TRON Makes History: RUBx Token Goes Live with Russian Ruble Backing

TRON just flipped the script—again. The blockchain giant launched RUBx, its first ruble-pegged stablecoin, marking a major play for Eastern European crypto adoption.

Why it matters: While Western regulators drag their feet, TRON’s betting big on emerging markets. RUBx could turbocharge cross-border payments in regions where traditional banking stumbles (looking at you, SWIFT).

The cynical take: Another day, another stablecoin—because what crypto really needed was more exposure to the Russian central bank’s monetary policy rollercoaster.

Bottom line: Love it or hate it, TRON keeps pushing boundaries while legacy finance plays catch-up.

Key Insights:

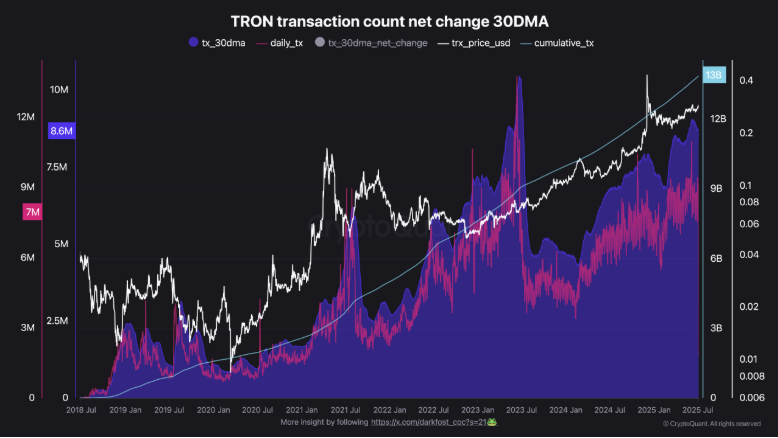

- Transactions on the Tron network blast past 13 billion, marking a new milestone.

- Rostec, a Russian company, rolls out RUBX, a Ruble-backed token.

- TRX concludes yet another week in the green as price wards off sell pressure.

Tron was no doubt one of the fastest-growing networks in the last five years. The extent of its success was recently cemented by a major milestone related to network transactions.

The TRON network recently crossed the 13 million transaction milestone, making it one of the successful blockchains in the world. The network recently managed to achieve over 8 million daily transactions.

A recent CryptoQuant report revealed that a significant chunk of the transaction activity was stablecoin-related. Particularly, USDT, which maintained its status as the most dominant stablecoin on the tron network.

The Cryptoquant analysis revealed that Tron maintained an average of more than $21 billion in USDT transfers every week.

Moreover, the network achieved robust adoption levels in regions such as Asia and South America, where it operated as a parallel system next to the financial system. Mainly due to fast and efficient transfers as well as an alternative option to volatile fiat currencies.

Tron Achieves Adoption Milestone in Russia

Despite its latest achievements, Tron did not show signs of slowing down, especially as far as regional adoption was concerned. The latest crypto news revealed that Russia was reportedly warming up to the Tron network.

According to recent reports, a state-owned Russian technology and defence company called Rostec reportedly launched a new crypto token called RUBx.

According to reports, the token, which was essentially a stablecoin, will be backed by the Russian Ruble. RUBx made its debut as the first Russian stablecoin developed by a state corporation to be rolled out on a public blockchain.

RUBx was also noteworthy for geopolitical reasons. The launch could potentially allow Russian users to bypass international sanctions, as well as traditional banking systems such as SWIFT.

Analysts expect Tron to potentially benefit from the robust demand for international fiscal exposure to international finance from Russia. The launch could potentially add to the robust transaction figures that the Tron network currently boasts.

The stablecoin’s addressable market was unknown at press time. However, figures from another Russian stablecoin called A7A5 may offer some insights.

A Russian publication revealed that the A7A5 stablecoin reportedly transacted about $9.3 billion worth of value in its first 4 months. This was confirmation that there was robust demand for Russian stablecoins in its local market.

The recently launched Russian stablecoin was expected to push the Tron stablecoin market cap higher. Interestingly, Tron’s stablecoin liquidity previously maintained a steady uptrend. It recently clocked a new ATH above $81 billion, and the latest addition suggests that it could push even higher.

TRX Price Action Concludes Another Week in the Green

Tron’s native coin TRX, demonstrated bullish momentum in the last week of June, and it maintained the same energy in the first week of July. But can the cryptocurrency maintain the same momentum past the $0.30 mark?

TRX price exchanged hands at $0.28 at press time, but the crypto has previously demonstrated resistance within the same price level. However, it is worth noting that the MFI regained its upside since the end of June after previously demonstrating some outflows in the second half of June.

According to IntoTheBlock, 4% of TRX in circulation was acquired within the last 4 weeks, confirming the presence of strong demand. About 65% of the coins were acquired or HODLed for more than 12 months, indicating a long-term focus.

The fact that price still maintained upside in the last 2 weeks was a sign of limited sell pressure, thus its ability to sustain upside. This was despite a few pullbacks along the way.