$8.05 Billion in Bitcoin and Ethereum Options Expire Today—Brace for Impact

Today marks a critical inflection point for crypto markets as $8.05 billion worth of BTC and ETH options contracts reach expiration. Traders are buckling up for potential turbulence—because when this much notional value hits the tape, volatility doesn’t ask permission.

Why it matters: Options expirations act like gravitational pulls on price action, especially in thinly liquid crypto markets. Market makers scrambling to hedge their exposure can amplify swings—just in time for the weekend.

The cynical take: Wall Street’s ’risk management’ tools now dictate price movements for assets supposedly designed to bypass Wall Street. How’s that for irony?

Today, Bitcoin (BTC) and Ethereum (ETH) options contracts totaling approximately $8.05 billion in value expired today. The crypto market is expecting a short term volatility due to this large expiry event.

According to Deribit data, around $7.24 billion of this value comes from Bitcoin options, while Ethereum options account for $808 million. This ends up expiring the contract meaning traders must adjust their positions which sometimes causes quick price movements. Bitcoin’s current put-to-call ratio stands at 0.56, suggesting a larger number of call options compared to puts. Meanwhile, Ethereum’s put-to-call ratio is at 1.01.

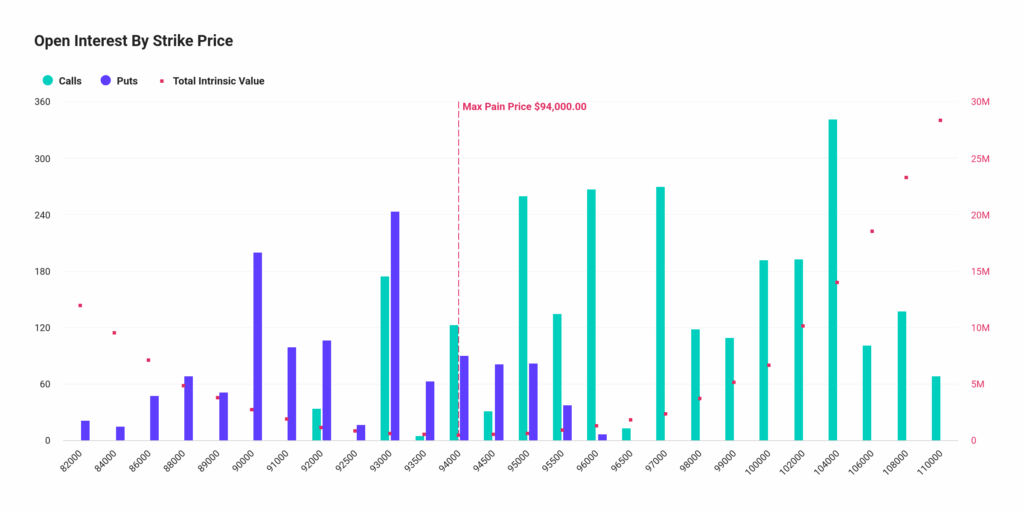

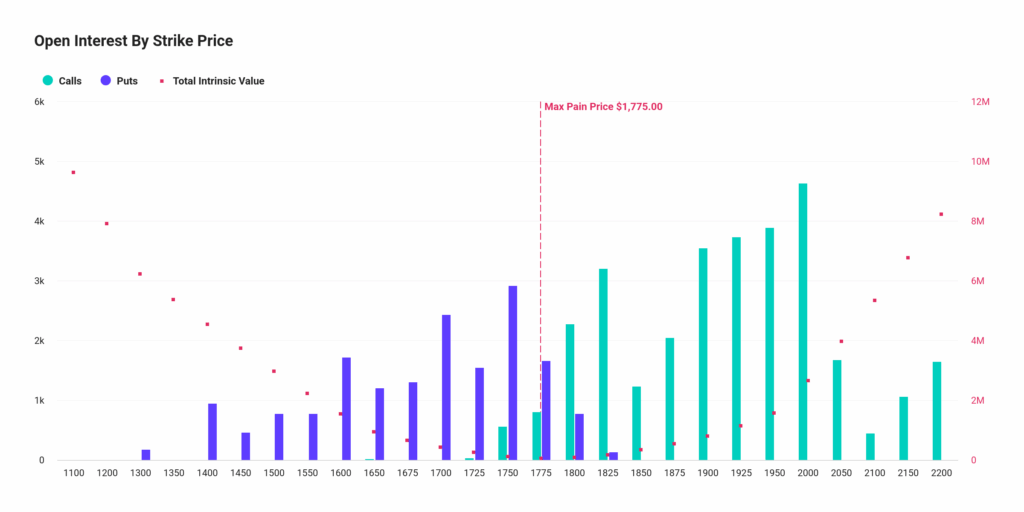

The maximum pain point for Bitcoin options is reported at $86,000, while for Ethereum it is $1,900. Bitcoin is trading above its maximum pain level, at $93,471, whereas Ethereum is trading below its level, around $1,764. Deribit analysts noted,

“BTC above max pain, ETH below; Positioning into expiry is anything but aligned.”

Trader Positioning and Market Behavior Around Expiry

Market participants are anticipating the concentration of open interest NEAR key levels. Bitcoin’s options open interest is densely clustered between $80,000 and $90,000. Ethereum’s open interest is similarly grouped between $1,800 and $2,000.

Based on these zones, this positioning implies that traders are in these zones and planning for further price movements. During expiry periods, spot price usually acts as a magnet towards the maximum pain price. However, with Bitcoin currently above its pain point and Ethereum below, traders are observing mixed signals.

In addition, data shows that 458,926 Ethereum options contracts were to expire today. Last week’s expiry was 177,130 contracts, which is much higher. The larger volume could add extra pressure on Ethereum’s price as traders realign their strategies post-expiry.

Long-Term Bullish Sentiment Remains Strong

Despite the expected short-term volatility, long-term sentiment for Bitcoin remains positive. Traders are selling cash-secured puts to collect premiums while setting buy targets at lower prices. Deribit explained,

“BTC traders on Deribit are expressing long-term bullish sentiment, selling cash-secured puts using stablecoins to potentially buy the dip and collect yield.”

There is also notable open interest for Bitcoin options at the $100,000 strike price. This shows that many market participants are expecting Bitcoin to reach higher levels in the coming months. Moreover, Bitcoin call option buying for expiries between April and June 2025 has increased, with strike targets ranging from $90,000 to $110,000.

Still, some caution remains. Prediction markets such as Polymarket report only a 16% probability of Bitcoin reaching $100,000 within April. However, fear exists in that, although Optimism stands due to future gains, expectations for a quick run up higher are more conservative.

Volatility Fueled by ETF Sensitivity and Hedge Fund Activity

Another factor contributing to volatility is the activity surrounding Bitcoin ETFs. The cumulative delta (CD) across Bitcoin and related ETF options has reached $9 billion, indicating heightened sensitivity to price changes. Short term volatility might indeed increase as market makers hassling their way to hedge their positions.

Furthermore, Deribit says that most of recent activity was not new money but just rebalancing. Tony Stewart from Deribit stated that half of the recent Bitcoin market movement involved rolling up existing positions rather than deploying new capital.

Also having a role in the stabilization of broader financial markets have been external factors such as the restitution of Donald Trump’s tariff policies. Reportedly, this has also lowered the volatility while fostering a move away from investing on gold and cryptocurrencies.