Tether CEO Paolo Ardoino Drops Jaw-Dropping USDT Metrics You Won’t Believe

Tether's USDT isn't just surviving—it's thriving. Paolo Ardoino just pulled back the curtain on performance stats that'll make even Bitcoin maximalists do a double-take.

The stablecoin that bankers love to hate keeps printing dominance. While traditional finance still debates 'stablecoin risks,' USDT's numbers scream market conviction.

No fluff, no maybes—just cold, hard metrics that redefine scale in crypto. The kicker? These figures dropped while SEC lawyers were probably drafting another 'volatility warning' press release.

Tether CEO Paolo Ardoino has shared the company’s new Q2 2025 figures. The update showed the stablecoin issuer is among the top holders of U.S. Treasuries, physical gold, and Bitcoin.

It also included details on USDT’s market performance and the company’s latest investment moves.

Tether Boasts Large Reserve Holdings Across Assets

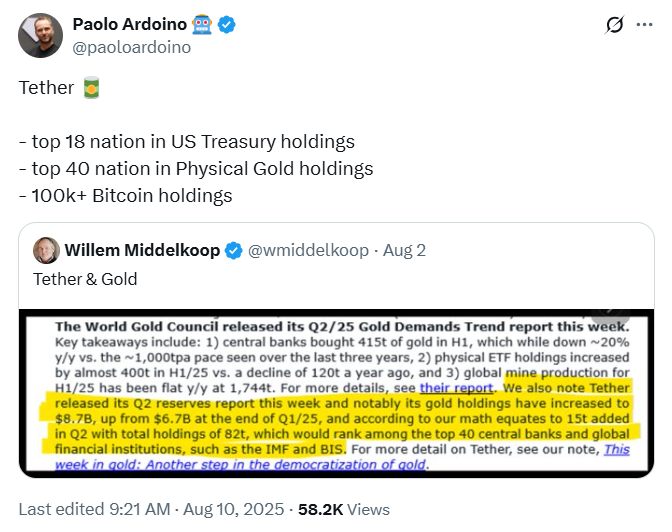

In his recent post on X, Tether CEO Paolo Ardoino said the company’s reserves now place it among major global holders of several key assets.

In Q2 2025, Tether ranked 18th worldwide in U.S. Treasury holdings with $127 billion in securities.

According to the update, the company’s Gold holdings also grew in the second quarter.

The latest reserve report showed gold valued at $8.7 billion, up from $6.7 billion at the end of Q1 2025.

This represented an increase of 15 tonnes in the quarter, bringing total holdings to 82 tonnes.

That amount WOULD put Tether in the same category as the top 40 central banks and financial institutions holding physical gold, including the IMF and BIS.

In addition, Tether also holds large amounts of Bitcoin. Blockchain data provider Arkham reported 77,780 BTC on Tether’s balance sheet, valued at $9.23 billion in July 2025.

In his post, Ardoino mentioned 100,000+ Bitcoin holdings. This suggests that the company’s position may be higher than the publicly tracked figure.

USDT’s Role in the Stablecoin Market

It is worth noting that Tether’s USDT token remained the industry’s largest stablecoin by market size.

Circulating supply is currently pegged at 164.51 billion, with a market value of $164.52 billion and daily trading volumes of more than $114 billion.

Tether’s Q2 attestation report, prepared by accounting firm BDO, showed net profits of $4.9 billion for the quarter. This brought total profits for the first six months of 2025 to $5.7 billion.

It is worth noting that a large part of these profits came from gains in bitcoin and gold prices.

Since January 2025, Bitcoin has risen 26.85%, reaching a record high of $123,000.

While gold prices had increased by 16%. Together, these assets generated $2.6 billion for Tether in the first two quarters.

In Q2 alone, Tether issued $13.4 billion worth of USDT, pushing total issuance for 2025 to $20 billion.

The growth in circulating supply reflected the token’s continuing role in cryptocurrency trading and transactions.

Broader Investment Moves

It is important to add that Tether continued to expand into other areas of investment in the second quarter.

Ardoino confirmed that the company holds a majority stake in Jack Maller’s Twenty One Capital.

As part of that investment, Tether transferred 18,812 BTC to FORM the firm’s Bitcoin treasury and planned to add 5,800 BTC ahead of its listing.

The company also invested in Rumble, supporting the development of the streaming platforms’s digital wallet.

In May, Tether revealed work on a project called Tether AI, aimed at artificial intelligence applications.

Per a recent update, Tether purchased a minority stake in Spanish crypto exchange Bit2Me.

The company led a €30 million funding round that is expected to close in the coming weeks. Notably, the funds will help Bit2Me expand in the European Union.

The exchange recently became the first Spanish-speaking platform to receive a license under the MiCA regulatory framework.

The company also planned to extend its services to Latin America, starting with Argentina.

In addition, Tether’s investment in Bit2Me also provides it with a stronger foothold in Europe after some exchanges reduced or removed USDT trading pairs following MiCA regulatory changes.