Bitcoin Supercycle Ahead? How Bitcoin Hyper’s Layer-2 Could Trigger the Ultimate Rally

BREAKING: Layer-2 solution Bitcoin Hyper emerges as potential catalyst for Bitcoin's next parabolic move—while traditional finance still tries to figure out what 'blockchain' actually means.

The Scaling Solution That Changes Everything

Bitcoin Hyper's architecture doesn't just promise faster transactions—it delivers actual utility beyond digital gold speculation. Finally, something that might justify those conference circuit buzzwords.

Market Mechanics Unleashed

Reduced fees and increased throughput could trigger institutional adoption that actually matters, not just another press release from some wealth fund's 'innovation department'.

The Cynic's Corner

Because nothing gets traditional finance excited like something they don't understand but might make them money—until the SEC schedules another 'educational webinar'.

This isn't just another upgrade—it's the infrastructure play that could finally push Bitcoin beyond store-of-value into actual global payment territory. Maybe even before your bank's mobile app stops crashing.

Bitcoin’s bull case hasn’t disappeared, but it is clearly catching its breath. Several desks are trimming their Bitcoin price prediction targets for September, with some models flagging a dip below $100,000 if seasonal headwinds persist.

ETF inflows have softened, miner selling is ticking up as energy costs rise and whale wallets are quietly rotating part of their stack into alternative plays. In a market that has learned to hunt narrative beta when BTC stalls, attention is drifting toward LAYER 2 stories – some lighthearted, others deeply infrastructural.

Bitcoin Cools; Rotation Heats Up

For much of the summer, the path to $120,000 looked straightforward. Momentum has since faded. On-chain watchers note that dominance has flattened, while net ETF demand is no longer the one-way bid it was earlier in the year.

Whales aren’t capitulating, but the footprint has changed: measured outflows into stables and selective altcoin exposure suggest preparation, not panic. Miners, facing higher summer power costs, have been converting more block rewards to cash – historically a headwind in late Q3.

None of that undermines the structural case for BTC as a store of value. The institutional on-ramp built by spot ETFs remains intact and long-term holders are, by and large, unmoved. With September’s reputation for drawdowns and much of the good news arguably priced in, the near-term Bitcoin price prediction skews toward consolidation.

This is the backdrop for rotation. When Bitcoin “sleeps,” capital often probes earlier-stage risk. If September does deliver a dip, traders expect that kind of micro-cap reflex to intensify.

Why Infrastructure Still Matters

Step back and the core limitation remains the same: bitcoin is extraordinary at being “digital gold,” less so at being a programmable financial network.

Throughput (~7 TPS), fee spikes during congestion and slow governance cadence have kept DeFi, NFTs and most consumer apps elsewhere. That’s not new; it’s simply more visible now that crypto’s user base and use-cases have outgrown single-chain ceilings.

Enter Bitcoin Hyper – a project positioning itself as a next-generation Layer 2 for Bitcoin, with an explicit goal: preserve BTC’s security while delivering the speed, cost and programmability developers expect in 2025.

Bitcoin Hyper’s Design

The blueprint behind Bitcoin Hyper is straightforward to describe and ambitious to execute.

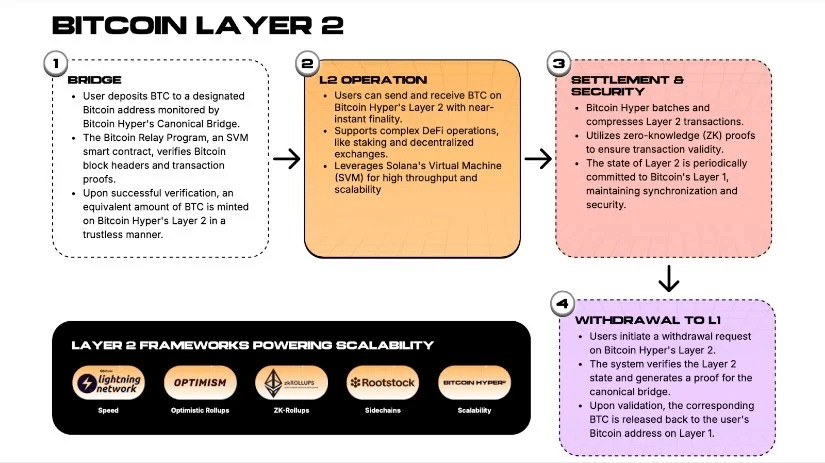

Canonical Bitcoin Bridge: Users deposit BTC to a designated address monitored by the bridge. A relay program verifies the transaction and mints a 1:1 wrapped BTC representation on the Layer 2. At any point, holders can burn the wrapped asset and withdraw the original BTC back on Layer 1.

