Whales Gobble 1.8M ETH—Is Ethereum’s $6,400 Price Target Next?

Ethereum's price could be primed for a moonshot—if whale demand keeps surging. Nearly 1.8 million ETH bought up by deep-pocketed investors hints at a bullish storm brewing.

Breaking the resistance ceiling

Whales aren't just dipping toes—they're diving headfirst. The sheer volume of recent buy-ups suggests institutional-grade conviction, not just retail FOMO. If accumulation continues at this pace, $6,400 becomes more than hopium—it's a technical possibility.

The cynical take? Wall Street probably just realized crypto exists again after their third yacht purchase. But hey—when whales move, markets follow. Whether it's smart money or dumb luck, Ethereum's chart is flashing green.

Ethereum (ETH) price may be on track to reach $6,400 if large investors keep buying at the current pace.

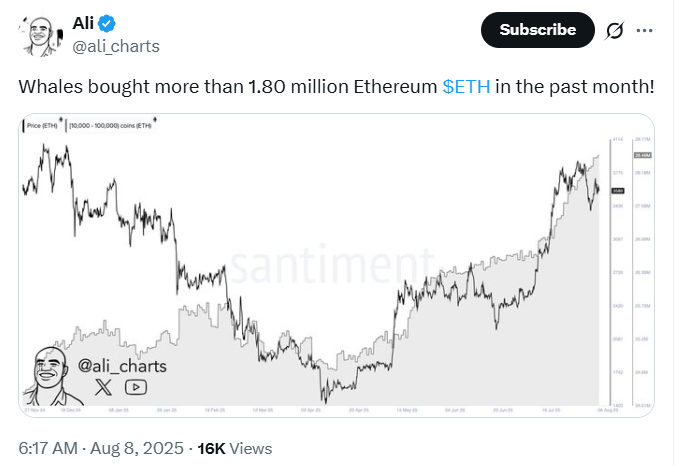

Over 1.8 million ETH were bought in the past month, according to new market data.

Drawing on this, analysts believe this activity could lead to a strong move if key ethereum price resistance levels are broken soon.

Whale Activity Builds Case for Ethereum Price Breakout

Ethereum price could be heading toward the $6,400 mark after major wallet holders purchased over 1.8 million ETH in the past month.

The buying was recently reported by market watcher Ali Martinez on the X social media platform.

The accumulation came as ethereum ETH showed higher activity on the network and pushed against technical price levels.

Ali said $6,400 could act as a “magnet” if the Ethereum price breaks out of its current range.

Notably, the statement caught attention as traders looked for new signals in a quiet market.

The rise in whale buying followed a period of lower trading volumes and soft price moves.

Still, with whales accumulating the digital asset again, some market participants believe a breakout may be close.

Others remain cautious, noting that volume and momentum WOULD need to pick up before a major move can happen.

Since the beginning of August, the Ethereum price has stayed around $3,500 to $3,800. However, in a surprising shift, Ethereum ETH breached the $4,000 mark for the first time this year.

However, growing interest from large wallets suggested that higher price levels might come into play soon.

Ethereum ETH and Market Event Momentum to Watch

It is worth mentioning that July 2025 was calm across most of the crypto market.

Bitcoin dropped back to retest its support NEAR $111,643 on August 7 before climbing back toward $117,000.

Analysts said the MOVE was expected and gave a cleaner setup for possible gains later.

Ethereum ETH saw stronger activity on-chain, with more wallet addresses sending and receiving the digital currency.

This growth came even as prices stayed mostly flat. Some analysts said the rising activity was based more on stories and investor hopes rather than hard data.

At the same time, political and financial news played a role. President Donald TRUMP recently made public remarks supporting gold and digital assets.

The signing of the Genius Act into law also played a pivotal role. So far, these changes have not moved markets much, but they may shape investor views in the months ahead.

U.S. regulations have also been more open to crypto this year. Several firms have added ETH to their treasuries, giving more access to traditional investors.

Tom Lee and Vitalik Buterin Share Their Views

Wall Street strategist Tom Lee said he still expects the Ethereum price to reach $16,000. He shared his view in an interview with CNBC in July.

His estimate is based on how Ethereum ETH compared to Bitcoin in 2021, when the ETH/BTC ratio was near 0.14.

Lee said Ethereum may now be at a stage like Bitcoin’s in 2017, when large investors began to buy in.

With friendlier rules and more access through investment platforms, Lee said the Ethereum price could follow a similar path.

Ethereum founder Vitalik Buterin also spoke about recent market trends.

In a podcast, he welcomed the use of ETH in company treasuries but warned against taking on too much risk.

He said adding ETH to balance sheets can give more investors access, but stressed that care must be taken not to turn it into a high-risk strategy.

Buterin said Ethereum’s future should be built on steady growth and useful services, not on overuse of leverage or fast gains.

He added that smart risk management will be key as more institutions come in.