Crypto Markets Score Major Wins: Why This Week Changed Everything (August 2025)

Crypto just flexed its muscles—again. While traditional finance scrambles to keep up, digital assets are racking up institutional endorsements, regulatory breakthroughs, and eye-popping trading volume. Here’s why the skeptics are sweating.

Wall Street’s worst nightmare: crypto eats another lunch

Another week, another parade of victories. From ETF approvals to layer-2 adoption spikes, the infrastructure for mainstream crypto adoption is being built at breakneck speed—while bankers still debate whether Bitcoin is ‘real.’

The cynical take

Meanwhile, hedge funds that dismissed crypto in 2021 are now quietly allocating 20% of their portfolios. Nothing convinces like price action—except maybe FOMO.

The crypto market has been recovering this week and that recovery was partly fueled by sentiment from some major crypto news. Here are some of the key highlights of the week.

The biggest crypto news were mostly those involving regulation. U.S. President Donald Trump signed two pro-crypto executive orders.

The move allows U.S investors to invest in Bitcoin through their 401K, and the other to guarantee fair banking for all Americans.

The first executive order made it possible more than 90 million Americans to get a piece of the bitcoin pie through their retirement savings.

This was seen as a MOVE to pave the way for retail liquidity flows into the market.

The second executive order preventing banks from discriminating against any specific groups, including cryptocurrency-related businesses.

In other words, TRUMP continued to tear down the walls that previously held back crypto liquidity from flowing through the banks.

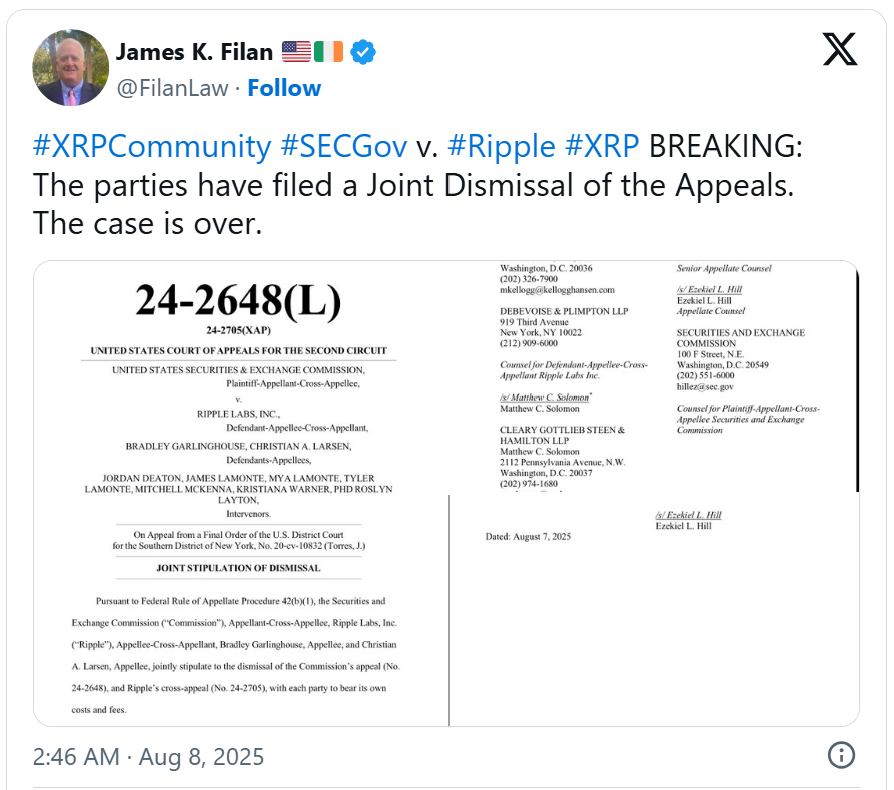

Good Crypto News for XRP Holders as Lawsuit Finally Sees Conclusion

While the focus has mostly been on Bitcoin, another key development tilted the focus towards Ripple and its long-standing legal battle with the SEC.

New reports revealed that the Ripple and the SEC have reportedly dropped their legal appeals. This effectively meant their conflict was over.

This highly anticipated development was a definite win for Ripple, as xrp price saw a huge upside soon after the news about the lawsuit’s conclusion came out.

While the pace has been somewhat subdued today, the price has maintained above the $3 mark. Further, the market activity has also pulled back considerably, with the 24 hour volume falling by over 49% to $6.63 billion.

The U.S to Impose Tariffs on Imported Gold Bars

The U.S has announced tariffs on 100 KG and 100 OZ gold bars in a surprising turn of events. Gold has been pushing higher, raising Optimism that it could rally as high as $5,000.

Interestingly, Gold previously found resistance above the $3,400 price level. Some analysts believe that the move could potentially lead to a gold short squeeze, which could potentially push prices higher.

Such an outcome was probable considering that a recent report hinted that the U.S might devalue gold and use some of the proceeds to buy BTC.

In the meantime, the tariffs on gold imports could potentially pave the way for the U.S to kickstart its 1 million BTC purchase plan.

Rate Cuts in July Could Fuel More Liquidity Flows Into Cryptocurrencies

While the prospects of a gold-backed BTC rally were strong based on recent development, the prospects of rate cuts just improved.

The U.S Federal Reserve has been holding off on rate cuts despite declining economic pressures.

However, the FED has increasingly faced pressure to cut rates, especially from President Trump. Major economics such as China and the UK have been lowering rates.

The prevailing narrative was that a FED rate cut could be coming as soon as September and that two more cuts could follow before the end of 2025.

The interesting thing is that this could do for the markets. Rate cuts are good crypto news due to the potential impact on liquidity.

It could be the final trigger that the market needs to trigger positive liquidity flows, especially from the retail segment.

In summary, these latest developments highlight a confluence of multiple pro-crypto factors. They may explain the recent crypto prices recovery considering the uncertainty that haunted the market at the start of August.

However, the same factors could also lead to major liquidation events fueled by the rising investor expectations.