BlackRock’s ETF Gambit: Is an XRP and Solana Fund the Next Crypto Power Move?

Wall Street's trillion-dollar gorilla just dipped another toe in crypto waters—but will it dive deeper?

BlackRock's ETF playbook keeps getting bolder. After dominating Bitcoin and Ethereum funds, the asset manager's flirting with altcoin exposure. Now the market's buzzing: Are XRP and Solana next on their shopping list?

The institutional crypto land grab accelerates

BlackRock doesn't make moves—it shifts paradigms. Their Bitcoin ETF crushed records, pulling in $20B AUM in six months. Now insiders spot the telltale signs of expansion: SEC meetings, custody partnerships, and that familiar regulatory chess game.

XRP's legal clarity and Solana's institutional-grade throughput make them prime candidates. Never mind that both assets still give traditional finance guys hives—since when did BlackRock care about volatility?

The real question isn't if, but when

With crypto ETFs printing money faster than the Fed's money printer, expect BlackRock to keep feeding the beast. After all, nothing lubricates Wall Street's wheels like 1.5% management fees on 'disruptive' assets.

As Ripple and SEC ended years-long legal battle in August 2025, and xrp price saw significant upside, discussion abound in the crypto community whether Blackrock will file for an XRP ETF.

American investment giant BlackRock swiftly put these discussions to rest, clarifying that it has no plans to launch spot exchange-traded funds for XRP or Solana.

This statement came even as market experts continued their dialogue on the topic, sparking market talk of possible new crypto products from the asset manager.

BlackRock Makes its Spot XRP and Solana Position Clear

According to recent reports, BlackRock has confirmed it will not be moving ahead with spot ETFs for XRP or solana at this time.

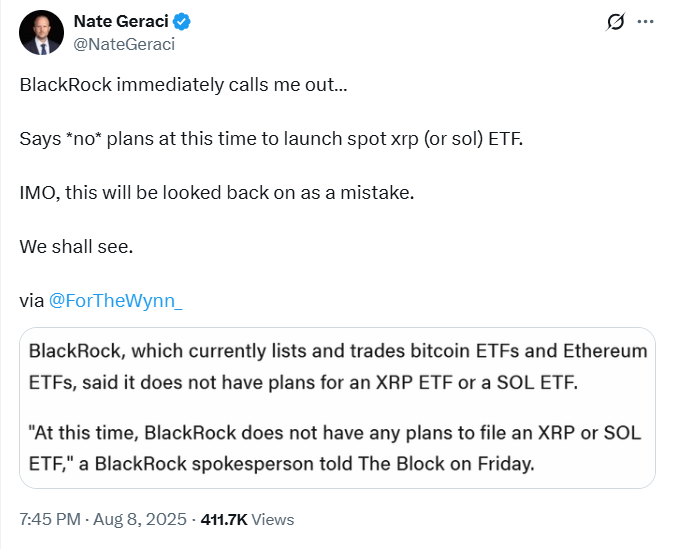

It is worth mentioning that the clarification came on August 9 during the Crypto Prime podcast hosted by Nate Geraci.

A spokesperson told The Block that “at this time, BlackRock does not have any plans to file an XRP or SOL ETF.”

It is important to state that the company already offers spot Bitcoin and ethereum ETFs.

Talk of adding other cryptocurrencies to its list has grown after the settlement of Ripple Labs’ case with the U.S. Securities and Exchange Commission earlier in the week.

The case, which began in 2020, centred on the SEC’s claim that Ripple raised $1.3 billion through unregistered sales of XRP.

In a ruling in July 2023, Judge Analisa Torres decided that some sales made through public exchanges were lawful, but direct sales to institutions counted as securities.

After a series of court duels, both Ripple and the SEC agreed to end their appeals, closing the case earlier in the week.

Speculation Follows Ripple Case Closure

The end of the lawsuit led to renewed interest in whether large firms such as BlackRock might launch an XRP ETF.

This is because some market watchers thought the legal uncertainty had been a barrier.

Geraci, President of NovaDius Wealth Management, suggested that it made little sense to limit ETFs only to Bitcoin and Ethereum.

Bloomberg Intelligence Senior ETF Analyst James Seyffart disagreed that the lawsuit was the main reason for the delay.

He said BlackRock had plenty of time to file earlier if it wanted to be among the first to offer such products.

Others in the industry also doubted that the legal outcome WOULD push BlackRock to act.

Alexander Blume, CEO of Two Prime Digital Assets, noted that XRP’s market value is less than half of Ethereum’s. This makes it less desirable for firm BlackRock.

This suggested that the firm was focused on building its Bitcoin and Ethereum funds instead.

Other Firms Push Ahead with XRP ETF Plans

It is worth noting that while BlackRock stays on the sidelines, several companies have already filed for XRP ETFs.

These include Franklin Templeton, ProShares, 21Shares, Canary Capital, and Bitwise.

Bloomberg analysts in June raised their year-end approval odds for spot ETFs linked to XRP, Dogecoin, and Cardano to 90%. Betting platform Polymarket showed slightly lower odds for XRP.

The SEC is also reviewing proposals for ETFs tracking other cryptocurrencies, such as Solana and Dogecoin.

Vivian Fang, a finance professor at Indiana University, said she believed it was more likely to see ETFs for altcoins like Solana before one for the Ripple-associated XRP.

BlackRock’s approaches may be to watch the market and see how other ETF products perform before expanding beyond bitcoin and Ethereum.

Geraci said the firm’s strategy might be to let competitors launch first, then respond based on investor demand.

For now, the asset manager continues to trade its existing crypto ETFs and has given no timeline for any future filings related to XRP, Solana, or other altcoins.

The decision leaves room for other companies to test the market for these products while BlackRock maintains its BTC and ETH ETF dominance.

Meanwhile crypto ETF expert, Nate Geraci continues to assert that he believes Blackrock will file foe XRP and SOL ETFs soon.