Ethereum’s $4,500 Breakout: Why This Rally Isn’t Just Hype

Ethereum bulls are back—and this time, they’ve got fundamentals to back the bravado. With Layer 2 adoption exploding and institutional DeFi wallets swelling, the $4,500 price target looks less like moon math and more like a pit stop. Here’s what’s fueling the fire.

The Merge 2.0 Effect

Post-upgrade transaction throughput is finally meeting demand—no more ‘gas fee horror story’ tweets clogging your feed. Validators are earning like 2021 never ended, and suddenly, staking doesn’t feel like charity work.

Institutional FOMO Gets Real

BlackRock’s ETH ETF filing wasn’t just paperwork—it was a bat signal for TradFi dinosaurs. Now they’re piling in, albeit three years late per Wall Street’s crypto adoption playbook.

The Cynic’s Corner

Let’s not pretend this is altruism. The same funds that mocked ‘magic internet money’ in 2022 now see dollar signs—and they’ll dump it just as fast when the SEC starts barking. Enjoy the ride while it lasts.

Key Insights

- Ethereum price has crossed $3,800 as Bitcoin’s dominance slips under 60%.

- BTCS Inc. now holds over $270 million worth of ETH, showing rising confidence.

- Traders are shifting their focus away from Bitcoin, with more attention now being given to Ethereum and altcoins.

Ethereum price crossed $3,800 in late July 2025, backed by rising dominance, growing investor interest, and higher trading activity.

With new funding and strong market signals, the question now is whether ethereum can push past the $4,500 mark in the coming weeks.

Ethereum Gains Strength as Bitcoin Slips

It is worth mentioning that Ethereum has been gaining ground in recent weeks. Its price stood at $3,806.30 as of July 28, 2025.

This development came as more traders shifted funds from Bitcoin to Ethereum, resulting in a steady increase in the ETH market share.

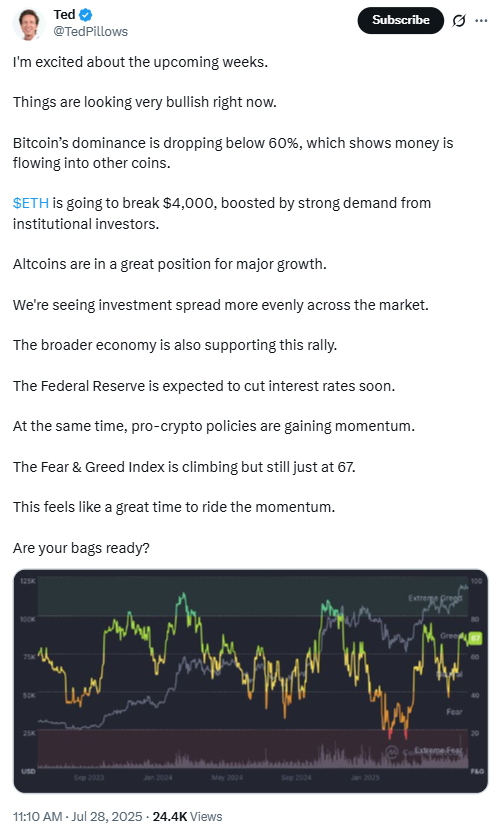

A chart shared by crypto commentator Ted Pillows on X showed Bitcoin’s dominance has dropped below 60%.

At the same time, Ethereum’s share of the market grew, following a familiar pattern seen in past altcoin rallies.

Notably, when this kind of shift occurred in the past, it often signaled stronger performance for Ethereum and other coins.

It is worth noting that Ted observed that this type of MOVE tends to trigger what is often referred to as altseason.

This is often a period when altcoins outpace bitcoin in terms of price growth. Ethereum, being the second-largest digital asset, usually led the charge during these times.

In a separate development, BTCS Inc., a U.S.-listed company, reported that it had added 14,240 ETH to its portfolio, bringing its total to 70,028 ETH.

The company valued its holdings at around $270 million, using a price of $3,850 for Ethereum.

According to the update, it has raised $207 million thus far this year to support its strategy around both decentralized and traditional finance.

Altcoins Rally as Ethereum Leads the Way

It is also important to note that Ethereum’s rise has not occurred in isolation. Many altcoins are also seeing strong gains.

As Bitcoin’s share shrinks, more money is being spread across the market. This has helped boost interest in Ethereum and other primary tokens.

The Fear & Greed Index, which tracks market mood, climbed to 67. While still shy of extreme highs, this number suggests growing confidence.

Based on historical trends, a score around this level often comes before major moves in altcoins.

Traders and analysts are closely watching Ethereum ETH as its movements often affect how other altcoins behave.

Still, as more capital flows into Ethereum, it tends to lift the rest of the market along with it.

Essentially, this has been true in past rallies and may be happening again now.

What Could Push Ethereum ETH to $4,500?

With ethereum price already near $3,800, many are asking what it would take to hit $4,500. One major factor is institutional buying.

According to reports, Ethereum-focused ETFs took in $727 million in July alone. That kind of demand can support higher prices.

Ethereum’s daily trading volume also jumped by 31.82% in 24 hours, reaching $33.34 billion.

This indicates strong activity, which often suggests there is room for further price movement. Its market cap now stands at $459.43 billion.

Analysts suggest that a few additional factors could further propel ETH’s growth.

These include expected interest rate cuts by the U.S. Federal Reserve and more favorable crypto policies in major economies. Both could increase investor appetite for digital assets like Ethereum.

While there are no guarantees, many are watching closely. If demand continues and market conditions hold, Ethereum ETH could have a clear path to test $4,500 soon.

Meanwhile, on a broader outlook, former Bitmex CEO Arthur Hayes predicted that Ethereum will hit $10,000 before the end of 2025.