Ethereum (ETH) Hits $4K: Is This Its ’Bitcoin Moment’? Analysts Say Yes

Ethereum just blasted past $4,000—and suddenly, everyone’s asking if it’s having a 'Bitcoin moment.' You know, that mythical pivot where skeptics become bag-holders and crypto Twitter loses its collective mind.

Bullish signals or hopium overdose? Let’s break it down.

The $4K Breakthrough: More Than Just a Number

ETH’s surge isn’t just about price. It’s a middle finger to the 'flippening' doubters and a flex for DeFi’s backbone. Institutional money? Probably lurking. Retail FOMO? Inevitable.

The Bitcoin Parallel: Narrative or Nonsense?

Comparing ETH to BTC’s historic rallies is tempting—but Ethereum’s got smarter contracts, dApps, and way more utility. Then again, since when did fundamentals ever stop a hype cycle? (Looking at you, meme coins.)

What’s Next? A Correction—Or the Moon?

Traders are split: some see a pullback, others eye $5K. Meanwhile, Wall Street 'experts' who called crypto a scam in 2020 are suddenly drafting ETH ETF proposals. Funny how price changes minds.

One thing’s clear: Ethereum’s not just riding Bitcoin’s coattails anymore. It’s writing its own playbook—and the market’s finally reading it. Whether that ends in glory or tears? That’s crypto, baby.

ETH price just pushed above the much coveted $4000 price tag, courtesy of its latest sharp bounce back this week.

It also pushed higher than its July peak, albeit briefly at the time of observation.

This latest ETH price recovery underscored a fresh effort at retesting the highly coveted $4,000 price level. The last time ETH traded above the same level was right after mid-December 2024.

ETH pushed as high as $4,209.46 in the early morning hours, crossing above $4,000, making a whopping 7.97% gain in 24 hours.

This latest upside was characterized by a surge in ETH dominance back above 12% while Bitcoin dominance slid below 61%.

ETH Price Soars Amid Short-Squeeze

The recovery rally in ETH price has been taking place despite lower confidence in bullish momentum, as evidenced by the dip in sentiment.

However, this latest spike was also accompanied by a sentiment recovery back to greed territory.

A short squeeze event may have played out, given that short liquidations surged past $164 million in the last 24 hours.

Interestingly, this latest ethereum price surge occurred with a slightly lower level of open interest compared to the July top.

Nevertheless, open interest ticked up slightly above $51 billion. It previously peaked above $58 billion on 29 July, which was its historic top. Funding rates were also slightly lower compared to their July peak.

The weaker open interest and funding rates signaled that the market was more cautious this time. This latest momentum also underscored a resistance retest.

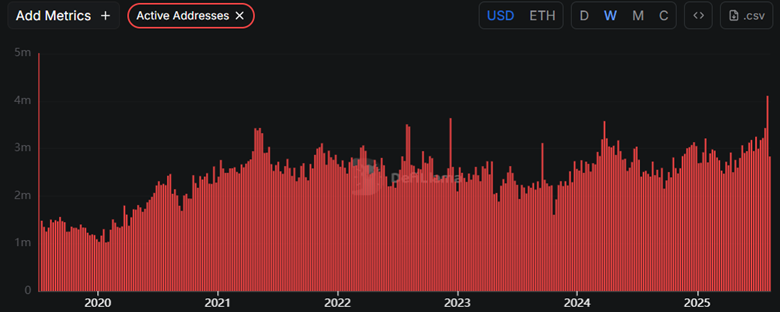

Ethereum Registers Record-High Address Activity

Interestingly, ETH price’s latest push to the upside occurred right after ethereum experienced its highest weekly activity.

The network recorded 4.1 million active addresses between July 28 and August 3.

Ethereum also achieved a record high number of transactions during the same week. There were 11.87 million transactions recorded during the week, which was the highest weekly activity observed in the network’s history

Speaking of network activity, DEX volume on the Ethereum network depicts network strength. Daily DEX volume pushed above $4 billion on Thursday and Friday.

The surging DEX volume suggests that Q3 might be on track to deliver robust activity just like Q4 2024 and Q1 2025.

Tom Lee Makes a Bold Price Prediction

Tom Lee recently made some interesting statements about Ethereum during a recent CNBC feature. The analyst noted that Ethereum was having its 2017 bitcoin moment.

He noted that Ethereum was Wall Street’s most preferred blockchain, especially now that the financial system is moving to blockchain.

One of the reasons for the preference was that Ethereum has so far not had any downtime, and multiple major banks were already building on Ethereum.

Lee also noted that Ethereum was operating at a high level of compliance. This contributed a great deal to the high level of tokenization on the network.

The Bitmine executive also noted a recent prediction that Bitcoin could rally as high as $16,000. This prediction was based on the ratio of ETH to BTC soaring back to 2021 highs.

Lee also noted that Bitmine was making moves aimed at becoming the MicroStrategy of Ethereum. He noted that Bitmine owns about $3 billion worth of ETH, which the company plans to stake.

The Bitmine executive believes that the company could potentially generate $100 million worth of net income by deploying a treasury model. That WOULD mean staking the $3 billion worth of ETH with just a 3% yield.