Bitcoin (BTC USD) Price Primed for Extended Overbought Rally—PlanB Issues Bullish RSI Alert

Bitcoin's relentless climb just got a technical green light. Analyst PlanB flags mounting overbought signals—but this time, they're fuel for the fire.

RSI on steroids

The relative strength index keeps punching into overbought territory, yet BTC's price action laughs at traditional resistance levels. 'This isn't your grandma's overextension,' quips a hedge fund trader (between martini sips).

When metrics break bad

Conventional wisdom says RSI above 70 spells trouble. Bitcoin's response? A 15% monthly gain anyway. The asset now treats technical indicators like Wall Street treats fiduciary duty—as gentle suggestions.

Parabolic or pragmatic?

With institutional flows hitting $1.2B daily and miners hodling like it's 2021, the 'overbought' narrative gets a crypto twist. As one VC put it: 'In bull markets, RSI stands for Really Should Invest.'

Bitcoin (BTC USD) RSI had reached 75 earlier this week, with PlanB suggesting that this could lead to more months of overbought levels. The analyst based his view on similar market setups in earlier bull runs.

Notably, this had occurred as Bitcoin traded near $118,700, with increased trading activity. Bitcoin was trading near $117,390 at the time of writing.

Bitcoin (BTC USD) RSI Hits 75 as PlanB Points to Past Bull Trends

Bitcoin climbed toward an RSI reading of 75 this week, a level known to mark the early stages of overbought conditions during past bull runs.

The market watched closely as PlanB, the creator of the Stock-to-Flow model, compared current data to past cycles.

In a recent chart shared on X, PlanB showed how bitcoin previously entered multi-month overbought phases after reaching a similar RSI level.

He marked the current reading with an orange DOT and said RSI could rise above 80 in the coming months, as seen in 2011, 2013, 2017, and 2021.

At the time of reporting, Bitcoin (BTC USD) was trading around $117,435.61, according to CoinMarketCap, representing a 0.25% decline in 24 hours.

The cryptocurrency market cap stood at $2.36 Trillion, with daily trading volume at $73.72 Billion.

It is worth mentioning that the latest price rise came after a brief dip to $117,000 on Thursday.

Traders linked the MOVE to profit-taking before a rebound lifted the price back above $118,000. Additionally, market participants observed a buildup of liquidity above the current spot price.

This increases the likelihood of a short squeeze if buyers break through the resistance levels.

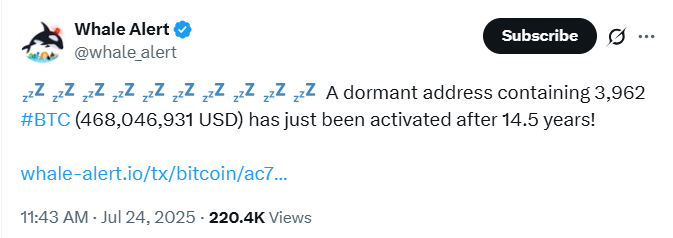

Dormant Wallet Holding 3,962 BTC Becomes Active

While traders focused on BTC price charts and RSI readings, blockchain tracking service Whale Alert reported that a long-dormant wallet had come back online.

According to the update, the address held 3,962 BTC, now worth around $468 Million. The wallet had not moved any funds in over 14 years.

When it was last active, in January 2011, Bitcoin (BTC USD) traded at roughly $0.30. At that price, the BTC in the wallet WOULD have been valued at just $1,189.

The identity of the wallet’s owner remains unknown, but large dormant wallets have caught the market’s attention in recent months.

Some believe they may belong to early miners or early adopters. Others think such activity could signal future sell-offs, although no coins from this address have moved to exchanges so far.

Similar events have happened throughout 2025. In one case, a wallet from the Satoshi era moved over $4.6 Billion in Bitcoin.

Another long-dormant address sent out $1 Billion worth of BTC after more than a decade of inactivity.

Price Outlook Mixed as Traders Watch for Squeeze

Some traders said the recent rally may still have room to run. Mister Crypto, a trader active on X, pointed to overhead liquidity clusters.

These clusters often act like magnets, pulling price toward them and causing short squeezes along the way.

At the same time, market volatility has remained low. Bitcoin’s 24-hour volatility was measured at 0.6%, indicating steady movement despite large volumes being traded.

More importantly, analysts believe that if Bitcoin breaks above near-term resistance, more upside could follow.

However, the return of dormant wallets has raised questions. While no coins have been sold yet, the timing has made some traders cautious.

For now, PlanB’s RSI observation for Bitcoin (BTC USD) remains one of the key signals many are watching.

It is important to add that if past market cycles repeat, more months of strong upward price pressure could still lie ahead.

Interestingly, former BitMEX CEO Arthur Hayes predicted that the largest digital asset may reach $250,000.

He linked this forecast to factors such as credit expansion, government policies, and growing investor interest.