Aptos Price Primed for Explosive Breakout as Institutional Demand Skyrockets

Aptos isn’t just ticking up—it’s coiled like a spring. With institutional players piling in, the Layer 1 token looks ready to shatter resistance. Here’s why.

Institutional FOMO hits Aptos

Hedge funds and crypto whales are circling. Not because they suddenly believe in decentralization—but because they smell momentum. The Aptos ecosystem’s developer activity and partnership whispers are fueling the fire.

Breakout or fakeout?

Technical setups scream bullish, but let’s not pretend Wall Street’s sudden ‘blockchain epiphany’ isn’t 90% profit-chasing. If the trend holds, Aptos could rip. If not? Well, there’s always another ‘next Ethereum’ to pump.

Aptos (APT) price action pulled off a sizable recovery in the first week of August after previously experiencing a sharp retracement.

But will it maintain the momentum and allow it to escape the subdued performance? APT price action retraced by 28% from its $5.6 July top to its recent local low near $4 on 2 August.

This bearish trend aligned with the overall market performance but may have been fueled by APT’s latest token unlock event.

Fast forward to press time and APT price had recovered to $4.8. An over 15% recovery indicating that the short term sell pressure had run its course.

A broader look at the price action revealed that it was still trading close to its historic bottom range.

This meant the cryptocurrency had the potential to achieve a significant upside if it were to experience a major recovery.

That recovery was elusive, largely due to the token unlocks which suppressed price action. However, some recent developments underscored massive potential driven by real-world adoption.

Major Institutions Embrace Aptos and Here’s How it Could Be Good for APT Price Action

APT price action’s latest drawback may have paved the way for some opportunities. The Aptos network’s long term utility looked promising, considering that some top financial institutions have been showing some love to the network.

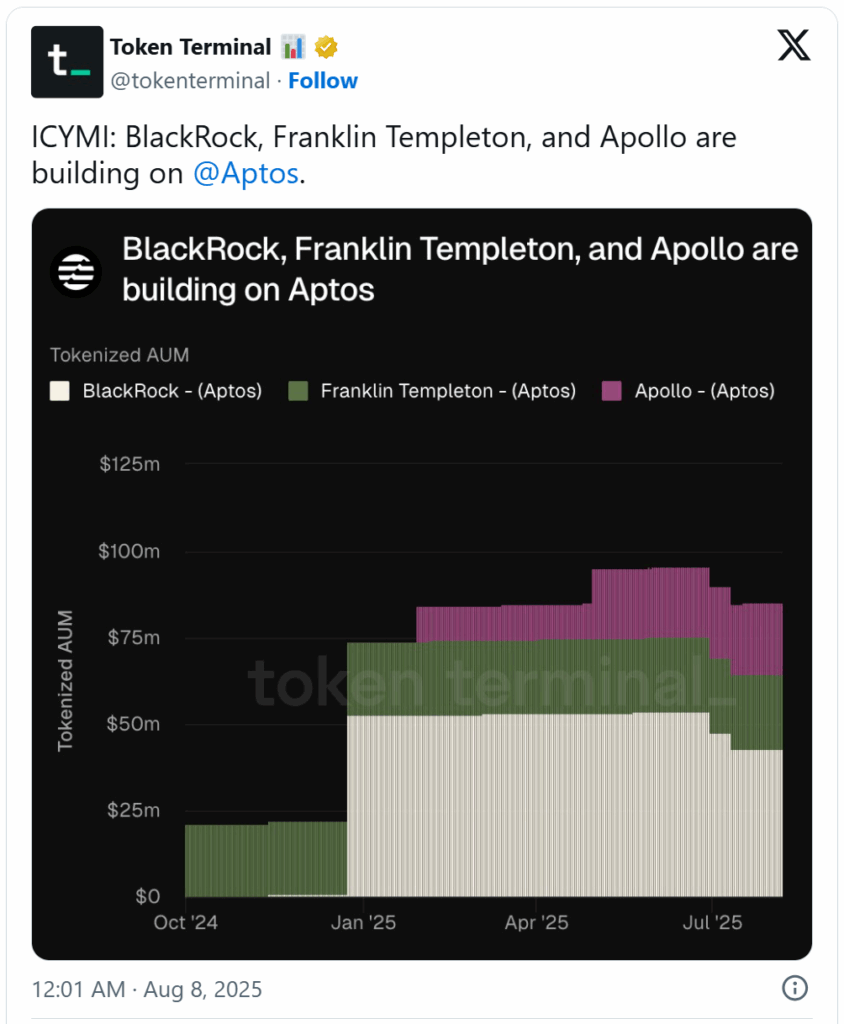

Franklin Templeton, Apollo and Blackrock were among the big institutional planers reportedly building on Aptos.

Blackrock, in particular even launched the BUIDL fund, which was aimed at spurring development in the ecosystem.

However, it was not the level of investment alone that made the institutional activity noteworthy.

Some of the institutional investors are heavy hitters in the finance and investment landscape. Their preference for Aptos will likely attract more institutional participation.

Their developments on the network will soon pave the way for robust utility.

Meanwhile, Apollo and Franklin Templeton have been building their tokenized Real-World Asset (RWA) portfolios on Aptos.

These factors positioned the network to leverage one of the biggest narratives proliferating in the crypto industry.

The latest market data revealed that there was over $700 million worth of RWAs already launched on the Aptos network.

Interestingly, Aptos was recently ranked as the third blockchain by RWA total value locked.

Aptos Network Performance Recap

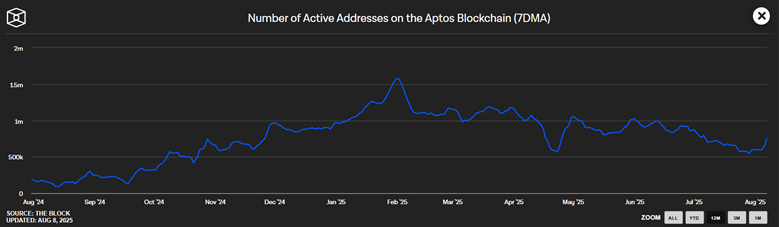

Although major corporations have been embracing Aptos, their influence has not yet reflected on the network’s key performance metrics.

For example, Address activity has been declining since early February. The number of active addresses peaked at $1.58 million on 1 February and recently dropped to 543,000 addresses at the end of July.

However, the slight market recovery in the last few days saw active addresses rise above 760,000 addresses.

Although address activity cooled down on a year-to-date basis, the network did experience a surge in DEX volumes during the last 4 months.

For context, daily DEX volume dropped below $6 million at its lowest point in mid-March.

However, DEX volume on the network surged multiple-fold, peaking above $255 million on its most active day (9 July).

Aptos DEX volume maintained significant volumes during the latest pullback during which the lowest recorded volume was above $136 million.

While DEX volume ticked up over the last few months, it was significantly lower compared to some of the top rival blockchains. This meant Aptos had a long way to go in terms of mass adoption.

Things could change for APT in the mid-to-long term as the RWAs segment gains momentum.

It could be the biggest catalyst for Aptos adoption and demand for APT especially now that the US has been pushing TradFi into WEB3.