Bitcoin’s Safe-Haven Status Challenged: Gold Gains Momentum as Digital Asset Lags Behind

Gold reasserts its dominance in the safe-haven arena while Bitcoin struggles to keep pace.

The Timeless Appeal of Tangible Assets

Investors flock to gold's physical certainty amid market turbulence, leaving digital alternatives searching for solid ground. The yellow metal's centuries-long track record provides comfort that algorithms simply can't match.

Digital Volatility Versus Physical Stability

Bitcoin's price swings continue to test investor patience while gold maintains its steady climb. Traditional finance veterans nod knowingly—another case of 'new technology' learning old lessons the hard way.

Market Realities Bite

When crisis hits, portfolio managers reach for proven hedges, not speculative experiments. Gold's liquidity and universal acceptance create a moat that even the most brilliant blockchain can't cross overnight.

As one Wall Street skeptic quipped: 'Digital gold still can't fill teeth or sit in a vault—some things just need to be real.' The safe-haven rivalry continues, but the scoreboard doesn't lie.

Bitcoin news: Gold price is climbing to new highs as investors seek safety, even as Bitcoin stalls. On Sept. 22, gold rose to about $3,721 per ounce – a new all-time record – pushing its 2025 gain to roughly 43%.

In the same hour, bitcoin fell about 3%, to roughly $112,000, leaving its year-to-date advance near 17%. The timing suggested a rotation: analysts noted that Bitcoin profit-taking may have fueled gold’s rally.

In effect, recent data show Gold drawing heavy safe-haven flows while Bitcoin’s momentum has waned.

Bitcoin news: Gold Safe-Haven Rally Outpaces Crypto

The trend has accelerated this week. Gold surged another 5% by Sept. 24, setting a fresh peak around $3,791/oz.

Central banks and institutional investors have driven this rally. Reuters reported that gold hit $3,728 on Sept. 22 as central-bank buying and geopolitical risks spurred demand.

Industry data confirm massive inflows: physically backed gold ETFs amassed 397 tonnes of bullion in Jan–June 2025, the largest first-half haul since 2020.

By comparison, Bitcoin’s peak came in mid-July, when it briefly touched $123,153, up 27% on the year. Since then Bitcoin has fallen back, trading in the low $110,000s as of late Sept.

Gold’s ascent reflects its classic safe-haven role amid market uncertainty. In the week after the Fed’s Sept. 17 rate cut, gold and U.S. equities each gained about 1%.

At the same time U.S. Treasury yields and the dollar strengthened. The 10-year yield jumped 2.5%, DXY +1% – a backdrop that typically puts pressure on risk assets.

In Bitcoin news, BTC/USDT duly slipped 3–5% in that period. In short, the macro setup – higher yields and a firmer dollar – has undercut Bitcoin’s recent rally but coincided with fresh gold demand.

Gold’s record highs have drawn unprecedented flows. Central banks continue to buy heavily: analysts report a doubling of annual central-bank purchases to about 900 tonnes expected in 2025.

Inflows into gold funds totalled $21.1 billion in Q1 2025, according to JPMorgan via The Block.

This flood of capital reflects fears of inflation, trade wars and dollar risks. As one analyst put it, safe-haven flows have “benefited [gold] more so than Bitcoin” this year.

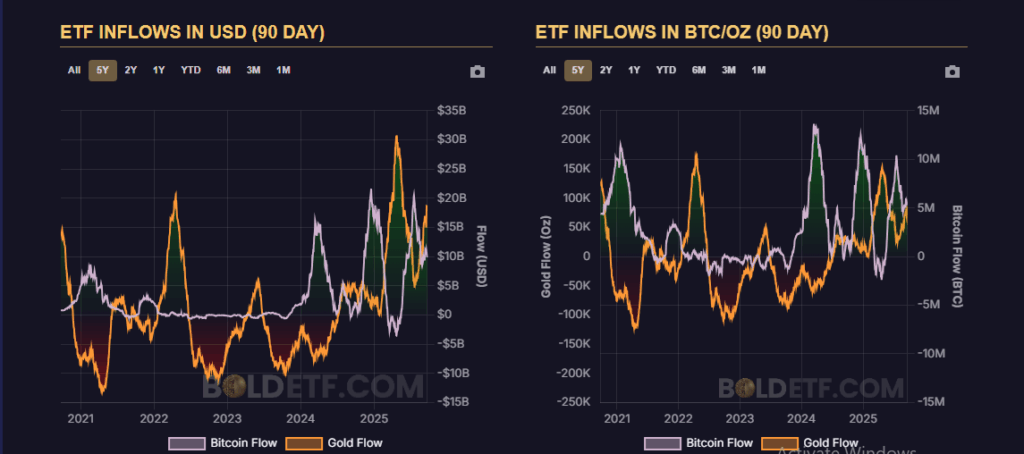

ETF Flows Reflect Divergence

Fund-flow data underline the diverging trends. CoinShares reports that $977 million flowed into Bitcoin funds in the latest week, the largest single weekly gain.

For Bitcoin news readers, Bitcoin funds have seen roughly $4.0 billion of inflows in September alone and about $24.7 billion year-to-date.

By contrast, traditional gold funds have seen calmer flows recently after earlier surges.

Notably, a BOLD Report analysis shows the 90‑day ETF inflow total for gold at about $18.5 billion versus just under $10 billion for Bitcoin.

For Bitcoin news readers, gold and Bitcoin are both drawing investment, but gold’s gains have outstripped.

Inflows into precious metals ETFs remain robust on safe-haven demand, while much of Bitcoin’s fund interest appears tied to risk-on factors like expected Fed easing.

Investors following Bitcoin news can see that the balance between these assets is shifting. Recent data-driven reports highlight gold’s renewed strength as a defensive asset.

Bitcoin, lauded as “digital gold,” has yet to match gold’s latest momentum. In the current market context, gold’s safe-haven premium is the headline story – at least for now – and Bitcoin trails in comparison.