XRP vs. The Dollar: Can Crypto Topple the World’s Reserve Currency by 2025?

The U.S. dollar's reign as the global reserve currency faces its most unpredictable challenger yet—XRP. With central banks flirting with blockchain and Wall Street still pretending to understand DeFi, Ripple's flagship asset is making moves that could rewrite the rules of financial hegemony.

Why XRP Stands a Chance

Faster than a SWIFT payment and cheaper than a Fed wire, XRP's utility in cross-border settlements has institutions paying attention. Liquidity pools are deepening, and regulatory clarity—though still murky—is inching forward. Meanwhile, the dollar staggers under inflation and geopolitical skepticism.

The Roadblocks

Volatility remains crypto's Achilles' heel. Even if XRP processes transactions in seconds, merchants won't price goods in a currency that swings 10% before lunch. And let's not pretend the IMF will endorse a decentralized alternative while bankers still wear suits to Zoom meetings.

The Verdict

Total replacement? Unlikely—for now. But as the dollar's dominance erodes, XRP is positioning itself as the leading contender in a multipolar financial world. Just don't expect hedge funds to admit it until they've finished accumulating their bags.

Key Insights:

- German venture VC exec says XRP could become the world’s reserve bridge currency.

- Whale activity around XRP is on the rise.

- Analyst predicts XRP ETF approvals in Q4 2025 and world reserve currency status in Q1 2026.

Social sentiment around XRP was on the rise in the last 7 days. It was with a particular focus on its role in global finance and the grand scheme of things. Most of it was driven by key industry figures who recently expressed their thoughts on the fate of XRP.

Perhaps the most notable XRP statements during the week came from Oliver Michel, the CEO of one of Germany’s top venture capital firms. Michel made a bold statement in a recent interview during which he stated that XRP could become the world’s reserve bridge currency.

Although the statement was more of a prediction, it suggested a high likelihood that it could become the medium for international currencies. This prediction was likely rooted in the Ripple ODL services, which were introduced a few years ago.

A world reserve bridge currency status WOULD allow XRP to be deeply rooted in the financial industry. Some analysts believe that this approach may allow XRP to take the place of the dollar, which has been losing traction as the global reserve currency.

Are Whales Buying More XRP?

XRP price action’s impressive run in June and part of July, leading up to a new ATH, was characterized by heavy whale activity. While the price retraced by as much as 19% since then, it still managed to recover and stick its neck above the $3 price level.

But will the recent recovery push for higher prices, or will XRP capitulate? Whale activity has been the canary in the coal mine as far as demand is concerned.

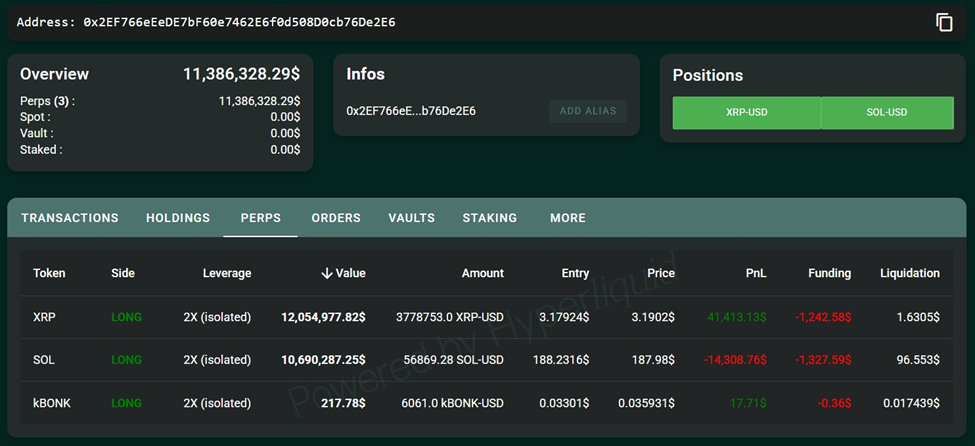

Recent On-chain Lens data revealed that whales were still active in the market, albeit while treading cautiously. For example, a whale recently executed a $12 million XRP long position on Hyperliqiquid at a 2X leverage.

The 2X leverage particularly highlighted a subdued approach compared to what was observed during peak HYPE in the market. For example, some whales were seen executing positions with as much as 40X leverage when the markets were heating up.

CoinGlass large orderbook statistics confirmed the whale activity. It revealed that whales injected over $25 million into XRP in the last 3 days on Coinbase and Binance. Derivatives bets were also heavily in favor of the bulls during the same period by over $600 million on Binance.

While the data still demonstrated the presence of whale activity, it was worth noting that liquidity injection remained relatively low, especially in the spot segment.

XRP ETFs could be coming before the end of the year

XRP also happened to be one of the coins whose ETFs are highly anticipated. Market experts have recently highlighted a calendar of key events related to XRP and Ripple likely to occur in the coming months.

The calendar predicted that XRP ETFs will likely secure the green light in December 2025. The calendar of events also predicted that a major financial reset was scheduled to take place in Q1 2026.

Moreover, it predicted that XRP would become the world’s financial reserve currency XRP ledger would become the next iteration of the global financial system. It also suggested that Ripple would be akin to a World Bank.

These predictions underscored the heavy weight of expectations that XRP and Ripple have been subjected to. However, it was worth noting that these were still predictions yet to take place.

Nevertheless, the heavy expectations also reflected the recent surge in XRP demand over the last few weeks. If those predictions play out as highlighted, then XRP could be headed for some interesting times ahead.