Bitcoin Surges as Fed Chair Powell Cements Rate Cut Bets - Crypto Bulls Charge Ahead

Bitcoin's rally accelerates following Powell's dovish stance—traders pile into risk assets as traditional finance braces for cheaper money.

Market Momentum Builds

Federal Reserve Chair Jerome Powell's latest comments have turbocharged cryptocurrency markets. Bitcoin, the flagship digital asset, ripped higher as investors interpreted Powell's tone as a green light for imminent rate cuts. The shift sent institutional and retail capital flooding back into crypto—proving once again that when traditional finance sneezes, digital assets catch a speculative cold.

Rate Cuts Fuel Optimism

Lower interest rates typically weaken the dollar and make yield-less assets like Bitcoin more attractive. Powell’s reinforced commitment to cutting rates didn’t just hint at easier money—it practically guaranteed it. Traders wasted no time pricing in the pivot, pushing Bitcoin toward recent highs and leaving skeptics scrambling.

Cynical Take: Because nothing says 'sound monetary policy' like fueling a volatile, speculative asset class with cheap money—what could go wrong?

Looking Ahead

If the Fed follows through, Bitcoin could test new resistance levels. But for now, the trend is your friend—until it isn’t.

Key Insights:

- Bitcoin price rallied nearly 4% today, indicating renewed investor confidence.

- Jerome Powell hints at a potential Fed rate cut in September, but said that macroeconomic risk remains.

- Analyst has highlighted a key support level for BTC to hit a new all-time high (ATH).

Bitcoin price has recorded massive gains today, after Fed Chair Jerome Powell cemented bets over a potential rate cut in September.

However, Powell, in his latest speech, said that the risks still remain and highlighted the impact of Trump’s tariffs on consumer prices.

Despite that, the recent surge of BTC price to cross $116k signals that market participants are regaining confidence in the market.

Despite that, the latest institutional buying trend and other factors reflect a shifting market focus from BTC to Ethereum.

Amid the ongoing volatile scenario, top analysts have also warned of a short-term correction in Bitcoin price. In addition, experts have also cited the key price levels to watch for traders.

A renowned expert has highlighted key levels that the flagship crypto must hold to avoid a drastic fall. So, here we explore the recent performance of BTC and see what may lie ahead for the asset.

Bitcoin Jumps as Fed Chair Powell Boosts Rate Cut Bets

BTC price today has jumped more than 3% and crossed the $116k level, after touching a 24-hour low of $111,678.

Its trading volume also jumped around 22% and touched $75 billion, indicating renewed interest from market participants.

In addition, the derivatives data also reflects bullish sentiment among traders, suggesting a continuing rally for the asset.

According to CoinGlass data, BTC Futures Open Interest ROSE 2.63% to $82.85 billion. Notably, the surge comes as Fed Chair Jerome Powell, in his Jackson Hole speech, hinted at a potential Fed rate cut.

However, he has highlighted the continuing risks of rising unemployment and high inflation. Following his comments, the broader financial market recorded a robust rally, let alone the bitcoin price.

Besides, the CME FedWatch Tool showed that there is a 90% odds of a potential 25 bps Fed rate cut in September.

However, despite that, some investors are evaluating the potential future performance of Bitcoin price.

While experts are bullish on the long-term potential of the flagship crypto, some have warned of likely short-term corrections.

Besides, the waning risk-bet appetite of institutions, which are betting heavily on Ethereum, has further spooked traders.

Is Institutional Interest Fading on BTC?

According to the latest data, it appears that the institutions are shifting their bets from BTC to Ethereum.

For context, Farside Investors data showed that the US Spot Bitcoin ETF has recorded robust outflow for the past five days through August 21.

The outflows totaled $1.16 billion from August 15 to August 21. This has also weighed on traders’ sentiment, triggering a massive decline in Bitcoin price.

On the other hand, the inflow into the US Spot ethereum ETF was $287.6 million on August 21, reversing its four-day outflow streak.

Meanwhile, Lookonchain also reported that a Bitcoin OG has sold its BTC holdings to buy $267 million in Ethereum. The OG received 100,784 BTC, worth $642 million seven years ago.

What Lies Ahead for Bitcoin Price?

With the ongoing surge and looming market uncertainties, experts have highlighted key price levels to watch for Bitcoin price.

