XRP Primed for $3.60 Rally as Whales Gobble Up 30 Million Coins

Whale activity sends shockwaves through XRP markets as massive accumulation signals potential price explosion.

Market Movers Dive In

Crypto whales just snapped up 30 million XRP tokens in a single feeding frenzy—the kind of move that typically precedes major price movements. This isn't random retail speculation; it's calculated accumulation at scale.

The $3.60 Target Zone

Technical analysts point to the $3.60 level as the next major resistance barrier. With whale accumulation providing fundamental support, the path appears clear for a significant recovery rally. Market structure suggests this isn't mere hopium but mathematically sound projection.

Institutional-Grade Positioning

When whales move this volume, they're not day-trading—they're building strategic positions. The 30 million coin purchase represents confidence in XRP's underlying utility beyond speculative chatter. Real-world adoption continues quietly while traders obsess over short-term charts.

Because nothing says 'sound investment strategy' like following billionaires who probably got their start selling Beanie Babies online.

Key Insights:

- XRP price rebounds 2% amid buy-the-dip sentiment among investors.

- Whales accumulated 30 million XRP in the last 24 hours after the crypto market crash.

- Institutional investments in Ripple coin doubled as evidence from rising inflows in the REX-Osprey XRP ETF.

XRP price holds above $2.86 after a 2% rebound following a crypto market crash. Amid the buy-the-dip sentiment, analysts anticipate a stronger recovery in Ripple coin.

Some whale movements were also recorded after analysts recommended buying after prices fell to $2.80. CoinGlass data indicated whales opening long positions NEAR the $2.80 level.

XRP Price Set for Rebound, Popular Analyst Predicts

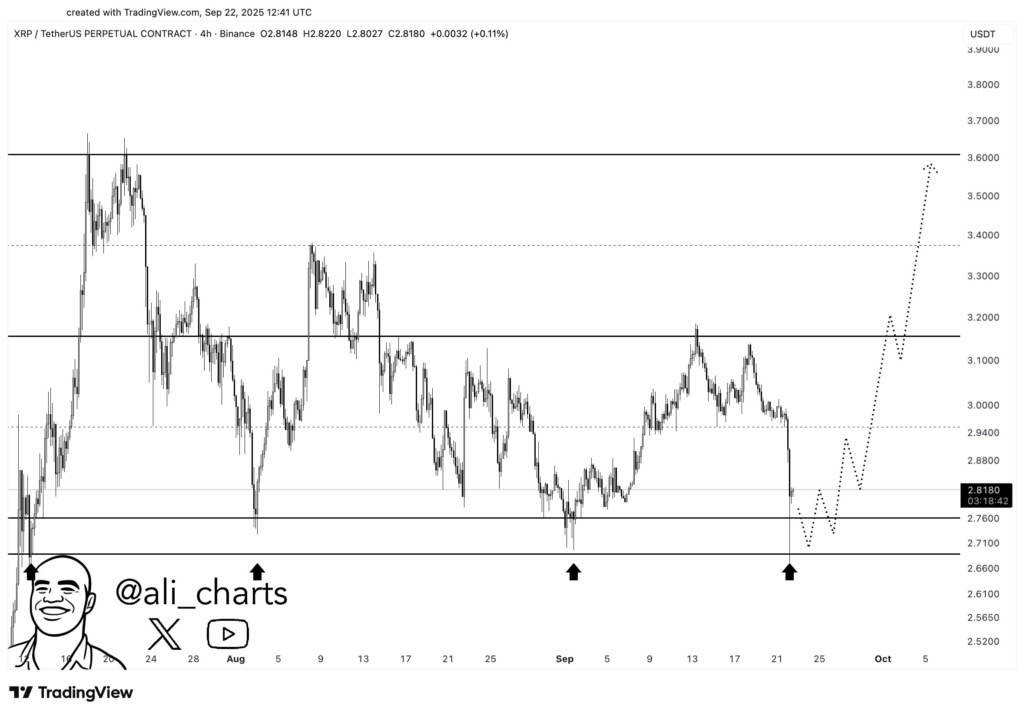

On September 23, crypto analyst Ali Martinez predicted xrp price looked ready to bounce. He added that if bulls hold above $2.71, buying pressure could build for a recovery to $3.60.

