Bitcoin’s Last Surge Before Bull Market Peak? Top Analyst Issues Urgent Warning

Bitcoin's price action screams 'final countdown'—one last explosive rally before the bull market taps out, according to a closely-watched crypto strategist.

The Calm Before The Storm

After months of sideways chop, BTC's chart is coiling like a spring. The analyst—who nailed previous cycle tops—sees a textbook 'blow-off top' pattern forming. Retail FOMO hasn't even peaked yet.

Institutional Gasoline

Wall Street's latest ETF inflows are pouring accelerant on the fire. But let's be real—these are the same geniuses who called Bitcoin 'rat poison' at $6,000. Now they're suddenly blockchain evangelists?

The Cynic's Take

When your Uber driver starts giving BTC price targets, it's probably time to check your stop-losses. The market's about to separate the diamond hands from the bagholders—again.

Key Insights:

- Bitcoin price spiked suddenly by 3% within hours to reclaim the $122,000 on Monday.

- Analyst Benjamin Cowen predicted this as last upside rally before bull market peak in Q4.

- BTC recorded massive demand from spot Bitcoin ETFs and treasury companies, price target of $133K.

Bitcoin price shoots over 4% to recover above $122,000 amid US policies boosting Bitcoin investments, technical chart pattern breakout, and seasonal momentum.

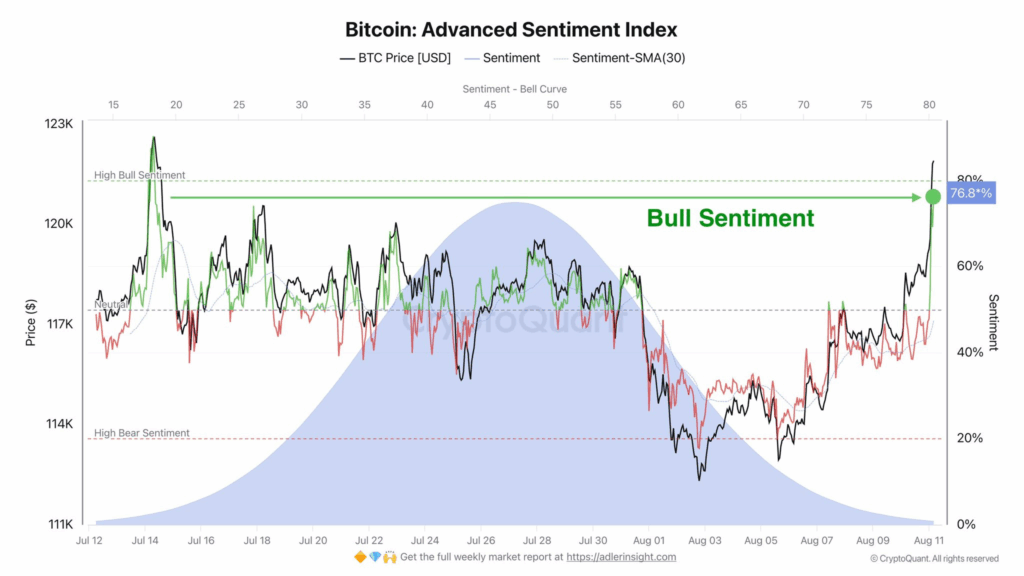

However, a popular analyst believes BTC is making its last upside move before cycle top in fourth quarter this year. crypto market fear & greed index rebound to 70 (greed) from 64 last week.

Analyst Shares Bitcoin Price Historical Pattern Reemerges

Bitcoin price saw sudden 3% spike within hours to reclaim the $122,000 psychological level on August 11. The recovery looked strong as bulls gained dominance over bulls after a key BTC options expiry last week.

Benjamin Cowen, one of the top crypto analysts, took to X and shared a bitcoin historical pattern. According to Cowen, Bitcoin had historically printed the same pattern after every halving year.

July and August remained seasonally positive months for BTC in many past years, recording nearly 20% rally. Whereas, BTC had recorded by a pullback in September.

If history repeats, Bitcoin bull market could top in October this year. Several analysts predicted Bitcoin to peak by September-end or mid-October.

Bitcoin Price Will Rally to $133K?

Analyst Ali Martinez predicted $133K as next Bitcoin price target if bulls keep it above $112K as per the MVRV Pricing Bands. He also revealed that 364,126 new daily Bitcoin address were created last week, which was the highest this year.

This indicated a bullish sentiment among investors for further upside. Also, President Donald Trump’s executive order to enable crypto investments by 401(k) retirement plans continues to raise bullish sentiment in the market.

Moreover, Bitcoin held in treasuries continued to increase in recent years. It increased from a combined amount of 1.2 million BTC in 2024 to over 1.86 million BTC in August this year, according to Sentora data.

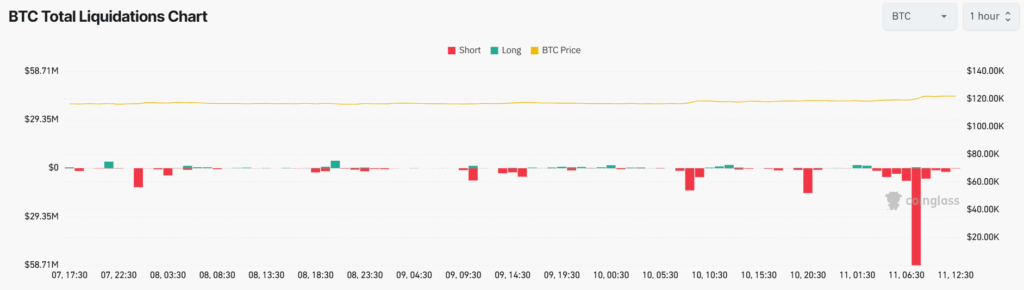

The massive spike in bitcoin price caused nearly $60 million in shorts liquidation in an hour on August 11, as per Coinglass data. In the last 24 hours, $350 million in crypto assets were liquidated, with nearly $220 million in short positions liquidation.

Notably, over 105K traders were liquidated over the last 24 hours. The largest single liquidation order happened on OKX crypto exchange as someone swapped BTC to USDT valued at $9.14 million.

BTC Price Performance Amid Huge Demand

BTC price was trading more than 3.30% higher at $122.075 at the time of writing. The 24-hour low and high were $117,519 and $122,309, respectively.

Furthermore, the trading volume has increased by more than 28% in the last 24 hours, indicating a significant rise in interest among traders.

The bullish bull flag pattern is at play amid a breakout above the descending channel in 3-hour timeframe chart. The pattern target a Bitcoin price rally above $135K.

CoinGlass data showed massive buying in the derivatives market. At the time of writing, the total BTC futures open interest jumped more than 6% to $84.45 billion in the last 24 hours.

Meanwhile, BTC futures OI on CME and Binance climbed more than 3% and 10%, respectively. This signals bullish sentiment among derivatives traders.

Huge demand from spot Bitcoin ETFs and BTC treasury companies continue to push Bitcoin price higher. In the futures market, bullish sentiment has risen to its highest level in the past month.