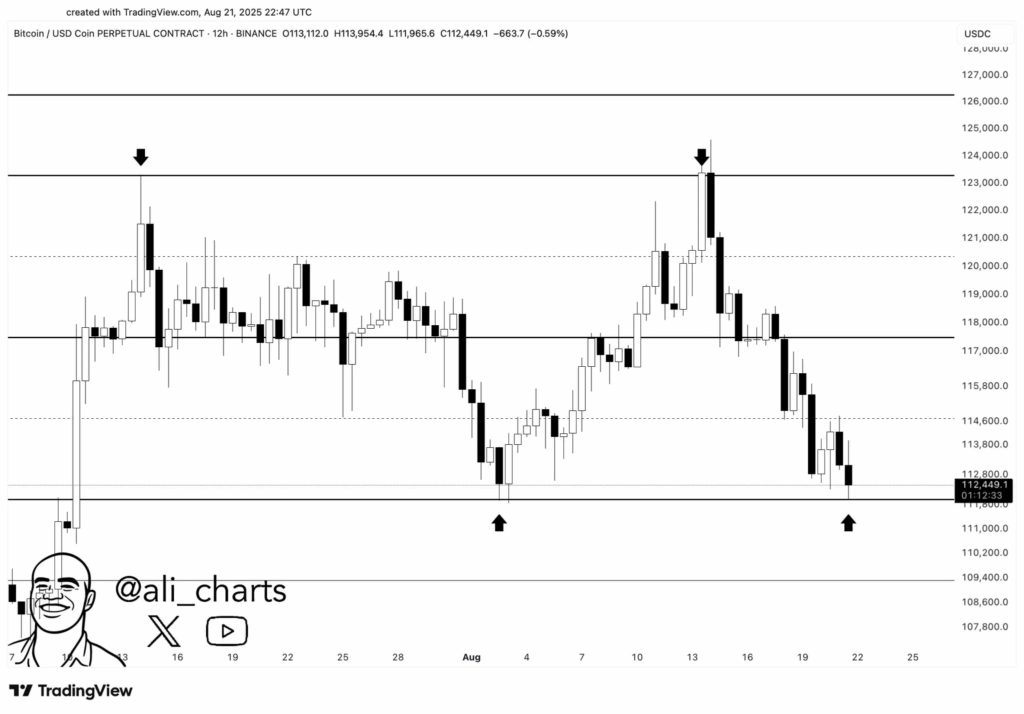

In a recent X post, renowned analyst Ali Martinez said that BTC price must hold its $112k support to avoid a dip to $108k.

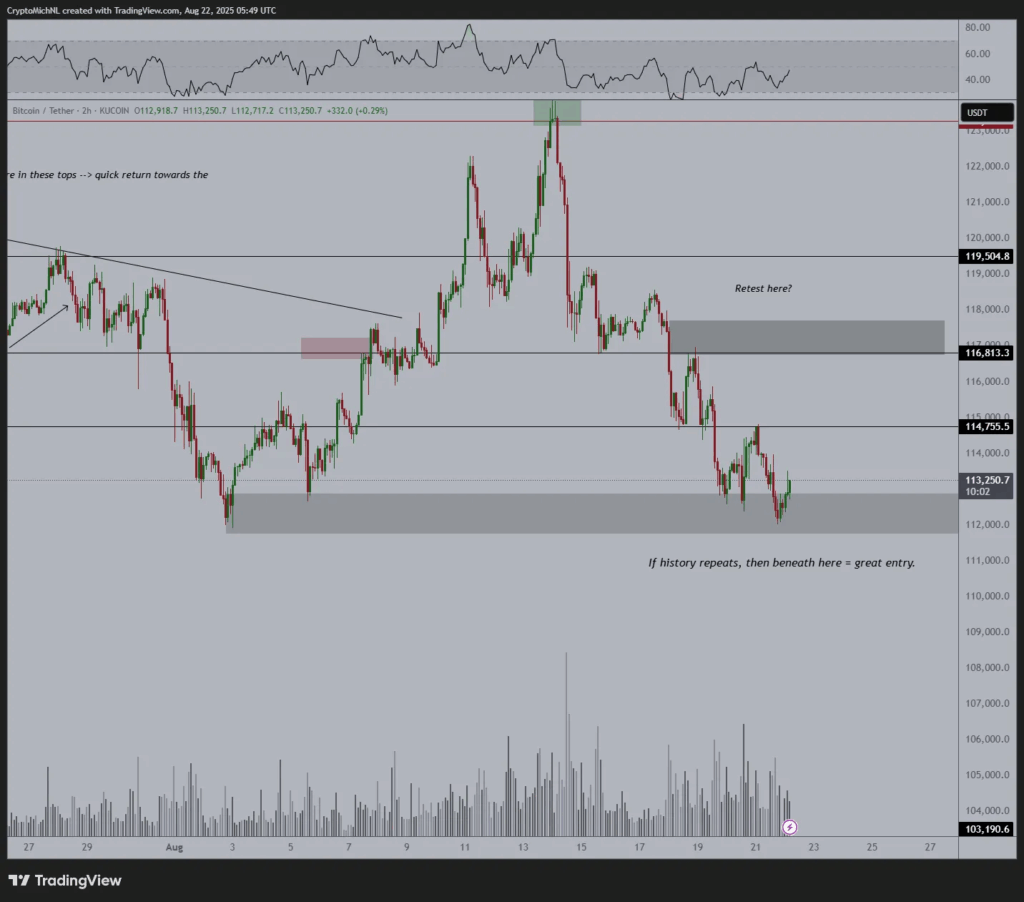

On the other hand, analyst Michael van de Poppe said that the flagship crypto must trade above the $116,813 mark to continue its upward momentum.

He noted that holding above that could trigger a rally to $119,504, and potentially to a new ATH if the bulls remain in control.

However, losing the $114,755 level could trigger a downside to $113,250. Having said that, it appears that Bitcoin price must hold above $116.8k to aim for a new high.

With Fed Chair Jerome Powell’s hint of a rate cut, it seems that the crypto might continue to witness a robust rally ahead.