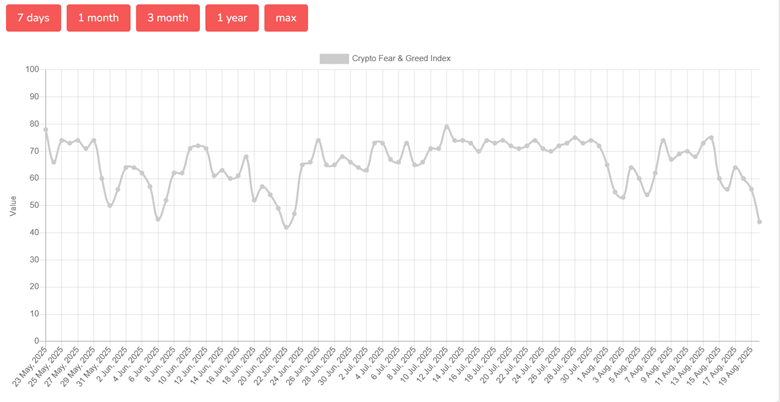

Crypto fear and greed index: Source: Alternative.me

Heavily speculative conditions and high leverage made Bitcoin more volatile

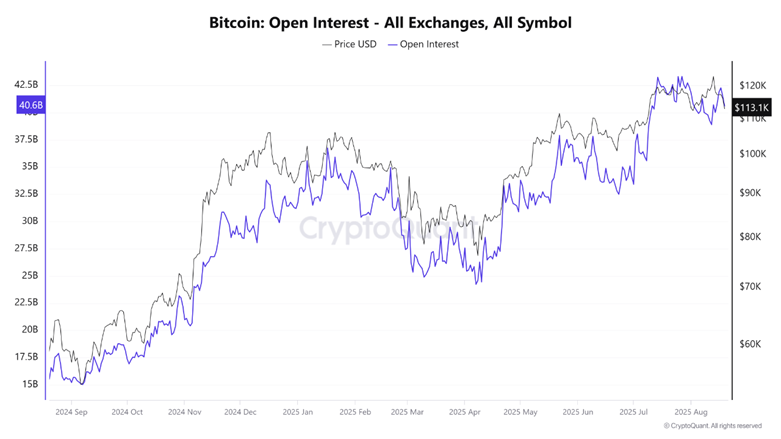

If you kept up with market data in the last two weeks, chances are that you noticed rising open interest and funding rates. This was the situation for Bitcoin and a few other top cryptocurrencies.

Rising open interest highlighted a growing appetite for Leveraged positions. Liquidations were on the rise in the last two weeks and may have contributed to Bitcoin’s volatile price movements.

Bitcoin open interest on all exchanges/ source: CryptoQuant

Unsurprisingly, leveraged long positions suffered heavy blows this week. Especially in the last two days, during which leveraged long liquidations collectively amounted to over $228 million.

This outcome occurred after the price capitulated in favor of more downside since Sunday. This pullback also took place at a time when bullish expectations remained high.

Bitcoin ETFs contributed to sell pressure

BTC ETFs previously contributed to the bullish sentiment that prevailed in the first half. However, even the ETFs changed tune this week and shifted in favor of distribution.

BTC ETF recorded $523.3 million in outflows on Tuesday. This was the second-highest spot outflows observed so far this month after the spike in outflows on 1 August.

The sell pressure from institutions may have contributed further to sentiment deterioration into fear territory. BTC price appeared to have found short-term support near the $112,500 price level. However, there was a risk of more downside if another liquidity sweep occurs near this support.

The probability of such an outcome was quite high, considering the weekly events scheduled to take place this week. This includes the S&P Global manufacturing PMI, scheduled for Thursday.

The markets have been particularly keen on Jerome Powell’s speech at the once a year Jackson Hole symposium. Powell’s speech could determine the market’s mood for the next 2 to 3 months.

In other words, this week’s economic data still has a heavy hand in the latest sentiment shift in the market. It was a sign that investors were adopting a cautious stand ahead of economic data that could lead to a market shift.

While this underscored the potential for more downside, investors will be on the lookout for potential accumulation events. Recent market dips were accompanied by healthy buying at discounted prices and rapid recovery.