Cardano Crashes Through Support—Yet Bold Traders Still Eye $1.50 Surge

Cardano's price just nosedived past critical support—but the crypto faithful aren’t backing down. Here’s why some traders are doubling down on a $1.50 rebound.

### The Breakdown: ADA Defies Gravity (Briefly)

Another day, another ‘buy the dip’ chant from crypto bros as Cardano flirts with danger. The so-called ‘Ethereum killer’ got killed first—sliding below key levels while Bitcoin barely blinked.

### The Hopium Pipeline: $1.50 or Bust

Technical charts show traders stacking bids near the abyss, convinced ADA’s ‘undervalued’ status (read: down bad) makes it prime for a pump. Never mind the 90% of altcoins that never recover—this time is different, right?

### The Cynic’s Corner: Wall Street’s Playing Both Sides

Meanwhile, institutional desks quietly short ADA futures while publicly tweeting moon emojis. Classic hedge fund move—talk up the retail bagholders, profit from their hopium. Cardano’s not special; it’s just today’s casino chip.

Bottom line? ADA’s either a steal or a trap. Place your bets—just don’t cry when the house wins again.

The broader crypto market has seen some fluctuating price action, in the past few days and Cardano is no exception.

The coin had held support NEAR $0.95 after breaking out of a long-term descending channel in mid-August 2025.

Analysts said the breakout created a foundation for potential gains, with attention turning to resistance at $1.12, $1.20, and $1.50.

However, earlier today, it broke below the support, losing 4.24% in a day. At the time of writing, it was trading at $9043.

Cardano Price Maintains Key Breakout Structure

The ADA price established a sequence of higher lows after leaving the descending channel. Analysts said this indicated steady buying pressure.

The token held above $0.94–$0.96 until earlier today, which they described as a critical zone for sustaining the current structure.

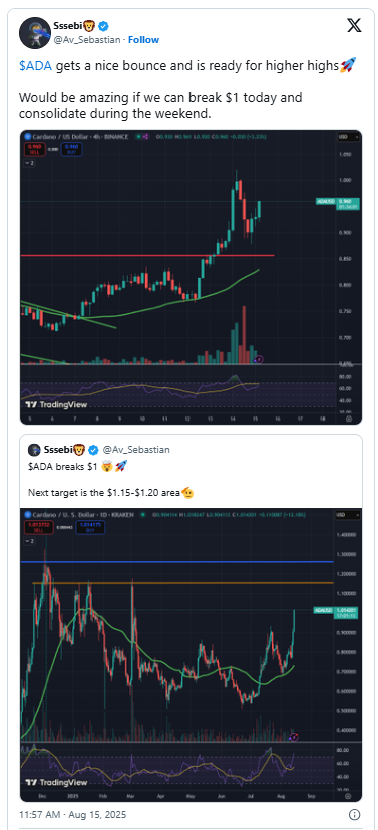

A MOVE beyond the $1.00 psychological barrier was seen as confirmation of renewed strength.

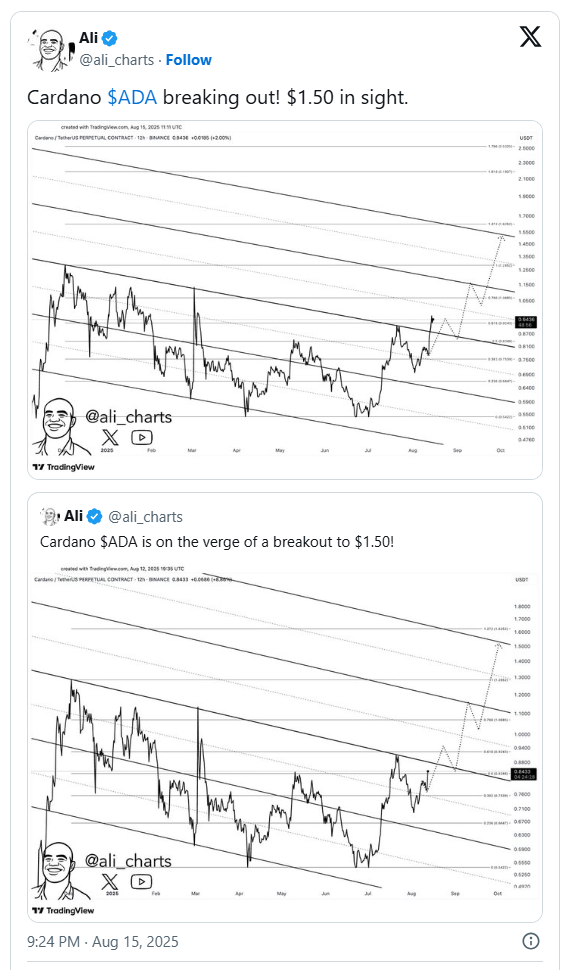

Ali Martinez, a market analyst, said that holding above the support zone could validate the breakout attempt. Measured move projections from the channel suggested a possible rally toward $1.50.

