Metaplanet Outshines Trump Media: 18,113 BTC Treasury Sparks Market Frenzy as Stock Dips with Bitcoin

Move over, Trump Media—Metaplanet just dropped the mic with a staggering 18,113 BTC war chest. While Bitcoin's price swings drag its stock down, this Tokyo-based firm is doubling down on crypto as the ultimate hedge. Talk about putting your money where your mouth is.

When HODLing becomes a corporate strategy. The company's stock might be bleeding with BTC's volatility, but good luck finding a traditional balance sheet with this much diamond-handed conviction. Wall Street analysts are either sweating or secretly stacking sats.

Here's the kicker: In a world where most CFOs still think 'blockchain' is a Peloton accessory, Metaplanet's treasury move looks either brilliantly reckless or recklessly brilliant—depending on which crypto Twitter guru you ask. One thing's certain: they're not betting on printer go brrr economics.

Key Insights:

- Metaplanet purchased an additional 518 BTC for $61.4 million, boosting total Bitcoin holdings to 18,113 BTC.

- The company’s Bitcoin stash has topped Trump Media & Technology Group’s BTC holding.

- Metaplanet stock slipped more than 2% as Bitcoin price fell nearly 3% below $119K.

Metaplanet Inc, aka Asia’s MicroStrategy, on Tuesday said it acquired an additional 518 BTC for $61.4 million. After the latest purchase, Japan-listed Metaplanet’s Bitcoin holdings surpassed Trump Media & Technology Group.

Moreover, Metaplanet stock failed to hold the recent rebound and tumbled below 1000 JPY again on Tuesday, down 2.69% at market close.

Metaplanet Tops Trump Media in Bitcoin Holdings

Metaplanet purchased an additional 518 BTC at an average price of $118,519 per Bitcoin, according to an official announcement on August 12. Also, the company’s quarter-to-date BTC yield increased to 26.5%.

With the latest bitcoin buy, the company expanded its total Bitcoin holdings to 18,113 BTC worth over $2.15 billion. It surpassed Trump Media’s BTC holdings of 15,000, according to Bitcoin Treasuries data.

Metaplanet purchased these BTCs for nearly $1.85 billion at an average price of $101,811 per BTC. This makes the company sit on an unrealized profit of $32.42 million after the latest buy.

CEO Simon Gerovich also took to X to share about the latest BTC buy with shareholders and the crypto community. He reflected on achieving a BTC yield of 468.1% year-to-date (YTD) 2025 under the accelerated Bitcoin strategy.

Metaplanet last purchased 463 BTC for $53.7 million at an average price of $115,895 per Bitcoin on August 4.

The company has acquired 14,067 BTC since April this year, indicating the company’s accelerated Bitcoin strategy to generate value for its shareholders. The firm plans to hold at least 30,000 BTC by the end of 2025.

Metaplanet Stock Slips Over 2%

Metaplanet stock price closed 2.69% lower at 975 JPY on Tuesday. This happened as Bitcoin price slipped from $122K to $119K in the last 24 hours.

The 24-hour low and high were 970 and 1053 JPY. Also, the 24-hour trading volume was lower than the average volume of almost 46 million.

As per Yahoo Finance, the stock price has plunged more than 37% in a month as traders continued shorting the stock. This reduced the year-to-date return to almost 180%.

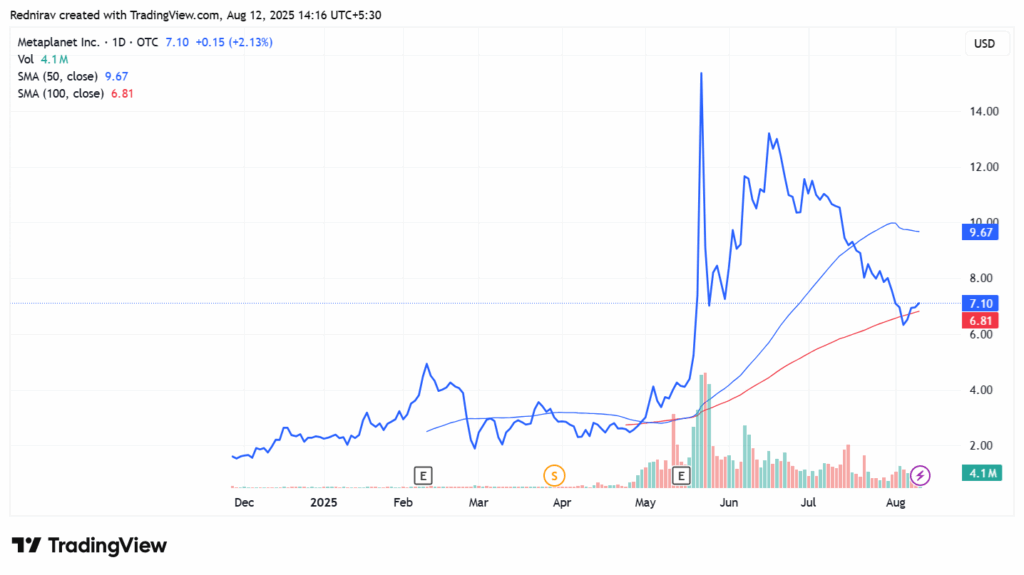

Meanwhile, MTPLF stock closed 2.13% higher $7.10 on Monday, expanding the weekly increase to nearly 7.74%. Moreover, the stock has rallied 216.96% YTD.

The stock remained one of the most traded stocks. In the daily timeframe, the stock was trading below the 50-SMA but rebounded above the 100-SMA after a pump following Bitcoin price.

Bitcoin Price Slips to $119K Post Strategy’s Low BTC Buy

Bitcoin price tanked below $119K after Michael Saylor’s Strategy acquired only 155 BTC for $18 million in a week.

BTC price dropped more than 2% to trade at $119,014 at the time of writing. The 24-hour low and high were $118,159 and $122,603, respectively.

Furthermore, the trading volume remained flat over the last 24 hours, indicating muted action in the spot crypto market.

CoinGlass data showed huge selloffs in the derivatives market. At the time of writing, the total BTC futures open interest jumped more than 5% to $79.74 billion in the last 24 hours.

Meanwhile, 4-Hour BTC futures OI on CME climbed 0.70% and fell 0.47% on crypto exchange Binance, respectively.

This signals negative sentiment among derivatives traders, with uncertainty ahead of the key US CPI and PPI inflation headwinds this week.