Notably, XRP price fell more than 8% during the crypto market crash on Monday, reversing the recent rebound to $3.10. Liquidation data revealed investors have sold Ripple coin worth millions.

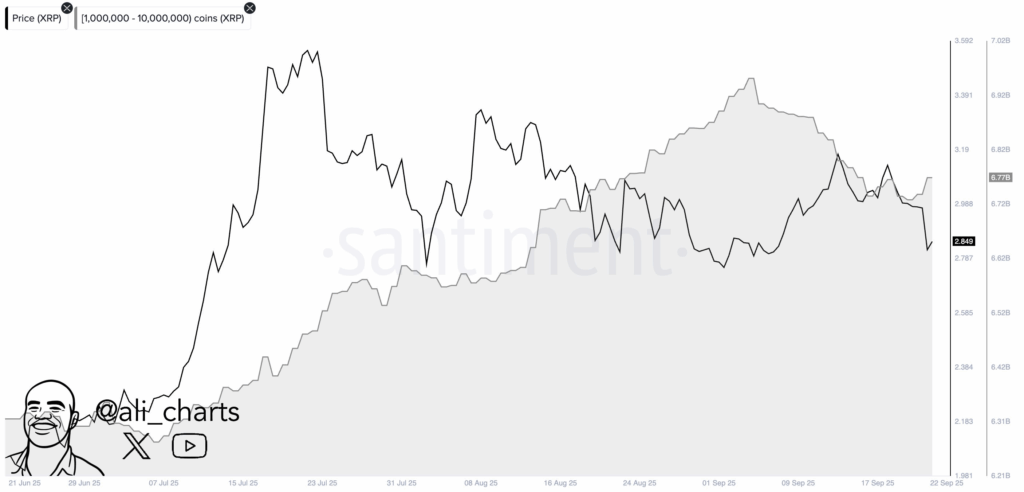

In the latest X post, Ali Martinez pointed out that whales accumulated 30 million XRP in the last 24 hours. He claimed the crypto asset looked ready for a rebound after the recent crash.

According to Santiment data, whales holding 1000-10,000 XRP bought the dip. These whales have sold part of their holdings in the last few days.

Meanwhile, analyst CrediBULL Crypto highlighted that XRP is making a stronger recovery from this dip. He predicted that higher trading volume could trigger a rebound in XRP price above $3.

Rising Institutional Interest in XRP

As The Coin Republic reported, institutional interest in Ripple Coin (XRP) doubles amid accumulations by institutions. Institutional investments are leading the inflows amid the REX-Osprey XRP ETF launch.

XRP funds recorded $69.4 million in inflows in a week, up from $32.5 million in the previous week. According to Glassnode, XRP is witnessing a rising open interest, signalling renewed Leveraged engagement and growing appetite for directional exposure.

CoinShares flows data also revealed that year-to-date (YTD) inflows increased to $1.51 billion, which boosted total assets under management (AuM) to $3.01 billion.

Meanwhile, the XRP Ledger has solidified its position as the trusted open-source settlement LAYER for global institutions. It ranked among the top 10 chains for RWA tokenization and reached its first month with over $1 billion in stablecoin volume.

XRP Price Performance amid Buy-the-Dip Sentiment

XRP price jumped 2% in the few hours to recover some losses, with the price trading at $2.86 at the time of writing. The 24-hour low and high were $2.80 and $2.88, respectively.

However, trading volume has slightly increased by 5% ahead of an upcoming $23 billion crypto options expiry and the US Fed’s preferred PCE inflation data. This indicated cautious trading in the spot market in the last 24 hours.

A breakout above the pennant pattern formation on the XRP chart could trigger a rally above $4. However, analysts expect a breakout above key resistance levels at $3.30 and $3.65 first.

CoinGlass data showed mixed sentiment in the derivatives market over the last few hours. At the time of writing, the total XRP futures open interest was down more than 1.5% to $7.71 billion in the last 24 hours.

However, XRP futures open interest on CME and Binance surged more than 1.2% and 0.90% in the last 4 hours, respectively. This signals buy-the-dip sentiment among derivatives traders.