Binance Net Taker Roars Back: How Macroeconomic Whiplash Fueled the Crypto Giant’s Rebound

Binance's net taker volume—the metric that separates the bulls from the bagholders—just staged a comeback worthy of a crypto Twitter hype thread. Here's why Wall Street's latest mood swing sent traders flocking back to the king of exchanges.

The Macro Pivot No One Saw Coming

When the Fed blinked on rate hikes last quarter, it wasn't just traditional markets that got a sugar rush. Crypto's liquidity vampires woke up hungry—and Binance's order book became the all-night diner. Suddenly, those 'risk-off' hedge fund narratives sounded about as convincing as a BitMEX resume.

Taker Volume: The Crypto Canary

Net taker flow doesn't just measure trading activity—it's the blood pressure of market conviction. When it spikes? That's the sound of leverage getting stacked higher than a DeFi yield farm's APY promises. And right now, the EKG is printing that sweet, sweet upward curve.

The Cynic's Corner

Of course, this being crypto, the 'macroeconomic factors' could just as easily be code for 'a few whale wallets finally finished their tax evasion paperwork.' But hey—when the liquidity spigot turns on, even the SEC's lawyers start checking CoinMarketCap.

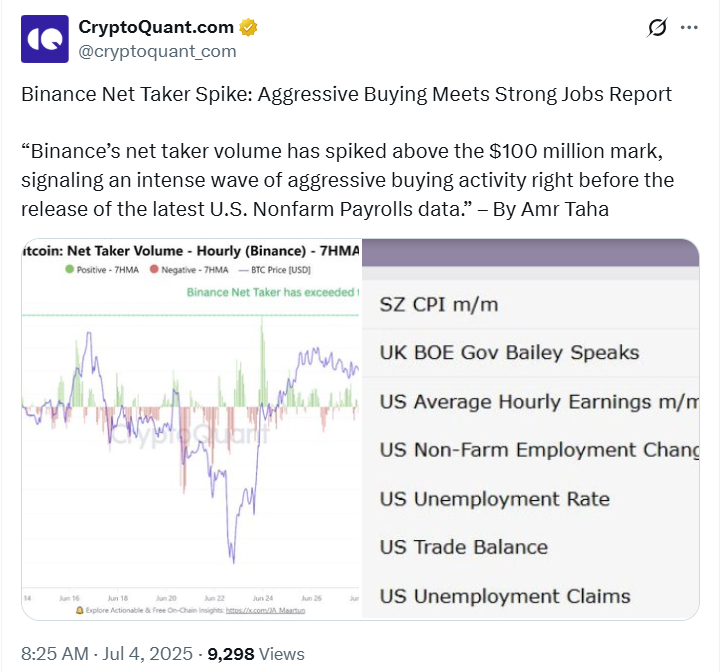

CryptoQuant data indicate that the Binance net taker volume has rebounded past the $100 million mark.

This development occurred hours before the United States Nonfarm Payrolls report that was released on July 3.

The figure shows renewed buying activity linked to stronger-than-expected labor figures and a shifting macroeconomic outlook.

Binance Net Taker Value Soars Ahead of Key Data

According to CryptoQuant, the Binance net taker volume climbed above $100 million on July 3.

It is worth noting that this development signals a return to aggressive market buying. This change occurred just before the release of the latest U.S. Nonfarm Payrolls data.

Per the update, market participants may have been anticipating market-moving news.

The volume spike marked a significant rebound from recent lows. This showed heightened demand for Bitcoin at a critical macroeconomic juncture.

It is essential to add that the net taker volume metric tracks whether market participants are placing more aggressive buy or sell orders.

More importantly, a positive figure above the $100 Million threshold indicates significant market buy orders.

The data showed this movement occurred on Binance, the world’s largest cryptocurrency exchange by volume.

It is essential to add that the timing of the surge coincided with anticipation around U.S. labor market data.

Based on market observations, traders may have been reacting to expected volatility stemming from economic indicators due later in the day.

The sharp increase in buying interest appeared aligned with recent movements in Bitcoin’s price.

Market data shows that it approached the $109,000 level at the time of the spike. As of now, CoinMarketCap data shows that bitcoin is trading at $108,953.99.

U.S. Jobs Report Beats Forecasts

The U.S. Bureau of Labor Statistics released the June employment data on July 3 at 3:30 p.m. GMT.

The Nonfarm Payrolls report showed an increase of 147,000 jobs, outperforming the projected figure of 111,000.

Meanwhile, the unemployment rate fell to 4.1%, beating the expected 4.3%. This marked the lowest level since February.

Financial experts consider these results to point to continued resilience in the U.S. labor market.

The stronger-than-expected employment figures reduced the likelihood of an immediate economic slowdown.

Analysts noted that such a scenario could delay potential interest rate cuts by the Federal Reserve.

Additionally, following the release, market pricing shifted. The probability of the Fed holding rates steady at its upcoming July meeting ROSE from 75% to 95%.

This development signaled market confidence in prolonged tight monetary policy.

Market Outlook May Shift on Fed Policy

It is worth noting that the rebound in Binance net taker volume occurred against this backdrop of shifting expectations.

Historical trends show that a stronger jobs market generally supports a stronger U.S. dollar.

This can weigh on risk assets such as Bitcoin, as higher interest rates increase the opportunity cost of holding non-yielding assets.

However, some traders appeared to position for upward momentum in digital assets.

The renewed buying could reflect speculative behavior or hedging strategies in response to shifting macro conditions.

It is worth noting that the short-term impact remains uncertain.

The spike in net taker volume suggested renewed market activity on Binance after a relatively quiet period.

The net taker surge also aligned with broader movements in the crypto market, where traders respond closely to U.S. economic signals.

It is also important to note that as long as interest rate expectations continue to shift, Binance’s net taker volume may remain a key indicator to watch.