Metaplanet Doubles Down: Bitcoin Treasury Balloons to 16,352 BTC in $93.6M Power Move

Another day, another corporate bet on Bitcoin—this time Metaplanet just shoved $93.6 million into the digital gold rush.

The Japanese firm’s stash now hits 16,352 BTC, making traditional treasury managers clutch their spreadsheets. Who needs bonds when you’ve got volatility, right?

While Wall Street hedges with ETFs, Metaplanet’s all-in approach screams either genius or recklessness—pick your narrative. Either way, their balance sheet’s riding the crypto rollercoaster now.

Funny how 'risk management' looks different when you’re chasing the dragon of 10,000% returns. Just don’t look at the charts on a red day.

Key Insights:

- Metaplanet acquired an additional 797 BTC for $93.6 million, with total Bitcoin holdings surpassing 16,352 BTC.

- Metaplanet shareholders increase amid Bitcoin treasury strategy as it aims to become the 4th largest Bitcoin holder by this year.

- Stock price fell nearly 1% after the company used proceeds from its recent early redemption to buy Bitcoin.

The stock price pared an earlier 1% gain after the company announced the latest BTC buy. This happened despite the recent increase in shareholders.

Metaplanet Boosts Total Bitcoin Holdings to 16,352 BTC

According to a press release on July 14, Japan’s MicroStrategy Metaplanet acquired an additional 797 BTC at an average price of $117,451 per Bitcoin.

After the latest Bitcoin buy, the company’s total Bitcoin holdings expand to 16,352 BTC, acquired for nearly $1.64 billion at an average price of $100,191 per Bitcoin.

Moreover, the company achieved a BTC yield of 19.4% in the latest two weeks and a BTC yield of 435.9% YTD 2025. Notably, companies use BTC yield to assess the performance of their bitcoin acquisition strategy, intended to be accretive to shareholders.

CEO Simon Gerovich took to X and shared about the latest BTC buy worth $93.6 million. He revealed that the company acquired 7,464 BTC in just 30 days, indicating the accelerated Bitcoin strategy to generate value for its shareholders.

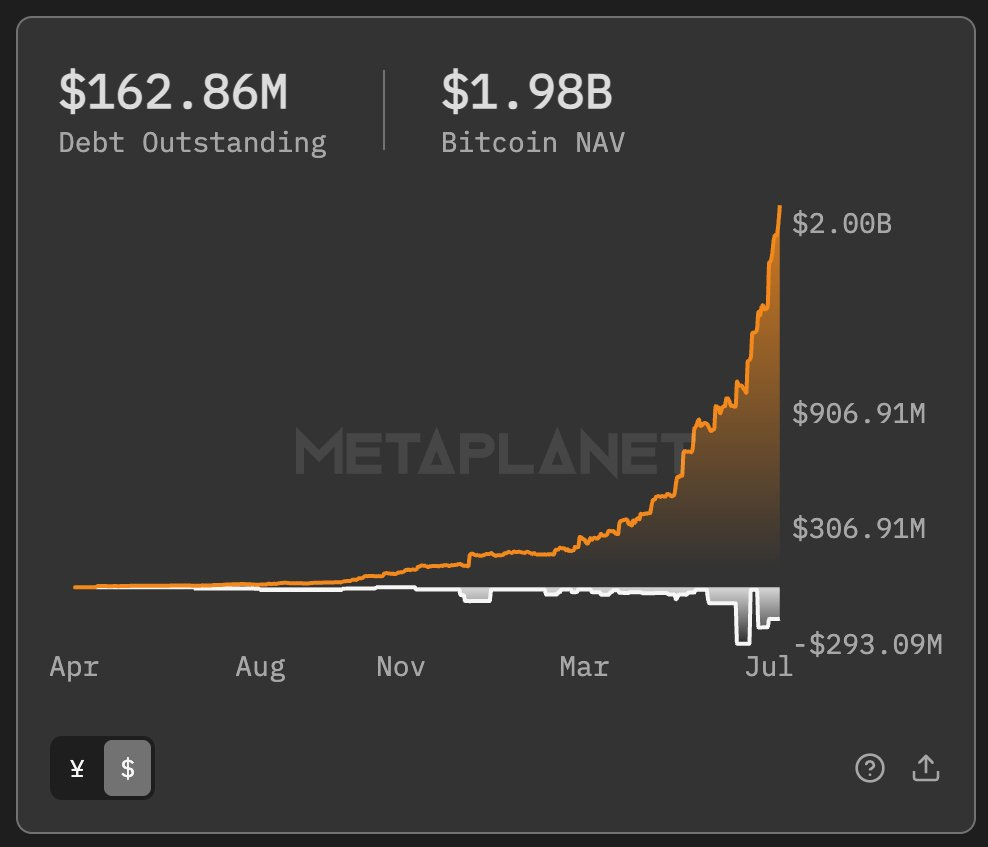

Metaplanet’s Unrealized Gain and Outstanding Debt

Dylan LeClair, director of Bitcoin strategy at Metaplanet, revealed that the company’s net asset value for its Bitcoin holdings is now valued at over $2 billion, making the unrealized gain surpass $370 million. Also, the debt outstanding was $162.86 million.

On July 7, Metaplanet announced a 2,205 BTC acquisition for $238.7 million at an average price of $108,237 per Bitcoin. The company became the 5th largest corporate Bitcoin holder, with a plan to hold the 4th rank by year-end.

On July 4, the company executed a partial early redemption of 6 billion yen from its 19th Series of Ordinary Bonds. This happened in accordance with the bond terms and funded using proceeds from the exercise of the 20th through 22nd Series of Stock Acquisition Rights.

The company targets to hold at least 30,000 BTC by the end of 2025 amid an aggressive BTC buying strategy. Also, it plans to hold 100,000 BTC by 2026 and 210,000 BTC by the end of 2027, under the Accelerated 2025-2027 Bitcoin Plan.

Metaplanet Stock Price Falters

Metaplanet Inc. (3350.T) stock price fell after the company announced the latest $93.6 billion in Bitcoin due to early redemption. The stock rally slowed after the company revealed a plan to raise $5.4 billion to hold at least 210,000 BTC by 2027.

Metaplanet shareholders have doubled in just 3 months to 129,000. The top shareholders continued to increase their shareholding in the company, as per CEO Gerovich.

Metaplanet Inc. (3350.T) stock price closed 0.51% lower at 1,552 yen on Monday. The 24-hour low and high were 1,536 and 1,599 yen.

As per Yahoo Finance, the stock price rallied nearly 3% in a month and 347% year-to-date.

Bitcoin Price Makes New ATH Over $122K

BTC price picked up upside momentum again amid massive trading activity as technical indicators turned bullish. As The Coin Republic reported, Bitcoin price could hit an ATH of at least $135K this year on technical chart strength, with the peak expected in October.

Notably, veteran trader Peter Brandt, 10x Research, and other analysts also support bitcoin price hitting $135K in the coming months after a bull flag pattern formation in the daily chart recently.

At the time of writing, BTC price was trading 4% higher at $122,403 in the last 24 hours. The 24-hour low and high were $117,733 and $122,603, respectively.

Furthermore, the trading volume increased by 120% in the last 24 hours, indicating a massive rise in interest among traders.