Ethereum Surges Past Mastercard: Market Cap & Price Defy Traditional Finance

Move over, legacy payments—Ethereum just lapped Mastercard in a market cap sprint. The crypto asset’s blistering rally isn’t just a fluke; it’s a middle finger to Wall Street’s 'mature asset' playbook.

Price? Skyrocketing. Market cap? Toppling giants. TradFi analysts? Scrambling to justify why a 'nerd money' protocol now dwarfs their plastic empire.

One cynical take: Maybe Mastercard should start offering gas fee rebates to stay relevant.

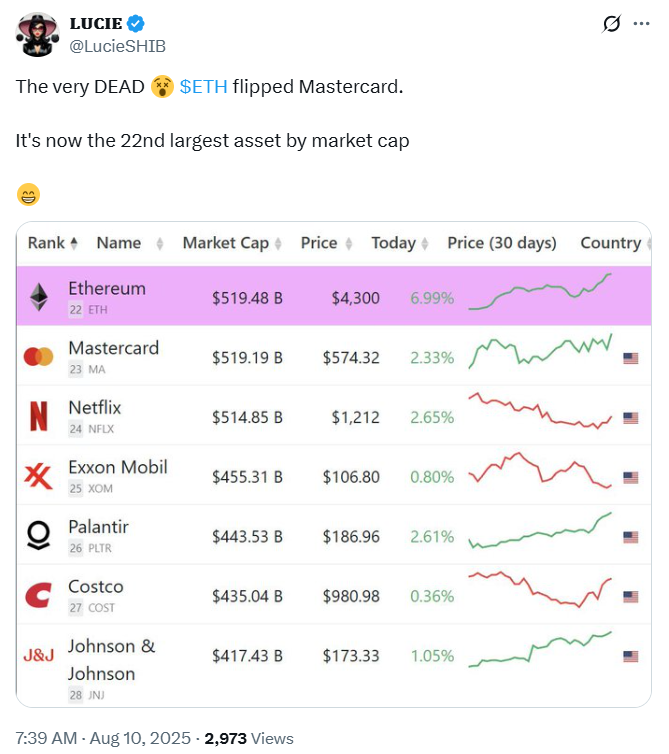

Ethereum, amid its positive price shift, has surpassed Mastercard in market capitalization, climbing to $519.48 billion after weeks of steady gains.

The move placed the cryptocurrency in the 22nd spot among the world’s largest assets and sparked fresh debate on its long-term position.

Ethereum (ETH) Moves Ahead of Mastercard

According to recent reports, the second-largest digital asset, ethereum surpassed Mastercard in market value.

It is worth noting that figures from market trackers showed Ethereum’s capitalization is pegged at $519.48 billion.

Per the update, this is slightly higher than Mastercard’s $519.19 billion. To achieve this rare feat, Ethereum’s price hit $4,300, rising nearly 7% in just one day.

This came after weeks of consistent growth, with its value climbing more than 21% during that time.

Notably, the jump pushed Ethereum up to become the 22nd most valuable asset in the world.

It now ranks ahead of major companies like Netflix, Exxon Mobil, Palantir, Costco, and Johnson & Johnson.

More importantly, part of this surge is tied to how the cryptocurrency market operates.

Unlike traditional stocks that stop trading at the end of each business day, crypto markets run without closing.

This gave Ethereum more time to attract buying activity over weekends and public holidays, when Mastercard and other stocks saw no movement.

Critics React to the Ethereum Price Surge

Furthermore, the flip-over of Mastercard drew quick reactions from traders and analysts online.

Some critics, like Samson Mow, pointed out that a large share of early Ethereum holders also owned Bitcoin from earlier investments.

Mow suggested these holders had been moving some of their bitcoin into Ethereum to take advantage of the current interest in the asset.

Additionally, this includes stories of companies adding Ethereum to their balance sheets.

According to these critics, such moves could be temporary as they may take profits after pushing the price higher.

Similarly, some investors might sell off large amounts of Ethereum, causing the price to drop and leaving later buyers with losses.

This pattern, they said, had happened before in different markets and was a risk for anyone expecting prices to keep climbing without pause.

Samson Mow specifically described a “Bagholder’s Dilemma,” where investors struggle between selling at high prices.

Perhaps, holding in hopes of even bigger gains, often leading to sharp market swings NEAR previous record highs.

Will Ethereum (ETH) Challenge Bitcoin Next?

In separate development, the discussion also turned to Ethereum’s possible future against Bitcoin.

Joseph Lubin, one of Ethereum’s co-founders, said earlier that growing adoption by treasury-focused companies could push Ethereum past Bitcoin in market value within a year.

For now, Bitcoin still holds the top spot in the crypto market by a wide margin. As of this publication, Bitcoin holds a $2.36 trillion market capitalization.

However, Ethereum’s consistent price rise since July 2025 has kept the idea of a flip in play. Its market cap is currently $505.58 billion.

In early August, its daily trading volume went above $41.7 billion, showing strong activity from both individual traders and large investors.

Market watchers said the next test for Ethereum ETH WOULD be whether it could stay above Mastercard in the rankings and continue moving up the list.

ETH proponents are, however, worried that certain price points, like previous record highs, might trigger more selling as traders cash in their profits.

The real test will be in the coming months, showing whether Ethereum price’s recent surge is the start of a lasting climb or just a brief spike.

For now, it has already made headlines by surpassing one of the biggest names in global finance.