Solana VIRTUAL Machine (SVM) integration: Rather than invent a new execution environment, Bitcoin Hyper proposes to leverage SVM’s high-throughput design. The aim is “thousands of TPS” at near-zero fees while deferring final settlement to Bitcoin’s base layer. In practice, that means builders could port familiar Solana-style programs – DEX logic, oracles, games, NFT rails, DAOs – while tapping Bitcoin liquidity.

If it ships as described, that stack would let developers deploy smart contracts, build DeFi and support consumer apps with BTC in the loop – without waiting for base-layer changes. It’s the same functional split that helped ethereum scale: push computation to Layer 2, reserve the base layer for ordering and security.

Why This Could Intersect with the Supercycle Thesis

Macro-adoption arguments haven’t gone away. From 2010’s pennies to 2011’s $20, 2017’s ~$17,000 and a July ATH NEAR $123,000, Bitcoin’s compound story has been unmatched. ROI since launch is a statistical outlier.

Household names like Mastercard and a range of S&P 500 treasuries – now interact with BTC in some form. Raoul Pal projects the total crypto market could grow from roughly $4T to $100T by 2034, with users potentially topping 4B by 2030 if mobile rails and trust gaps keep pulling people on-chain.

A credible Bitcoin Layer 2 that unlocks scale and programmability is the kind of missing piece that could extend that arc. Think of what DeFi Summer did for Ethereum’s value accrual: activity, fees and mindshare compounded once the tools existed.

If Bitcoin Hyper (or any BTC-centric Layer 2) gives builders the same surface area – cheap transactions, contract support, easier cross-chain flows – the “digital gold” narrative gains a working-capital engine.

There are nearer-term signals, too. Corporate balance sheets have been accumulating BTC; some Asia-listed firms (Metaplanet among them) have telegraphed aggressive treasury plans, even seeking fresh capital to scale positions.

Political brand endorsements periodically stoke attention. Those may be noisy catalysts, but they underscore a simple point: demand drivers are diversifying. To sustain them, usable rails matter.

Where The Market Stands Right Now

Technically, BTC’s attempt to stabilise around the low-$110Ks has drawn interest. On the 4-hour chart, traders flagged a break above a descending trendline that capped August’s pullback, with price pressing the 50-EMA and eyeing the 200-EMA next.

The bounce aligned with a weekly 61.8% Fibonacci retracement – a level technicians watch for trend continuation. That doesn’t cancel the seasonal caution; it just frames the week: hold the EMAs and the downside scenarios soften. Lose them and those sub-$100K bitcoin price Prediction calls will get louder.

Against that tape, Bitcoin Hyper has attracted presale attention, with reported commitments north of $13 million and community chatter comparing today’s energy to “early-Ethereum-style” infrastructure phases

Supporters argue the token sits at the junction of BTC’s brand and a fresh utility layer; critics counter that shipping production-grade bridges and SVM execution with Bitcoin-level security is hard. Both can be true.

The question for September isn’t whether a supercycle happens tomorrow; it’s whether the market is allocating to the tools that could enable it.

What to watch through September

Flows and miners. If ETF inflows perk up and miner-to-exchange transfers ease as summer energy pressure moderates, the near-term Bitcoin Price Prediction improves.

Dominance and volatility. Rising alt dominance into weak BTC weeks is typical; sustained alt outperformance into October WOULD be a stronger signal risk is “on.”

Layer-2 roadmaps. For Bitcoin Hyper, shipping milestones around the Canonical Bridge and SVM compatibility will matter more than headlines.

Independent audits, testnet throughput and developer tooling will be the credibility catalysts.

Treasury signals. Additional corporate or fund mandates to accumulate BTC on dips can offset seasonal weakness and, paradoxically, raise the urgency for higher-capacity rails.

September rarely rewards complacency. The near-term Bitcoin Price Prediction leans toward chop with downside tails and whales have already shown they’re willing to rotate when BTC stalls.

That said, rotation isn’t just about chasing the next flashy pre-sale. If this cycle is going to evolve into something bigger – a genuine supercycle – new capacity has to exist where the demand is. A Bitcoin-centric Layer 2 that is fast, cheap and programmable is one plausible path.

Bitcoin Hyper is one attempt to build that path. Whether it becomes the catalyst or not, its architecture – Canonical Bridge for BTC in/out, SVM execution for speed and smart-contract breadth – addresses the precise bottlenecks that keep activity off Bitcoin today.

If those bottlenecks ease, the narrative shifts from “digital gold” to “digital Gold with rails” and that’s the sort of shift super cycles are built on.

This content is for informational purposes only and does not constitute financial advice. cryptocurrency investments are highly volatile and you should do your own research before investing.