The Relative Strength Index (RSI), a momentum indicator that signals overbought or oversold conditions, was neutral at the time of writing.

Analysts said this left room for another advance without immediate exhaustion.

Cardano Price Targets Aligned With Analyst Views

Analysts outlined resistance levels that aligned with the token’s structure. They noted $1.12 and $1.20 as short-term hurdles that WOULD need to break before the mid-range $1.50 target.

Ssebi, a crypto analyst, said that Cardano was one of the few large-cap tokens that could deliver significant returns this cycle.

He added that capital rotation from BTC and ETH into alternative assets could benefit ADA if broader market conditions stayed favorable.

Cardano’s price performance coincided with a shift in sentiment toward risk assets. Market participants described the token’s resilience around long-term support as constructive for the bullish case.

Analysts said continuation depended on whether momentum in altcoins expanded through the cycle.

Open Interest in Cardano Futures Reached Record High

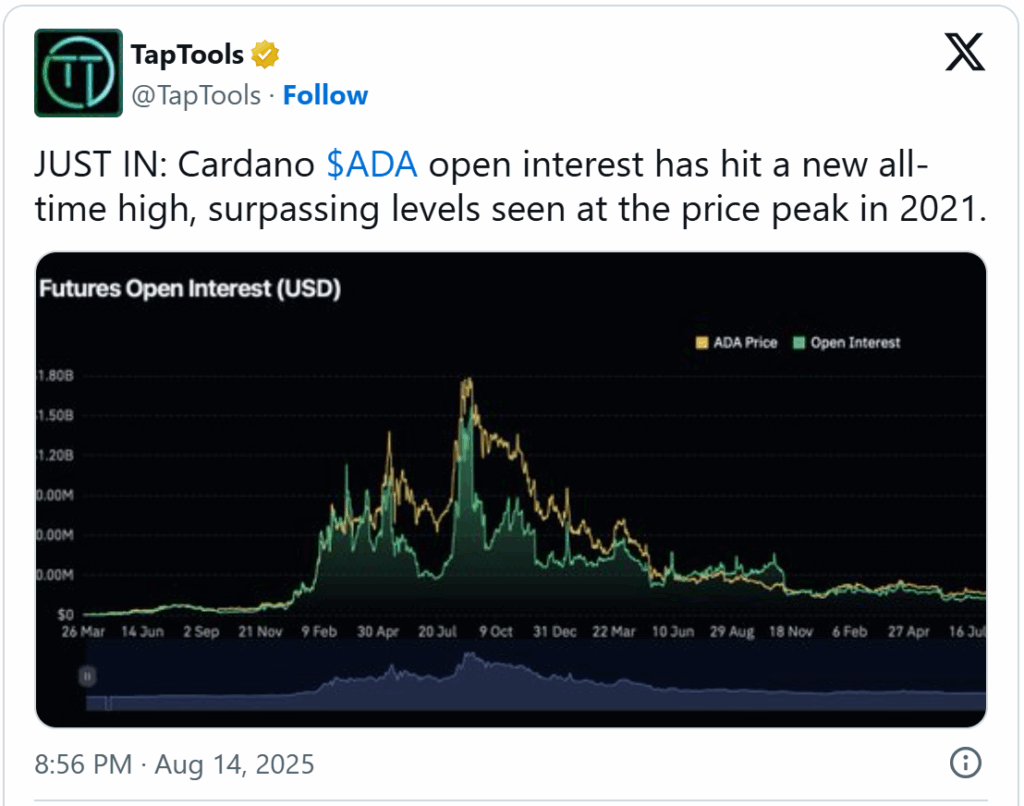

Futures open interest for ADA surpassed its 2021 peak at press time. Analysts said the increase signaled stronger speculative participation and higher levels of leverage.

The rise in open interest, combined with the breakout structure, indicated that market participants positioned for larger moves.

Analysts said this could increase volatility in either direction. With trend indicators pointing upward, they viewed the probability of continuation toward resistance as higher than reversal.

Trading volume stabilized after the initial breakout surge, suggesting that gains were absorbed without heavy profit-taking.

Analysts noted that the stabilization supported the case for a sustainable trend rather than a temporary spike.

Outlook for Cardano in The Coming Weeks

Cardano’s technical picture combined sustained support, defined resistance levels, and rising futures activity.

With the current state of Cardano price action, it remains to be seen what direction it will take. Will buyers push it to higher levels or will it take a bearish turn.

If the ADA price manages to climb back up and maintain its base near $0.95, analysts said the next checkpoints were $1.12 and $1.20. A breakout through those levels could put $1.50 within reach.

At press time, Cardano’s chart structure, neutral RSI, and record futures interest all aligned to suggest that the token remained in a favorable position within the current cycle.

Broader market sentiment was expected to determine whether the breakout extended or stalled in the short term.