XRP Price Stalls—But Whale Movements Hint at a Coming Storm

XRP’s price flatlines while crypto’s big players make their move.

Beneath the surface calm, whale transactions surge—signaling a potential shake-up.

Retail investors left guessing as the usual suspects play their high-stakes games.

Another day in crypto, where the ‘decentralized’ dream still dances to the tune of a few deep pockets.

Key Insights:

- Over 780,000 XRP was withdrawn from Coinbase on July 5, pointing to renewed whale interest

- Ripple’s U.S. banking license and ETF buzz are feeding speculation

- But active address and sentiment data hint at underlying weaknesses

XRP price is trading around $2.29 after a slow breakout from a multi-week pennant pattern. With Ripple making moves behind the scenes and on-chain activity flashing mixed signals, the case for another all-time high is mounting. But it’s far from guaranteed, even with whales gobbling up supply.

Funding Rates Suggest Cautious Bullishness

The XRP funding rate has turned strongly positive, reaching levels we haven’t seen since early this year. That means traders are heavily betting on the xrp price going up, and they’re paying a premium to hold those long positions.

This kind of setup can be risky. When funding rates stay this high, it often means the market is overcrowded with bullish trades. If the XRP price doesn’t move up fast enough, many of those traders might get forced out, causing a sharp drop.

In short, confidence is high, but it might be too high. Funding rates like this usually don’t stay elevated for long. If buyers slow down, we could see a pullback, especially with the XRP price already NEAR resistance.

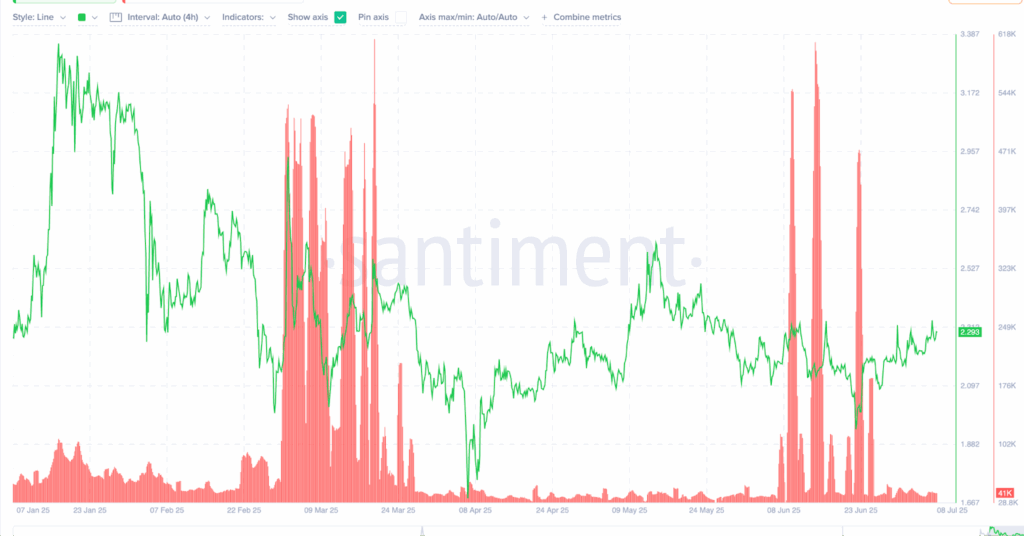

XRP Active Address Growth Is Losing Steam

In June, XRP’s active address count spiked multiple times, and each time, the XRP price followed with a short-term gain. But since July began, wallet activity has cooled off. Fewer wallets are transacting, even though the XRP price continues to climb.

That’s a red flag. When fewer people are using the network while the price rises, it usually means the MOVE is being led by a small group, likely whales, not retail buyers. For any rally to hold, you need broader participation.

If the number of active wallets doesn’t pick back up soon, the XRP price could lose momentum fast.

Exchange Netflows Confirm Whale Accumulation

On July 5, over 780,000 XRP was pulled from Coinbase; a single-day spike that aligns with long-term accumulation patterns. Looking at Coinglass data over the past three months, the trend is clear: more XRP is flowing out of exchanges than in, especially during dips.

These net outflows are classic signs of large players parking tokens in cold wallets, not prepping them for sale. Historically, this kind of accumulation has preceded major price runs. More so when paired with steady price action and low funding spikes.

While retail may be slow to react, Ripple’s ongoing regulatory clarity and whispers of ETF inclusion appear to be attracting deep-pocketed buyers.

XRP Price Faces Resistance After Breaking Out

The XRP price broke out of its symmetrical pennant, clearing the $2.20 region. The move wasn’t explosive, but it was technically significant. The price is now testing the $2.35 resistance, which aligns with a horizontal ceiling that has capped past rallies.

RSI on the daily chart is hovering just under 55, still neutral territory. While it’s not overbought, it’s also not signaling momentum strength. If XRP clears $2.35 and holds it as support, the next zones to watch are $2.48, $2.65, and the psychologically loaded $2.78–$3 range. However, crossing $3 WOULD be needed if traders want to start thinking about the ATH levels.

On the downside, any sharp rejection followed by a break under $2.08 would invalidate the bullish breakout. Below that, $2.00 and $1.85 could come into play fast.